Snap Inc Results Presentation Deck

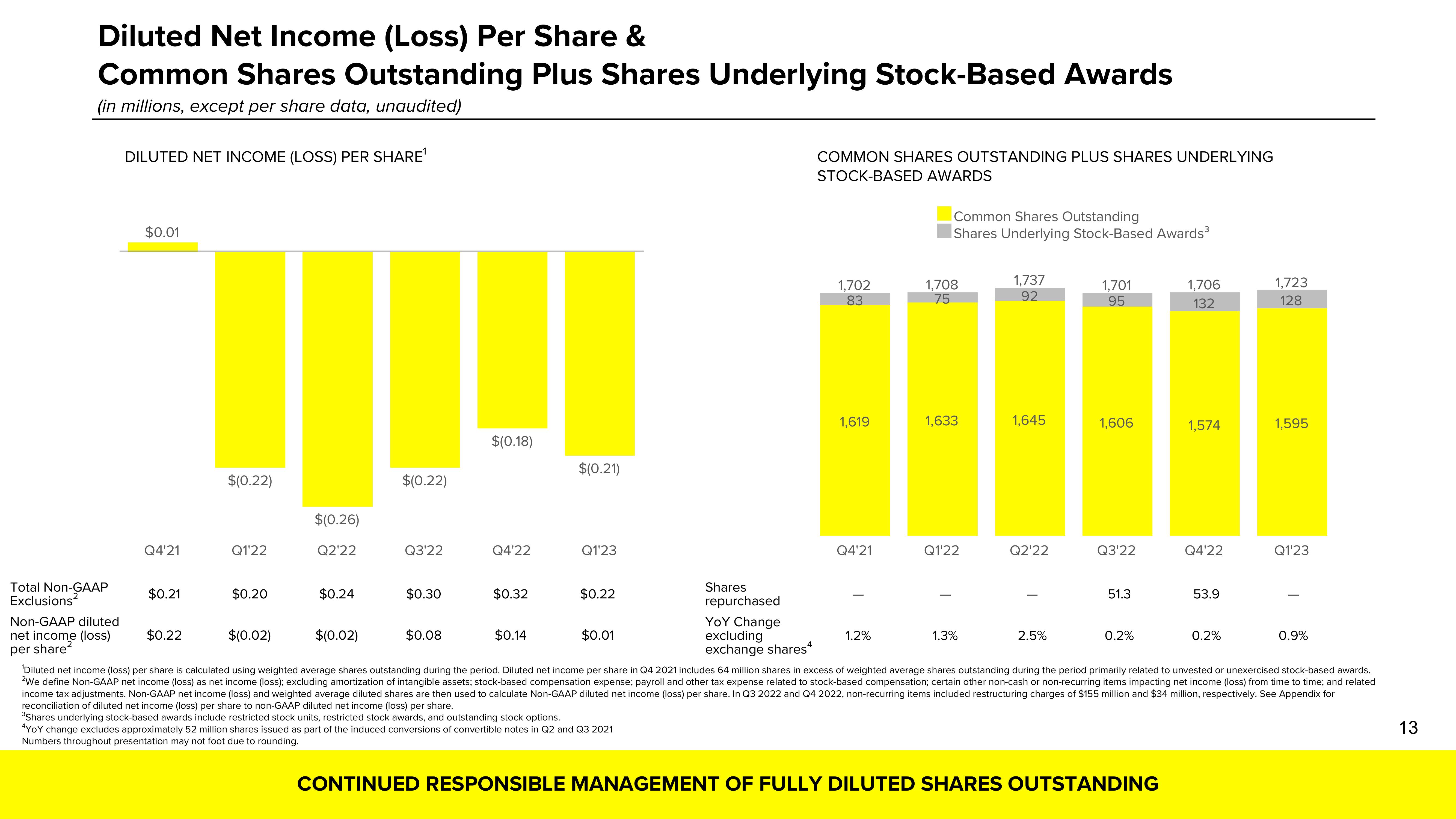

Diluted Net Income (Loss) Per Share &

Common Shares Outstanding Plus Shares Underlying Stock-Based Awards

(in millions, except per share data, unaudited)

DILUTED NET INCOME (LOSS) PER SHARE¹

$0.01

Q4'21

$(0.22)

$0.21

Q1'22

$(0.26)

$0.20

Q2'22

$0.24

$(0.22)

$(0.02

Q3'22

$0.30

$(0.18)

$0.08

Q4'22

$0.32

$(0.21)

$0.14

Q1'23

$0.22

$0.01

Shares

repurchased

COMMON SHARES OUTSTANDING PLUS SHARES UNDERLYING

STOCK-BASED AWARDS

YOY Change

excluding

exchange shares

1,702

83

1,619

Q4'21

Common Shares Outstanding

Shares Underlying Stock-Based Awards³

1.2%

1,708

75

1,633

Q1'22

Total Non-GAAP

Exclusions

Non-GAAP diluted

$(0.02)

net income (loss) $0.22

per share²

'Diluted net income (loss) per share is calculated using weighted average shares outstanding during the period. Diluted net income per share in Q4 2021 includes 64 million shares in excess of weighted average shares outstanding during the period primarily related to unvested or unexercised stock-based awards.

2We define Non-GAAP net income (loss) as net income (loss); excluding amortization of intangible assets; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; certain other non-cash or non-recurring items impacting net income (loss) from time to time; and related

income tax adjustments. Non-GAAP net income (loss) and weighted average diluted shares are then used to calculate Non-GAAP diluted net income (loss) per share. In Q3 2022 and Q4 2022, non-recurring items included restructuring charges of $155 million and $34 million, respectively. See Appendix for

reconciliation of diluted net income (loss) per share to non-GAAP diluted net income (loss) per share.

³Shares underlying stock-based awards include restricted stock units, restricted stock awards, and outstanding stock options.

¹YOY change excludes approximately 52 million shares issued as part of the induced conversions of convertible notes in Q2 and Q3 2021

Numbers throughout presentation may not foot due to rounding.

1,737

92

1.3%

1,645

Q2'22

1,701

95

2.5%

1,606

Q3'22

51.3

0.2%

1,706

132

CONTINUED RESPONSIBLE MANAGEMENT OF FULLY DILUTED SHARES OUTSTANDING

1,574

Q4'22

53.9

1,723

128

0.2%

1,595

Q1'23

0.9%

13View entire presentation