Deutsche Bank Results Presentation Deck

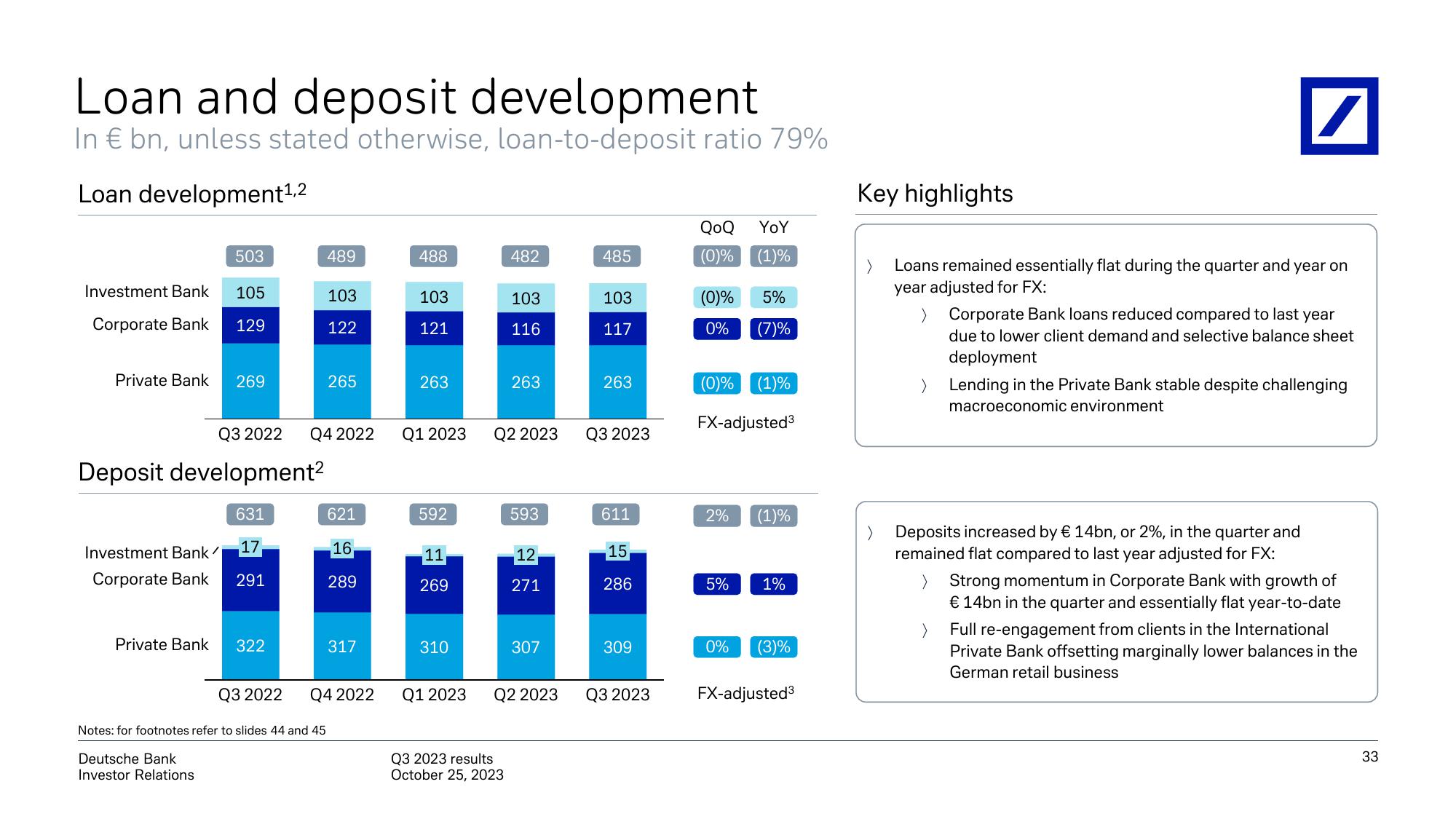

Loan and deposit development

In € bn, unless stated otherwise, loan-to-deposit ratio 79%

Loan development ¹,2

503

Investment Bank 105

Corporate Bank 129

Private Bank 269

Q3 2022

Deposit development²

631

17

Investment Bank

Corporate Bank 291

Private Bank 322

Q3 2022

489

103

122

Q4 2022

Notes: for footnotes refer to slides 44 and 45

Deutsche Bank

Investor Relations

265

621

16.

289

317

Q4 2022

488

103

121

263

Q1 2023

592

11

269

310

Q1 2023

482

103

116

Q3 2023 results

October 25, 2023

263

Q2 2023

593

12

271

307

Q2 2023

485

103

117

263

Q3 2023

611

15,

286

309

Q3 2023

QoQ YoY

(0)%

(1)%

(0)%

5%

0% (7)%

(0)% (1)%

FX-adjusted³

2%

5%

0%

(1)%

1%

(3)%

FX-adjusted³

Key highlights

Loans remained essentially flat during the quarter and year on

year adjusted for FX:

>

/

Corporate Bank loans reduced compared to last year

due to lower client demand and selective balance sheet

deployment

Lending in the Private Bank stable despite challenging

macroeconomic environment

Deposits increased by € 14bn, or 2%, in the quarter and

remained flat compared to last year adjusted for FX:

>

> Strong momentum in Corporate Bank with growth of

€ 14bn in the quarter and essentially flat year-to-date

Full re-engagement from clients in the International

Private Bank offsetting marginally lower balances in the

German retail business

33View entire presentation