Elms SPAC Presentation Deck

Case Study: Forum Merger II / Tattooed Chef

Tattooed Cher

Company Overview

Tattooed Chef is a leading plant-based food company with operations in the United States and Italy, offering

a broad portfolio of innovative plant-based food products

FORUM

MERGER

CORPORATION

Growth strategy includes expansion into supermarkets through existing and new retail customers for both

private label and branded products, development of innovative product offerings, and partnerships

opportunities in foodservice

Transaction Overview

$482 million enterprise value representing 2.2x Tattooed Chef's estimated 2021 net sales of $222 million, or

15.6x Tattooed Chef's estimated 2021 Adjusted EBITDA of $30.8 million

Transaction funded through SPAC IPO proceeds. Pre-existing Tattooed Chef stockholders will be paid $75

million in cash consideration and roll-over shares are valued at approximately $344 million

Pre-existing Tattooed Chef stockholders retained approximately 80% of their equity, which will convert into

60% of the outstanding shares of the combined company at closing, assuming no redemptions by Forum's

public stockholders

PF adj. EBITDA targets were $17.2 million and $30.8 million in 2020 and 2021, respectively

Note: Adj. EBITDA margin is a non-GAAP metric.

The ~$207mm in cash held in Forum's trust account will be used to pay cash consideration to current

shareholders of Tattooed Chef and transaction expenses, with the remainder staying on the balance sheet to

fund the combined company's growth and for general corporate purposes

46

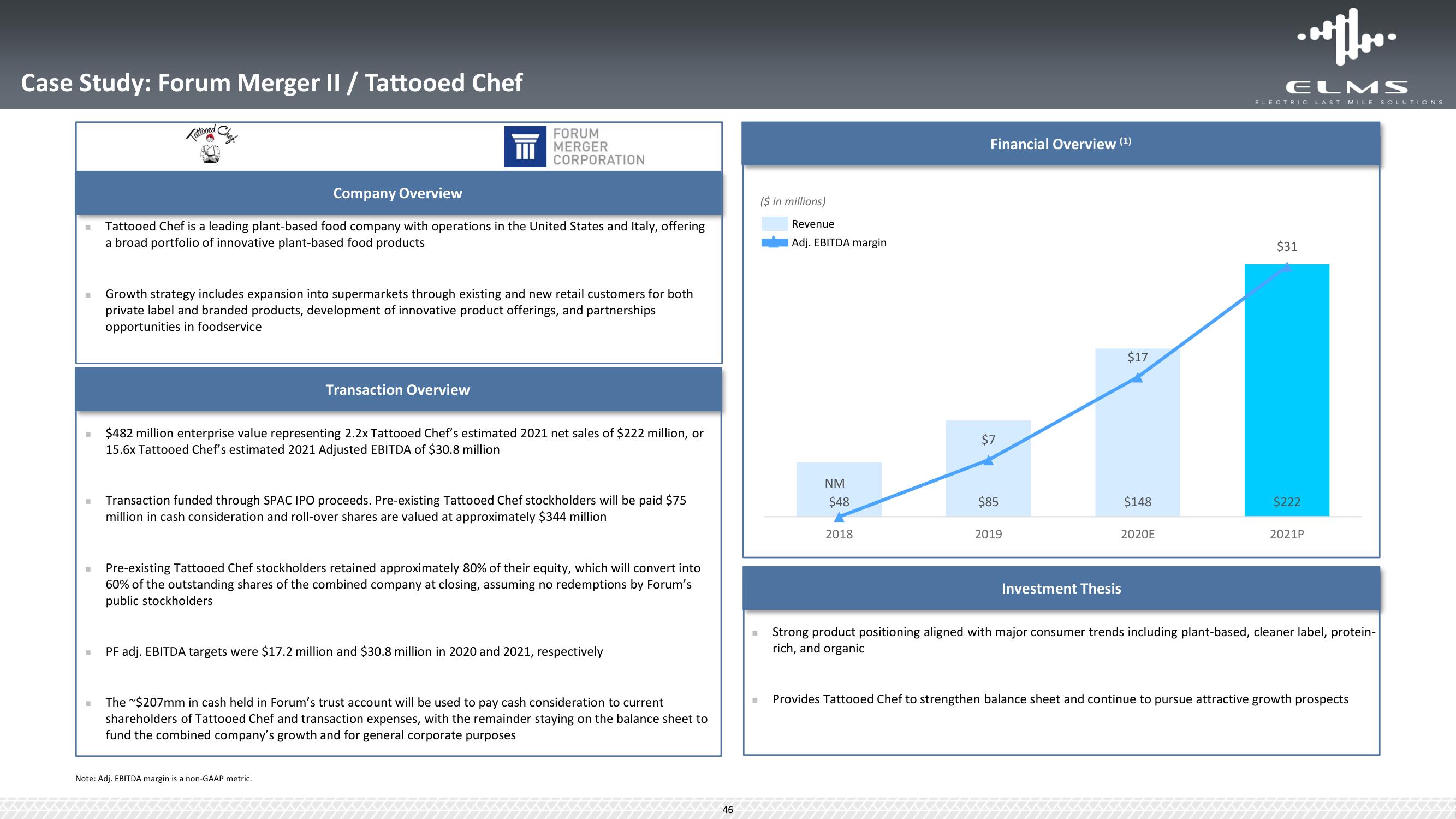

($ in millions)

Revenue

Adj. EBITDA margin

NM

$48

2018

Financial Overview (¹)

$7

$85

2019

Investment Thesis

$17

$148

2020E

ELMS

ELECTRIC LAST MILE SOLUTIONS

$31

$222

2021P

Strong product positioning aligned with major consumer trends including plant-based, cleaner label, protein-

rich, and organic

Provides Tattooed Chef to strengthen balance sheet and continue to pursue attractive growth prospectsView entire presentation