Booking Holdings Shareholder Engagement Presentation Deck

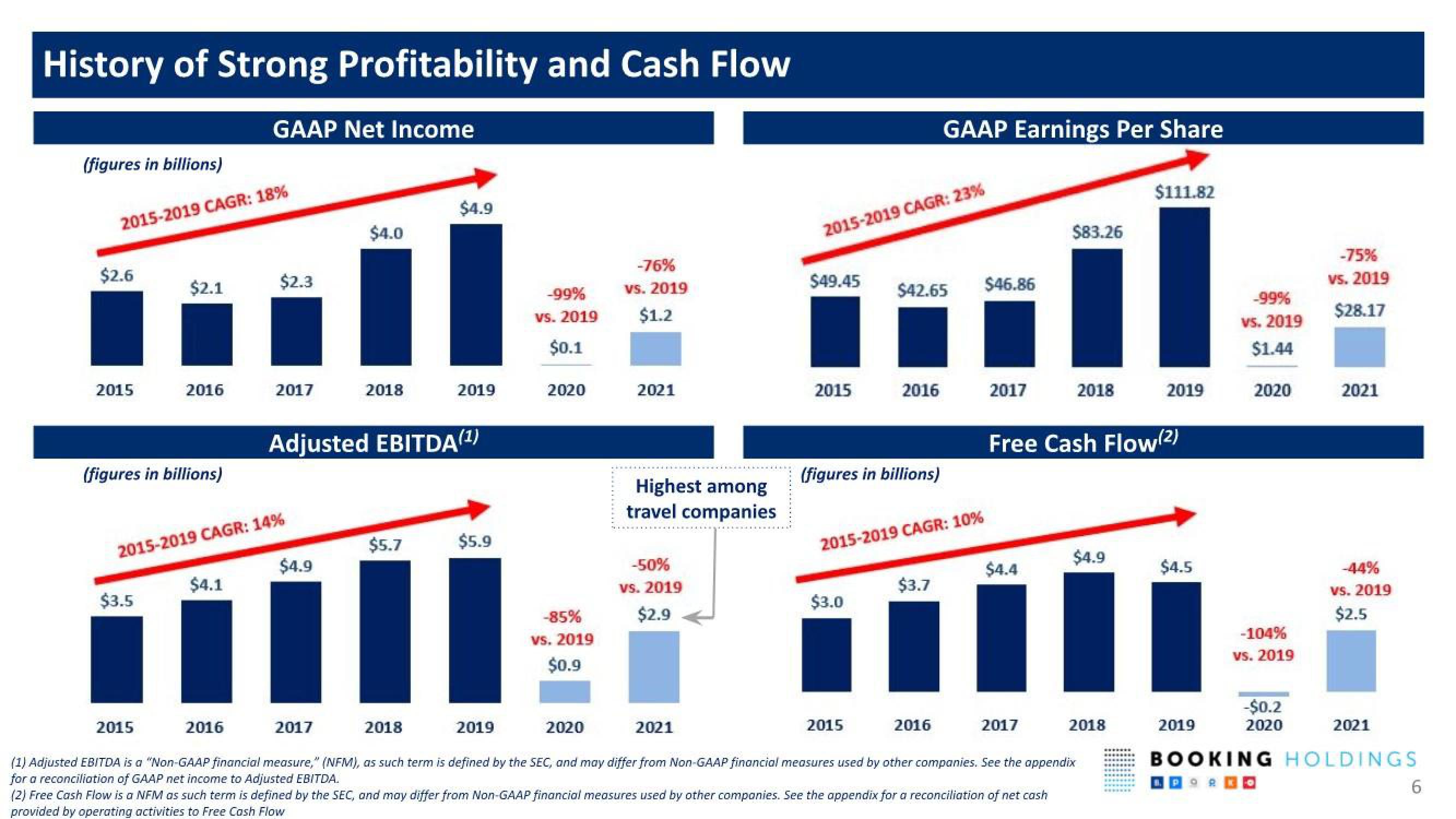

History of Strong Profitability and Cash Flow

(figures in billions)

2015-2019 CAGR: 18%

$2.6

2015

$2.1

(figures in billions)

$3.5

2016

2015

GAAP Net Income

$4.1

2015-2019 CAGR: 14%

$2.3

2016

2017

$4.0

$4.9

2018

Adjusted EBITDA(¹)

$4.9

$5.7

2019

$5.9

I

-99%

vs. 2019

$0.1

2020

-85%

vs. 2019

$0.9

-76%

vs. 2019

$1.2

2021

Highest among

travel companies

-50%

vs. 2019

$2.9

2015-2019 CAGR: 23%

$49.45

2015

(figures in billions)

$3.0

$42.65

2016

2015-2019 CAGR: 10%

2015

GAAP Earnings Per Share

$3.7

2016

$46.86

2017

2017

2018

2019

2020

2021

(1) Adjusted EBITDA is a "Non-GAAP financial measure," (NFM), as such term is defined by the SEC, and may differ from Non-GAAP financial measures used by other companies. See the appendix

for a reconciliation of GAAP net income to Adjusted EBITDA.

$4.4

$83.26

2017

Free Cash Flow(2)

(2) Free Cash Flow is a NFM as such term is defined by the SEC, and may differ from Non-GAAP financial measures used by other companies. See the appendix for a reconciliation of net cash

provided by operating activities to Free Cash Flow

2018

$4.9

$111.82

2018

2019

$4.5

2019

-99%

vs. 2019

$1.44

2020

-104%

vs. 2019

-$0.2

2020

-75%

vs. 2019

$28.17

2021

-44%

vs. 2019

$2.5

2021

BOOKING HOLDINGS

6View entire presentation