HSBC Investor Event Presentation Deck

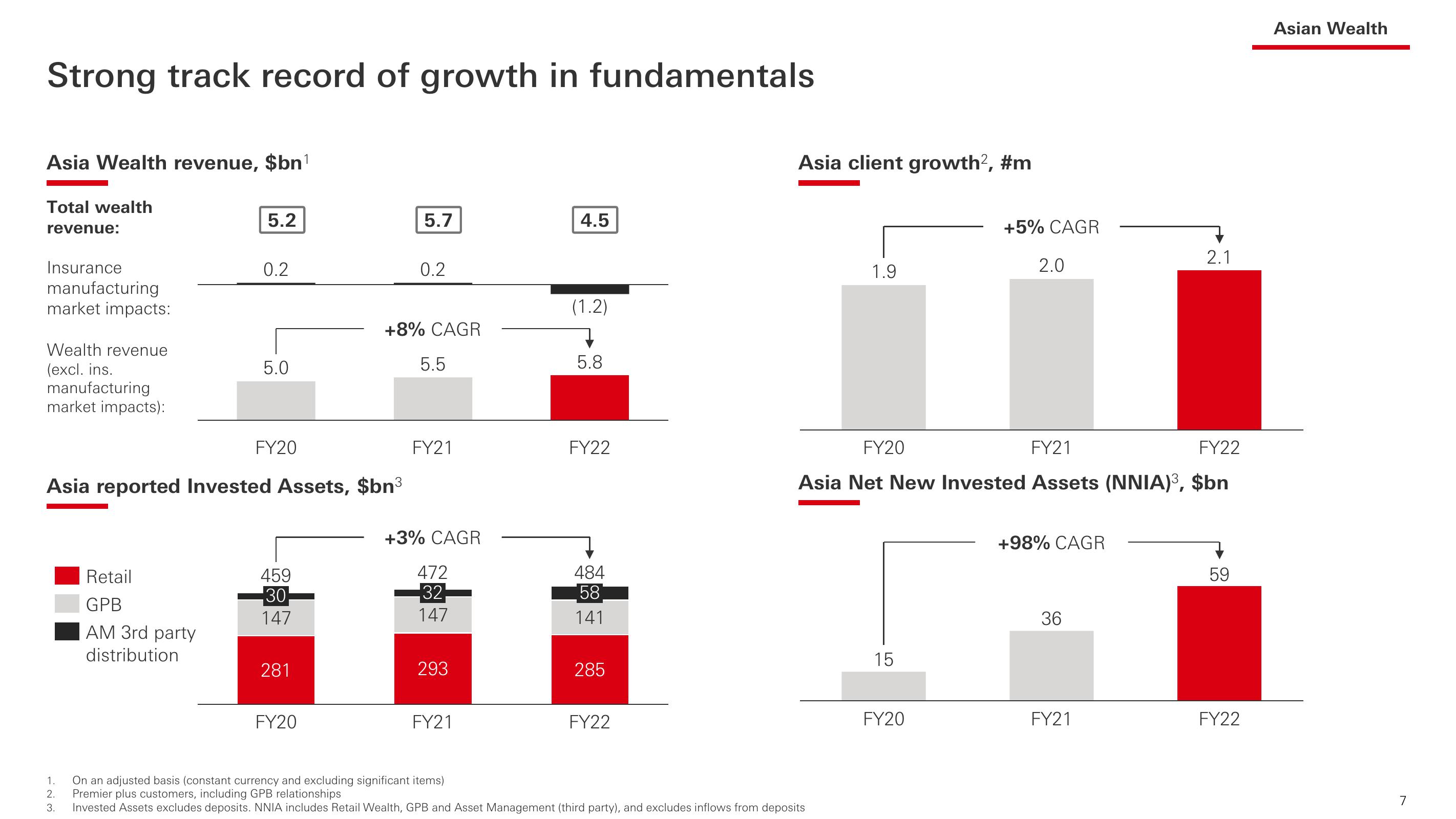

Strong track record of growth in fundamentals

Asia Wealth revenue, $bn¹

Total wealth

revenue:

Insurance

manufacturing

market impacts:

Wealth revenue

(excl. ins.

manufacturing

market impacts):

5.2

Retail

GPB

AM 3rd party

distribution

0.2

5.0

FY20

Asia reported Invested Assets, $bn³

459

30

147

281

FY20

5.7

0.2

+8% CAGR

5.5

FY21

+3% CAGR

472

32-

147

293

FY21

4.5

(1.2)

7

5.8

FY22

484

58

141

285

FY22

Asia client growth², #m

1.9

1.

On an adjusted basis (constant currency and excluding significant items)

2.

Premier plus customers, including GPB relationships

3. Invested Assets excludes deposits. NNIA includes Retail Wealth, GPB and Asset Management (third party), and excludes inflows from deposits

15

+5% CAGR

FY21

FY22

FY20

Asia Net New Invested Assets (NNIA)³, $bn

FY20

2.0

+98% CAGR

36

2.1

FY21

59

FY22

Asian Wealth

7View entire presentation