Altus Power Results Presentation Deck

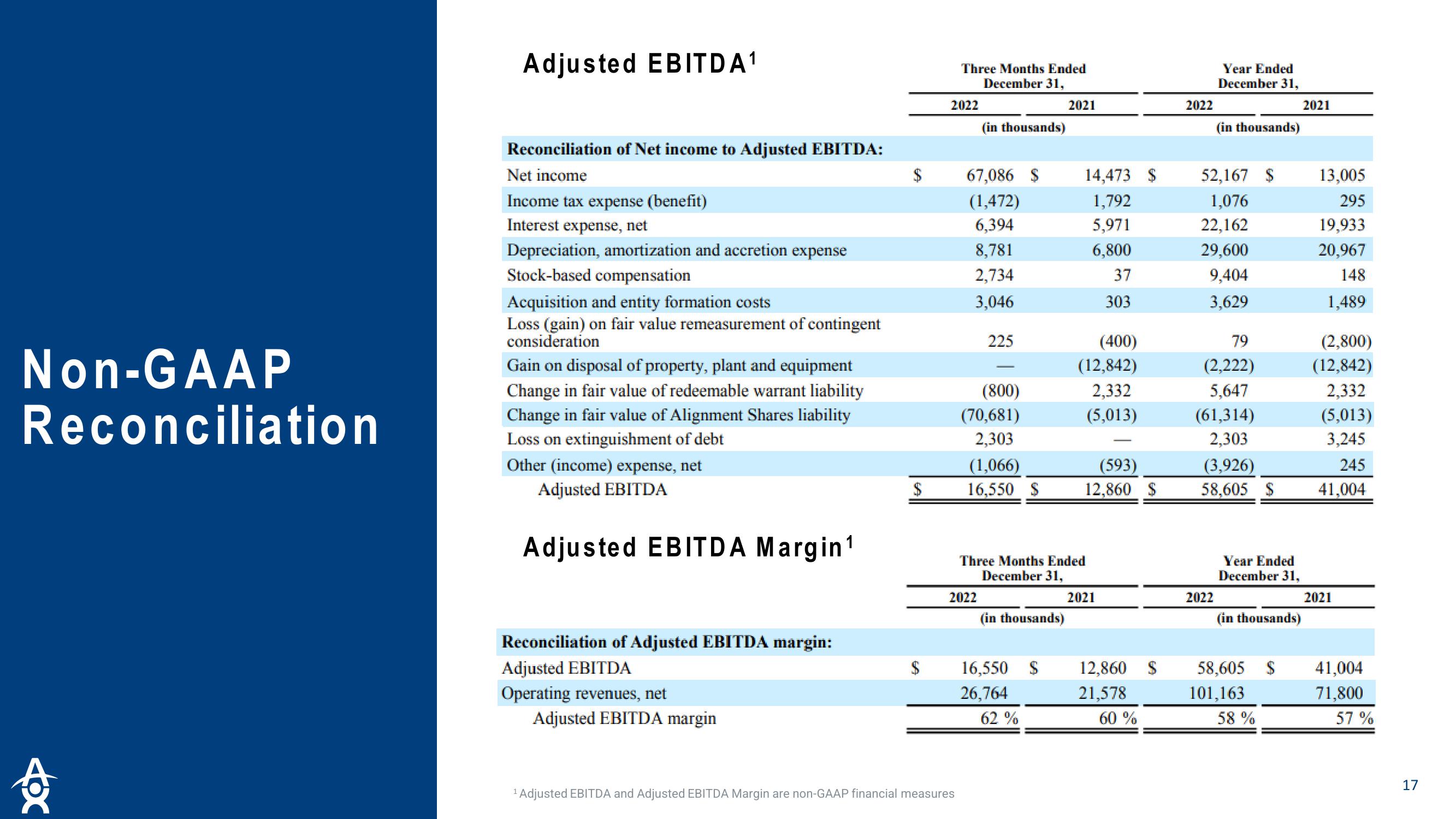

Non-GAAP

Reconciliation

box

Adjusted EBITDA¹

Reconciliation of Net income to Adjusted EBITDA:

Net income

Income tax expense (benefit)

Interest expense, net

Depreciation, amortization and accretion expense

Stock-based compensation

Acquisition and entity formation costs

Loss (gain) on fair value remeasurement of contingent

consideration

Gain on disposal of property, plant and equipment

Change in fair value of redeemable warrant liability

Change in fair value of Alignment Shares liability

Loss on extinguishment of debt

Other (income) expense, net

Adjusted EBITDA

Adjusted EBITDA Margin ¹

Reconciliation of Adjusted EBITDA margin:

Adjusted EBITDA

Operating revenues, net

Adjusted EBITDA margin

Three Months Ended

December 31,

2022

¹ Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures

(in thousands)

67,086 $

(1,472)

6,394

8,781

2,734

3,046

2022

225

(800)

(70,681)

2,303

(1,066)

16,550 $

(in thousands)

16,550

26,764

Three Months Ended

December 31,

62 %

2021

$

14,473 $

1,792

5,971

6,800

37

303

(400)

(12,842)

2,332

(5,013)

(593)

12,860 S

2021

12,860 $

21,578

60%

2022

Year Ended

December 31,

(in thousands)

52,167

1,076

22,162

29,600

9,404

3,629

2022

79

(2,222)

5,647

(61,314)

2,303

(3,926)

58,605 $

Year Ended

December 31,

(in thousands)

58,605 $

101,163

58%

2021

13,005

295

19,933

20,967

148

1,489

(2,800)

(12,842)

2,332

(5,013)

3,245

245

41,004

2021

41,004

71,800

57 %

17View entire presentation