Strategically Positioning Truist Insurance Holdings for Long-Term Success

Insurance brokerage industry backdrop

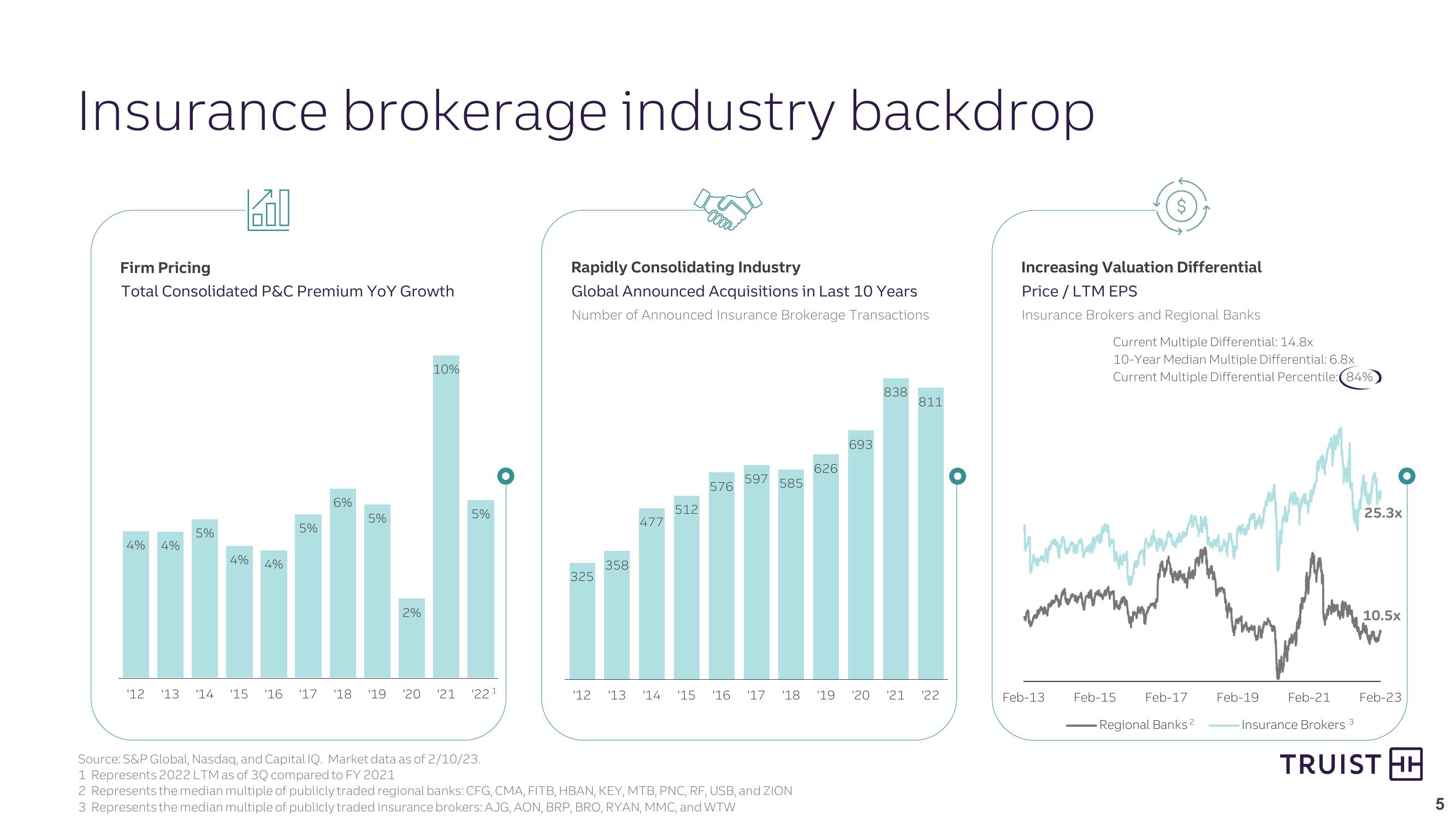

Firm Pricing

Total Consolidated P&C Premium YoY Growth

10%

Rapidly Consolidating Industry

Global Announced Acquisitions in Last 10 Years

Number of Announced Insurance Brokerage Transactions

Increasing Valuation Differential

Price/LTM EPS

Insurance Brokers and Regional Banks

Current Multiple Differential: 14.8x

10-Year Median Multiple Differential: 6.8x

Current Multiple Differential Percentile: (84%

5%

5%

4% 4%

4% 4%

6%

5%

5%

2%

358

325

693

626

597

576

585

512

477

838

811

'12 '13

'14 '15

'16 '17

'18 '19

'20 '21

'221

'12

13

'14

'15 '16 '17

'18

'19 '20

'21

'22

Feb-13

Feb-15

Feb-17

Feb-19

Regional Banks 2

Source: S&P Global, Nasdaq, and Capital IQ. Market data as of 2/10/23.

1 Represents 2022 LTM as of 3Q compared to FY 2021

2 Represents the median multiple of publicly traded regional banks: CFG, CMA, FITB, HBAN, KEY, MTB, PNC, RF, USB, and ZION

3 Represents the median multiple of publicly traded insurance brokers: AJG, AON, BRP, BRO, RYAN, MMC, and WTW

Feb-21

25.3x

10.5x

ww

Feb-23

Insurance Brokers 3

TRUIST HH

5View entire presentation