Allwyn Results Presentation Deck

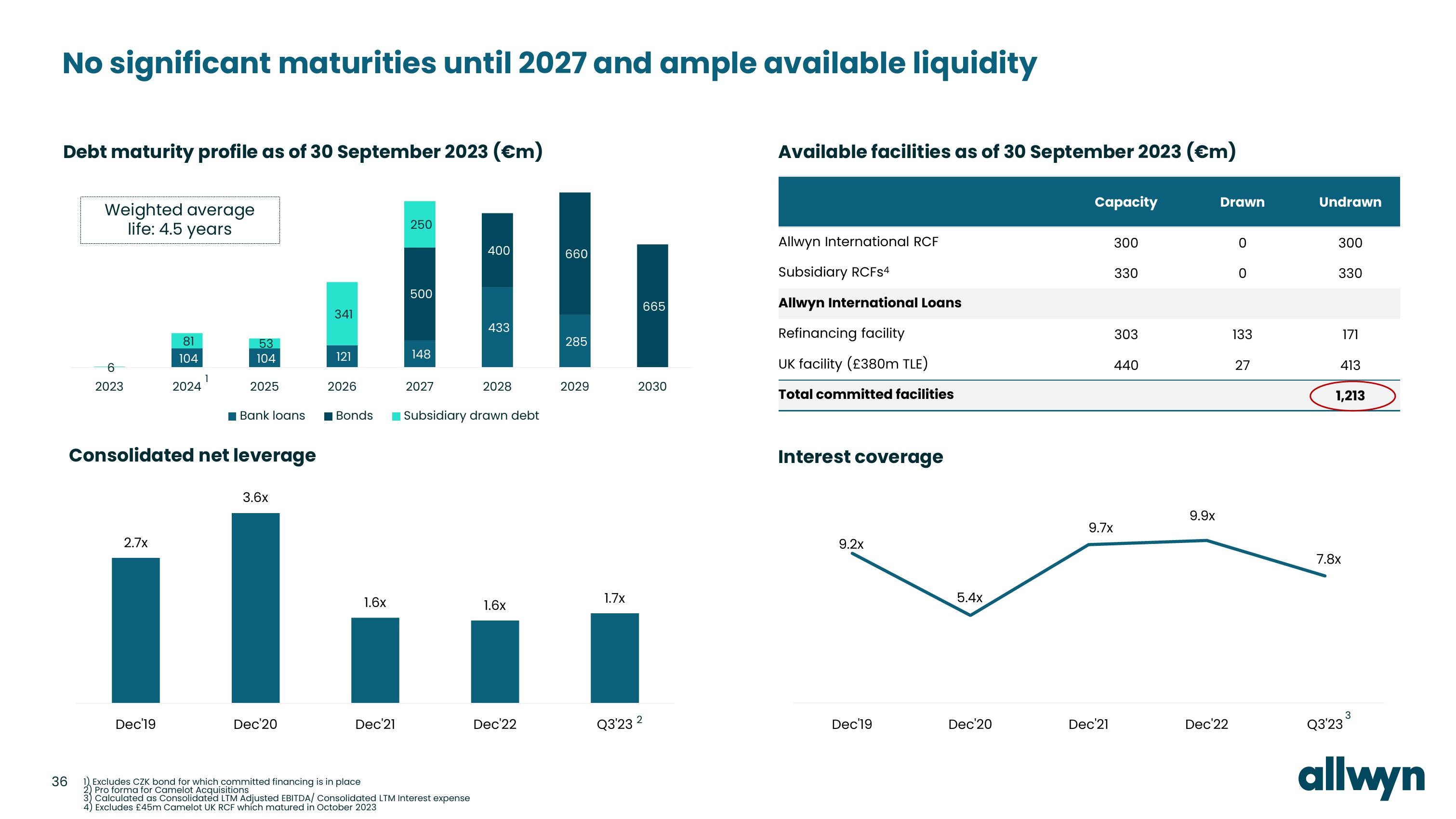

No significant maturities until 2027 and ample available liquidity

Debt maturity profile as of 30 September 2023 (€m)

36

Weighted average

life: 4.5 years

6

2023

2.7x

81

104

Dec'19

2024

1

53

104

2025

Consolidated net leverage

Bank loans

3.6x

Dec'20

341

121

2026

1.6x

250

Dec'21

500

148

2027

400

Bonds Subsidiary drawn debt

Excludes CZK bond for which committed financing is in place

Pro forma for Camelot Acquisitions

3) Calculated as Consolidated LTM Adjusted EBITDA/ Consolidated LTM Interest expense

Excludes £45m Camelot UK RCF which matured in October 2023

433

2028

1.6x

Dec 22

660

285

2029

1.7x

665

2030

Q3'232

Available facilities as of 30 September 2023 (€m)

Allwyn International RCF

Subsidiary RCFS4

Allwyn International Loans

Refinancing facility

UK facility (£380m TLE)

Total committed facilities

Interest coverage

9.2x

Dec'19

5.4x

Dec'20

Capacity

300

Dec'21

330

303

9.7x

440

9.9x

Drawn

Dec 22

0

0

133

27

Undrawn

300

330

171

413

1,213

7.8x

Q3'23

3

allwynView entire presentation