Cerberus Global NPL Fund, L.P.

ents used to calculate the

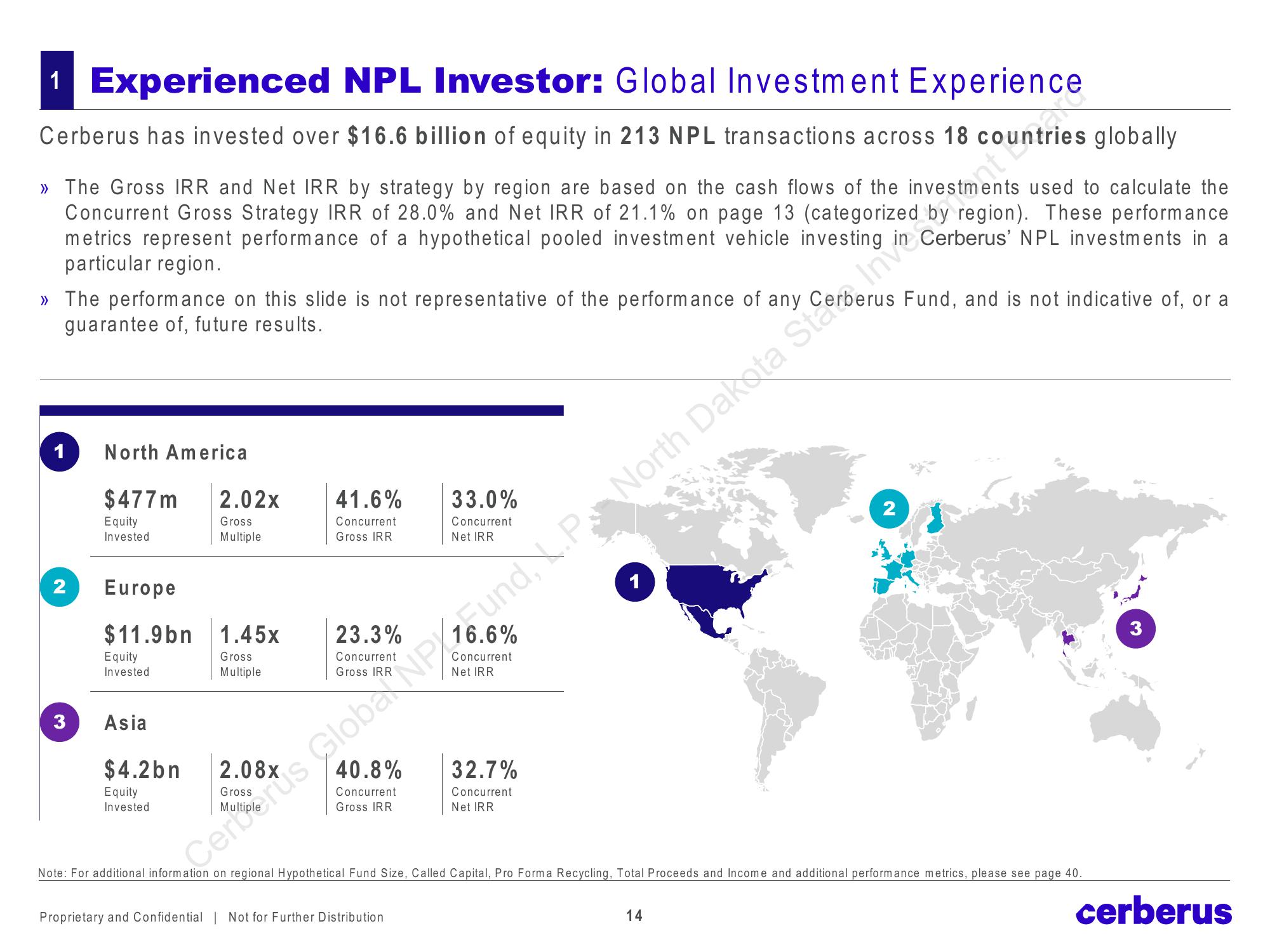

>> The Gross IRR and Net IRR by strategy by region are based on the cash flows of the

Concurrent Gross Strategy IRR of 28.0% and Net IRR of 21.1% on page 13 (categorized region). These performance

metrics represent performance of a hypothetical pooled investment vehicle investing

particular region.

>> The performance on this slide is not representative of the performance of any

guarantee of, future results.

1

1 Experienced NPL Investor:

Global

Invest tries

globally

1

Cerberus has invested over $16.6 billion of equity in 213 NPL transactions across 18

2

3

North America

$477m

Equity

Invested

Europe

$11.9bn 1.45x

Gross.

Multiple

Equity

Invested

Asia

2.02x

Gross

Multiple

$4.2bn

Equity

Invested

41.6%

Concurrent

Gross IRR

23.3%

Concurrent

40.8%

Concurrent

Gross IRR

33.0%

Concurrent

Net IRR

Concurrent

Net IRR

Proprietary and Confidential | Not for Further Distribution

32.7%

Concurrent

Net IRR

Cerberts Globa NP/Fund, L.P.

North Dakota St Cerberus' NPL investments in a

Fund, and is not indicative of, or a

2

Note: For additional information on regional Hypothetical Fund Size, Called Capital, Pro Forma Recycling, Total Proceeds and Income and additional performance metrics, please see page 40.

14

3

cerberusView entire presentation