Tradeweb Investor Presentation Deck

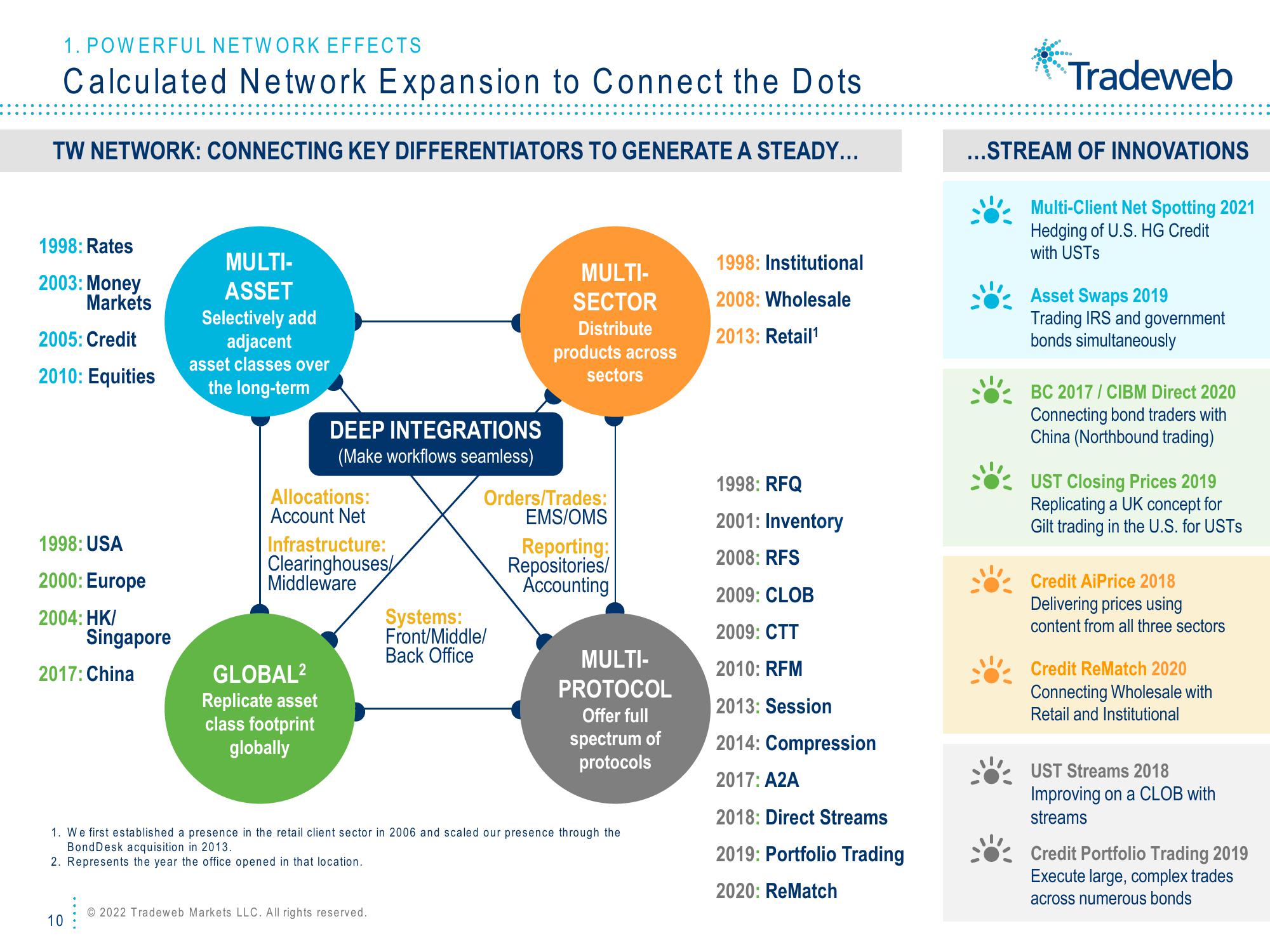

1. POWERFUL NETWORK EFFECTS

Calculated Network Expansion to Connect the Dots

TW NETWORK: CONNECTING KEY DIFFERENTIATORS TO GENERATE A STEADY...

1998: Rates

2003: Money

Markets

2005: Credit

2010: Equities

1998: USA

2000: Europe

2004: HK/

Singapore

2017: China

10

MULTI-

ASSET

Selectively add

adjacent

asset classes over

the long-term

DEEP INTEGRATIONS

(Make workflows seamless)

Allocations:

Account Net

Infrastructure:

Clearinghouses/

Middleware

GLOBAL²

Replicate asset

class footprint

globally

© 2022 Tradeweb Markets LLC. All rights reserved.

MULTI-

SECTOR

Distribute

products across

sectors

Orders/Trades:

EMS/OMS

Systems:

Front/Middle/

Back Office

Reporting:

Repositories/

Accounting

MULTI-

PROTOCOL

1. We first established a presence in the retail client sector in 2006 and scaled our presence through the

BondDesk acquisition in 2013.

2. Represents the year the office opened in that location.

Offer full

spectrum of

protocols

1998: Institutional

2008: Wholesale

2013: Retail¹

1998: RFQ

2001: Inventory

2008: RFS

2009: CLOB

2009: CTT

2010: RFM

2013: Session

2014: Compression

2017: A2A

2018: Direct Streams

2019: Portfolio Trading

2020: ReMatch

....

Tradeweb

...STREAM OF INNOVATIONS

Multi-Client Net Spotting 2021

Hedging of U.S. HG Credit

with USTS

Asset Swaps 2019

Trading IRS and government

bonds simultaneously

BC 2017/ CIBM Direct 2020

Connecting bond traders with

China (Northbound trading)

UST Closing Prices 2019

Replicating a UK concept for

Gilt trading in the U.S. for USTS

Credit AiPrice 2018

Delivering prices using

content from all three sectors

Credit ReMatch 2020

Connecting Wholesale with

Retail and Institutional

UST Streams 2018

Improving on a CLOB with

streams

Credit Portfolio Trading 2019

Execute large, complex trades

across numerous bondsView entire presentation