Ashtead Group Results Presentation Deck

US CONSTRUCTION OUTLOOK

300

250

200

150

100

50

2005

2007

2009

2011

Source: Dodge Data & Analytics (May 2022)

190

170

150

130

110

90

70

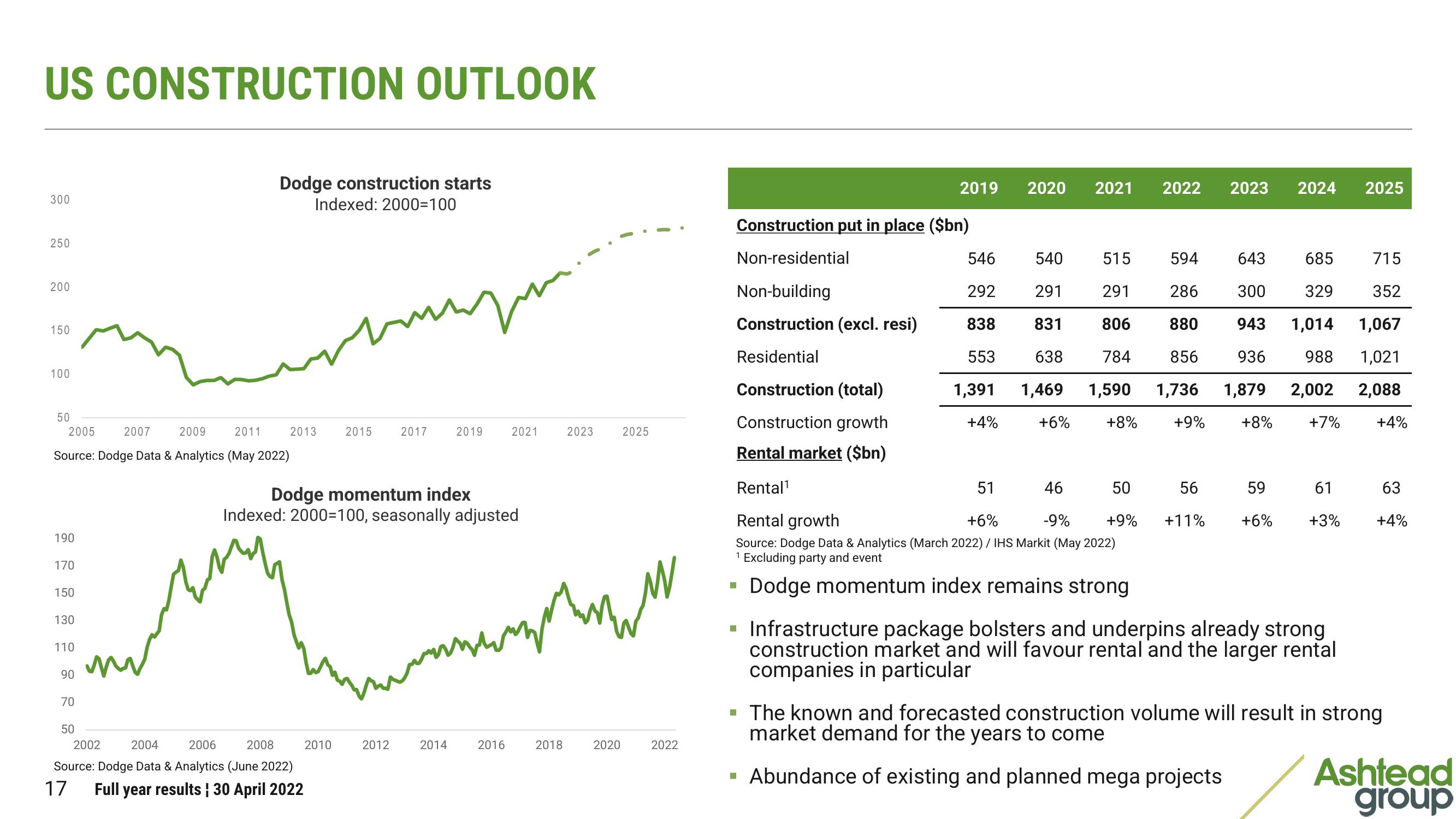

Dodge construction starts

Indexed: 2000-100

50

2013

2002 2004 2006 2008

Source: Dodge Data & Analytics (June 2022)

17 Full year results ¦ 30 April 2022

2015

2010

سر

2017

Dodge momentum index

Indexed: 2000=100, seasonally adjusted

2012

2019

2014

2021

2016

2023

начим

2018

2025

2020

2022

2019

Construction put in place ($bn)

Non-residential

■

2020

2021 2022

Non-building

Construction (excl. resi)

Residential

Construction (total)

Construction growth

Rental market ($bn)

Rental¹

51

46

50

Rental growth

+6%

-9%

+9%

Source: Dodge Data & Analytics (March 2022) / IHS Markit (May 2022)

¹ Excluding party and event

Dodge momentum index remains strong

2023 2024 2025

546

540

515

594

643

685

292

291

291

286

300

838

831

806

880

943

936

329

1,014

988

784

856

553 638

1,391 1,469 1,590 1,736 1,879 2,002

+4%

+6%

+8%

+9%

+8%

+7%

56

59

+11% +6%

61

+3%

▪ Infrastructure package bolsters and underpins already strong

construction market and will favour rental and the larger rental

companies in particular

715

352

1,067

1,021

2,088

+4%

63

+4%

▪ The known and forecasted construction volume will result in strong

market demand for the years to come

▪ Abundance of existing and planned mega projects

Ashtead

groupView entire presentation