Livent Corporation Investor Presentation

Livent

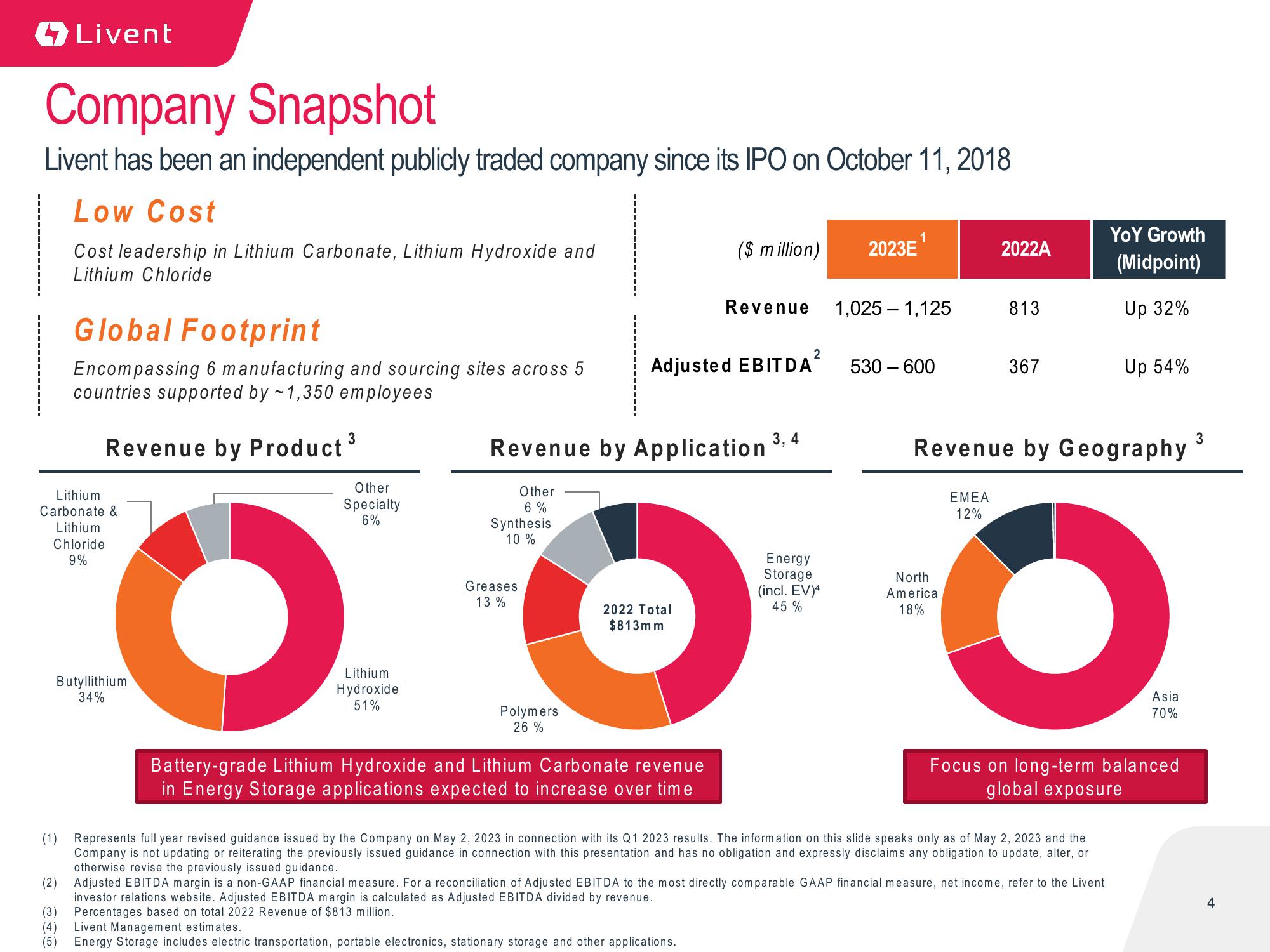

Company Snapshot

Livent has been an independent publicly traded company since its IPO on October 11, 2018

Low Cost

Cost leadership in Lithium Carbonate, Lithium Hydroxide and

Lithium Chloride

Global Footprint

Encompassing 6 manufacturing and sourcing sites across 5

countries supported by ~1,350 employees

Lithium

Carbonate &

Lithium

Chloride

9%

(1)

3

Revenue by Product ³

Butyllithium

34%

Other

Specialty

6%

Lithium

Hydroxide

51%

Other

6 %

Synthesis

10 %

Greases

13%

Revenue by Application ³,4

Polymers

26%

Adjusted EBITDA²

2022 Total

$813mm

1

($ million) 2023E

Battery-grade Lithium Hydroxide and Lithium Carbonate revenue

in Energy Storage applications expected to increase over time

Revenue

(4) Livent Management estimates.

(5) Energy Storage includes electric transportation, portable electronics, stationary storage and other applications.

Energy

Storage

(incl. EV)4

45%

1,025 - 1,125

530 - 600

2022A

North

America

18%

813

367

Revenue by Geography

EMEA

12%

Represents full year revised guidance issued by the Company on May 2, 2023 in connection with its Q1 2023 results. The information on this slide speaks only as of May 2, 2023 and the

Company is not updating or reiterating the previously issued guidance in connection with this presentation and has no obligation and expressly disclaims any obligation to update, alter, or

otherwise revise the previously issued guidance.

YOY Growth

(Midpoint)

Up 32%

(2) Adjusted EBITDA margin is a non-GAAP financial measure. For a reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure, net income, refer to the Livent

investor relations website. Adjusted EBITDA margin is calculated as Adjusted EBITDA divided by revenue.

(3) Percentages based on total 2022 Revenue of $813 million.

Up 54%

Focus on long-term balanced

global exposure

Asia

70%

3

4View entire presentation