Bank of America Investment Banking Pitch Book

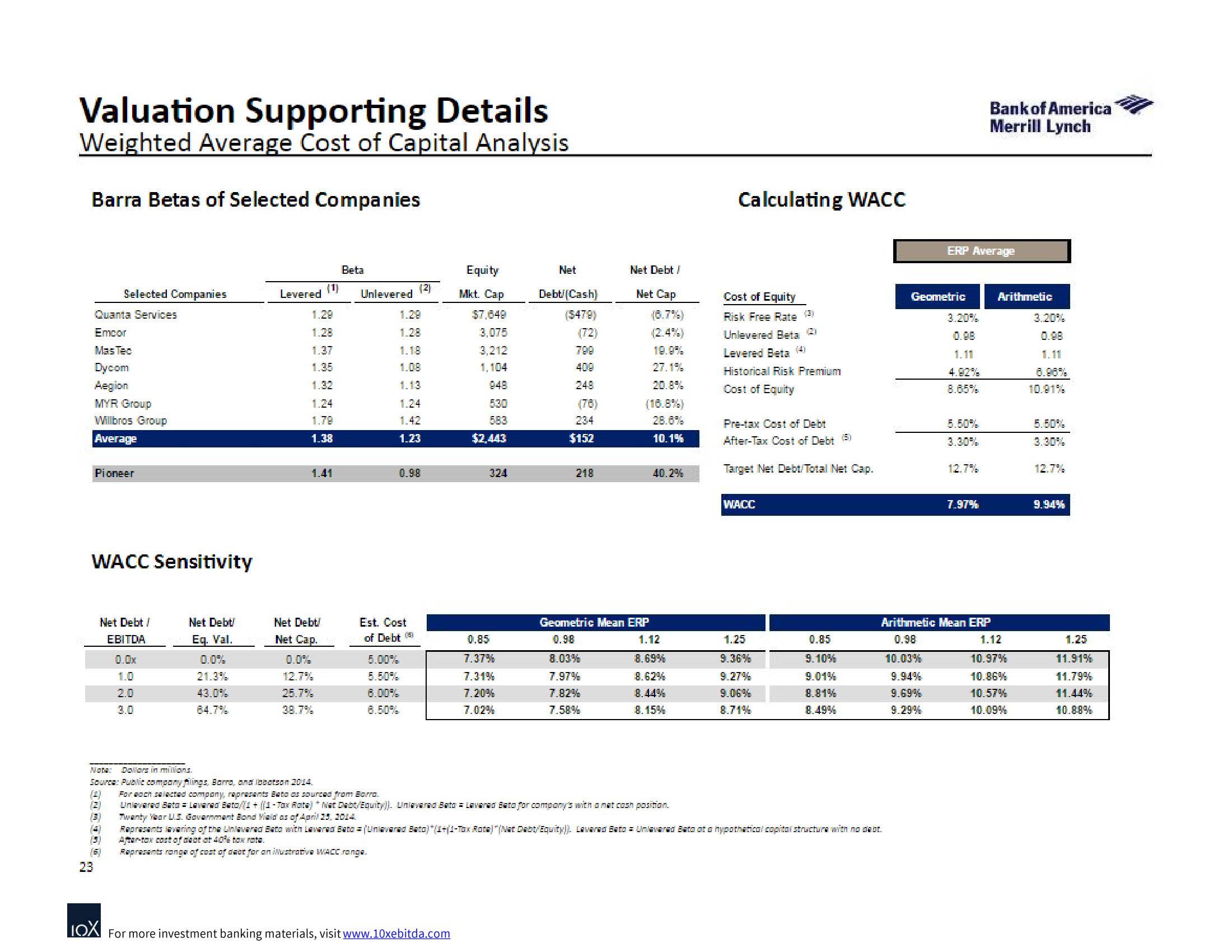

Valuation Supporting Details

Weighted Average Cost of Capital Analysis

Barra Betas of Selected Companies

Selected Companies

Quanta Services

Encor

Mas Tec

Dycom

Aegion

MYR Group

Willbros Group

Average

Pioneer

WACC Sensitivity

23

Net Debt /

EBITDA

(4)

5

(6)

3.0

Net Debt!

Eq. Val.

0.0%

21.3%

43.0%

84.7%

Levered

1.28

1.28

1.37

1.35

1.32

(1)

1.79

1.38

1.41

Net Debt/

Net Cap.

12.7%

25.7%

38.7%

Beta

Unlevered

1.28

1.18

1.08

1.13

5.00%

5.50%

6.00%

6.50%

1.24

1.42

1.23

0.98

Est. Cost

of Debt (5)

Equity

Mkt. Cap

$7,649

3,075

3,212

1,104

LOX For more investment banking materials, visit www.10xebitda.com

5:30

583

$2,443

324

0.85

7.37%

7.31%

7.20%

7.02%

Net

Debt/(Cash)

($478)

(72)

709

400

248

$152

218

Net Debt /

Net Cap

8.03%

7.97%

7.82%

7.58%

(6.7%)

(2.4%)

19.9%

27.1%

(16.8%)

28.6%

10.1%

40.2%

Geometric Mean ERP

0.98

1.12

8.69%

8.62%

8.44%

8.15%

Calculating WACC

Cost of Equity

Risk Free Rate (3)

Unlevered Beta (2)

Levered Beta (4)

Historical Risk Premium

Cost of Equity

Pre-tax Cost of Debt

After-Tax Cost of Debt (5)

Target Net Debt/Total Net Cap.

WACC

1.25

9.36%

9.27%

9.06%

8.71%

Nota: Dolors in millions.

Source: Public company filings, Barra, and lobotson 2014.

(1) For each salacted company, represents Bata as sourced from Borra.

(3)

Unlevered Beta = Lavared Bato/1 + ((1-Tax Rate) *Net Dabt/Equity)). Univared Bato Lavarad Bato for company's with anat cosh position.

Twenty Year U.S. Government Bond Vield as of April 23, 2014.

(3)

Represents levaring of the Unlevered Beto with Lavered Bato (Uniavared Bato)*(1+(1-Tax Rate)(Net Debt/Equity)). Lavarad Bato = Unlavarad Bata at a hypothetical capital structure with no debt.

After-tax cost of cact at 40% tax rata.

Represents range of cost of deat for an ilustrative WACC range.

0.85

9.10%

9.01%

8.81%

8.49%

ERP Average

Geometric

3.20%

1.11

8.65%

5.50%

3.30%

12.7%

7.97%

Arithmetic Mean ERP

0.98

10.03%

9.94%

9.69%

9.29%

Bank of America

Merrill Lynch

Arithmetic

1.12

10.97%

10.86%

10.57%

10.09%

3.20%

1.11

10.91%

5.50%

12.7%

9.94%

1.25

11.91%

11.79%

11.44%

10.88%View entire presentation