OpenText Investor Presentation Deck

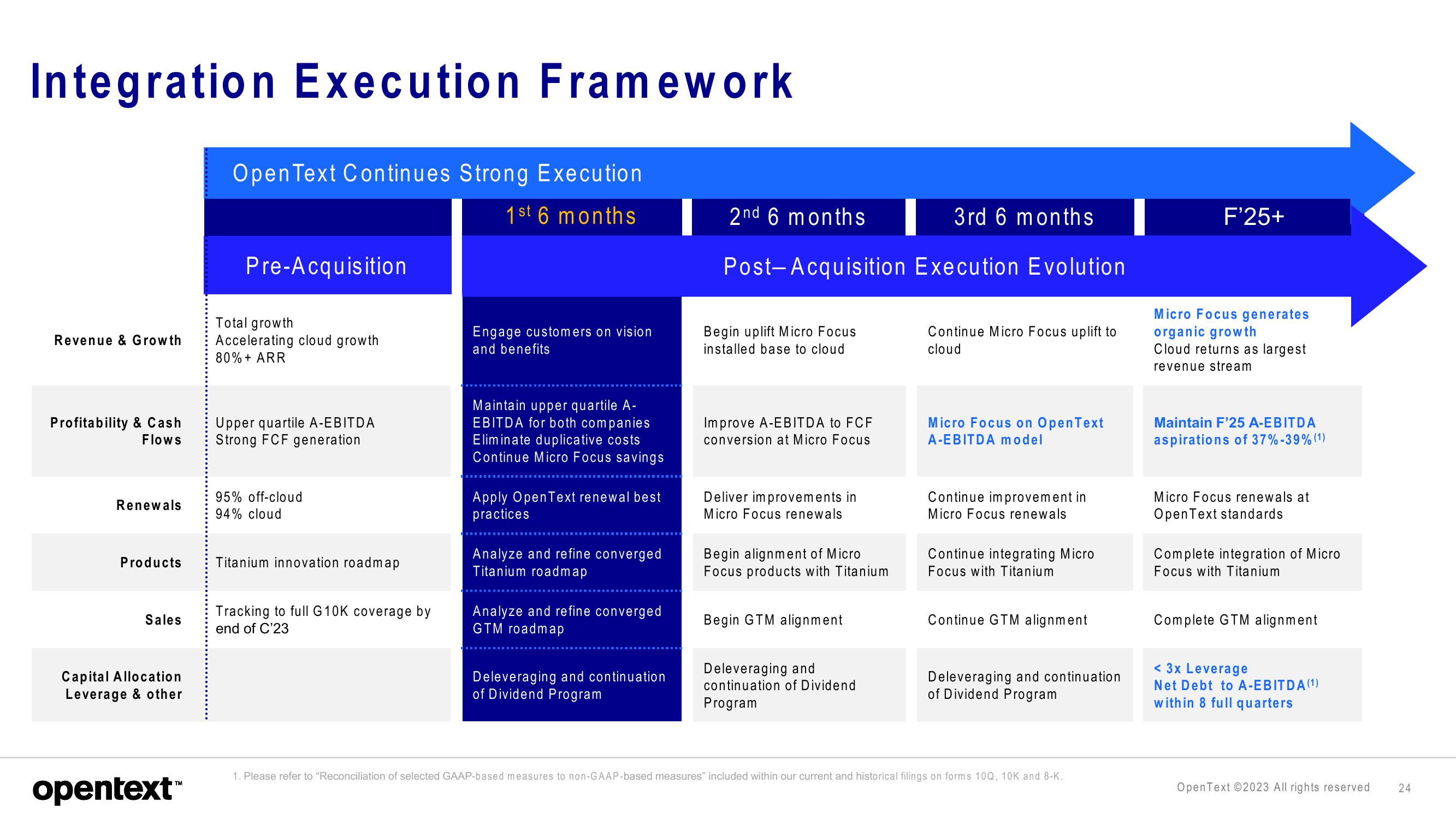

Integration Execution Framework

Revenue & Growth

Profitability & Cash

Flows

Renewals

Products

Sales

Capital Allocation

Leverage & other

opentext

TM

Open Text Continues Strong Execution

1st 6 months

Pre-Acquisition

Total growth

Accelerating cloud growth

80% + ARR

Upper quartile A-EBITDA

Strong FCF generation

95% off-cloud

94% cloud

Titanium innovation roadmap

Tracking to full G10K coverage by

end of C'23

Engage customers on vision

and benefits

Maintain upper quartile A-

EBITDA for both companies

Eliminate duplicative costs

Continue Micro Focus savings

Apply Open Text renewal best

practices

Analyze and refine converged

Titanium roadmap

Analyze and refine converged

GTM roadmap

Deleveraging and continuation

of Dividend Program

2nd 6 months

3rd 6 months

Post-Acquisition Execution Evolution

Begin uplift Micro Focus

installed base to cloud

Improve A-EBITDA to FCF

conversion at Micro Focus

Deliver improvements in

Micro Focus renewals

Begin alignment of Micro

Focus products with Titanium

Begin GTM alignment

Deleveraging and

continuation of Dividend

Program

Continue Micro Focus uplift to

cloud

Micro Focus on OpenText

A-EBITDA model

Continue improvement in

Micro Focus renewals

Continue integrating Micro

Focus with Titanium

Continue GTM alignment

Deleveraging and continuation

of Dividend Program

1. Please refer to "Reconciliation of selected GAAP-based measures to non-GAAP-based measures" included within our current and historical filings on forms 10Q, 10K and 8-K.

F'25+

Micro Focus generates

organic growth

Cloud returns as largest

revenue stream

Maintain F'25 A-EBITDA

aspirations of 37% -39% (1)

Micro Focus renewals at

Open Text standards

Complete integration of Micro

Focus with Titanium

Complete GTM alignment

< 3x Leverage

Net Debt to A-EBITDA (¹)

within 8 full quarters

OpenText ©2023 All rights reserved

24View entire presentation