Tudor, Pickering, Holt & Co Investment Banking

AM Status Quo

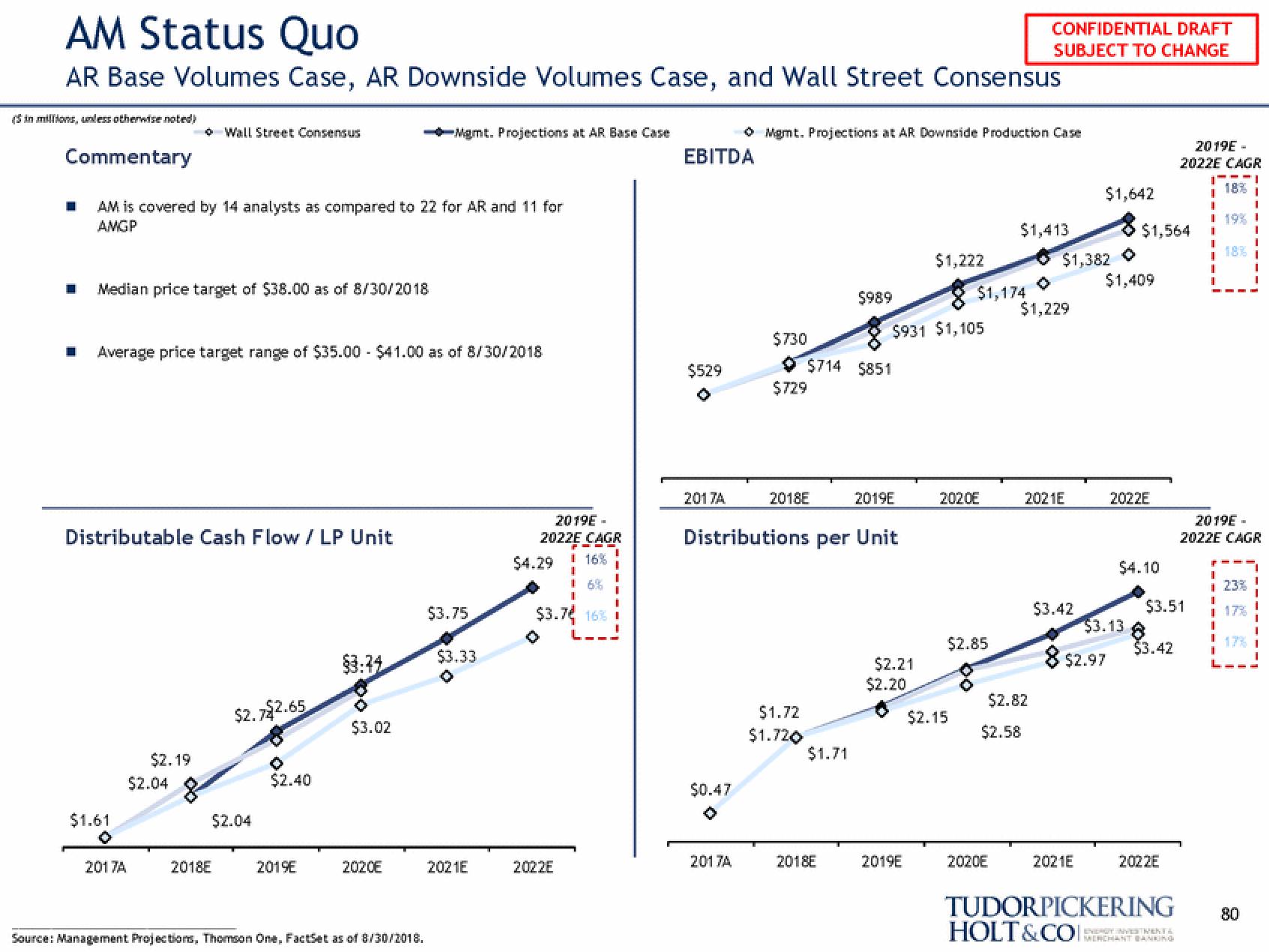

AR Base Volumes Case, AR Downside Volumes Case, and Wall Street Consensus

(in millions, unless otherwise noted)

Commentary

AM is covered by 14 analysts as compared to 22 for AR and 11 for

AMGP

Median price target of $38.00 as of 8/30/2018

Average price target range of $35.00 $41.00 as of 8/30/2018

Distributable Cash Flow / LP Unit

$1.61

Wall Street Consensus

0

2017A

$2.19

$2.04

2018E

$2.722.65

$2.04

$2.40

2019E

$3:24

$3.02

Mgmt. Projections at AR Base Case

2020E

Source: Management Projections, Thomson One, FactSet as of 8/30/2018.

$3.75

$3.33

2021E

2019E-

2022E CAGR

I 16%

$4.29

16% I

|

$3.74 16%

2022E

EBITDA

$529

2017A

$0.47

ⒸMgmt. Projections at AR Downside Production Case

2017A

$730

$729

2018E

$714 $851

$1.72

$1.720

Distributions per Unit

$989

$1.71

2018E

$931 $1,105

2019E

$2.21

$2.20

$1,222

2019E

2020E

$1,174

$2.85

$2.15

$1,413

2020E

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

O

$1,229

$2.58

$2.82

$1,382 O

2021E

$3.42

$1,642

2021E

$1,409

8 $2.97

$1,564

2022E

$3.13

$4.10

$3.42

2019E-

2022E CAGR

1

$3.51

2022E

ENERGY INVESTMENT &

MERCHANT BANKING

I

1

18%

2019E-

2022E CAGR

1 23%

I 17%

TUDORPICKERING 80

HOLT&COI:View entire presentation