SoftBank Results Presentation Deck

SoftBank

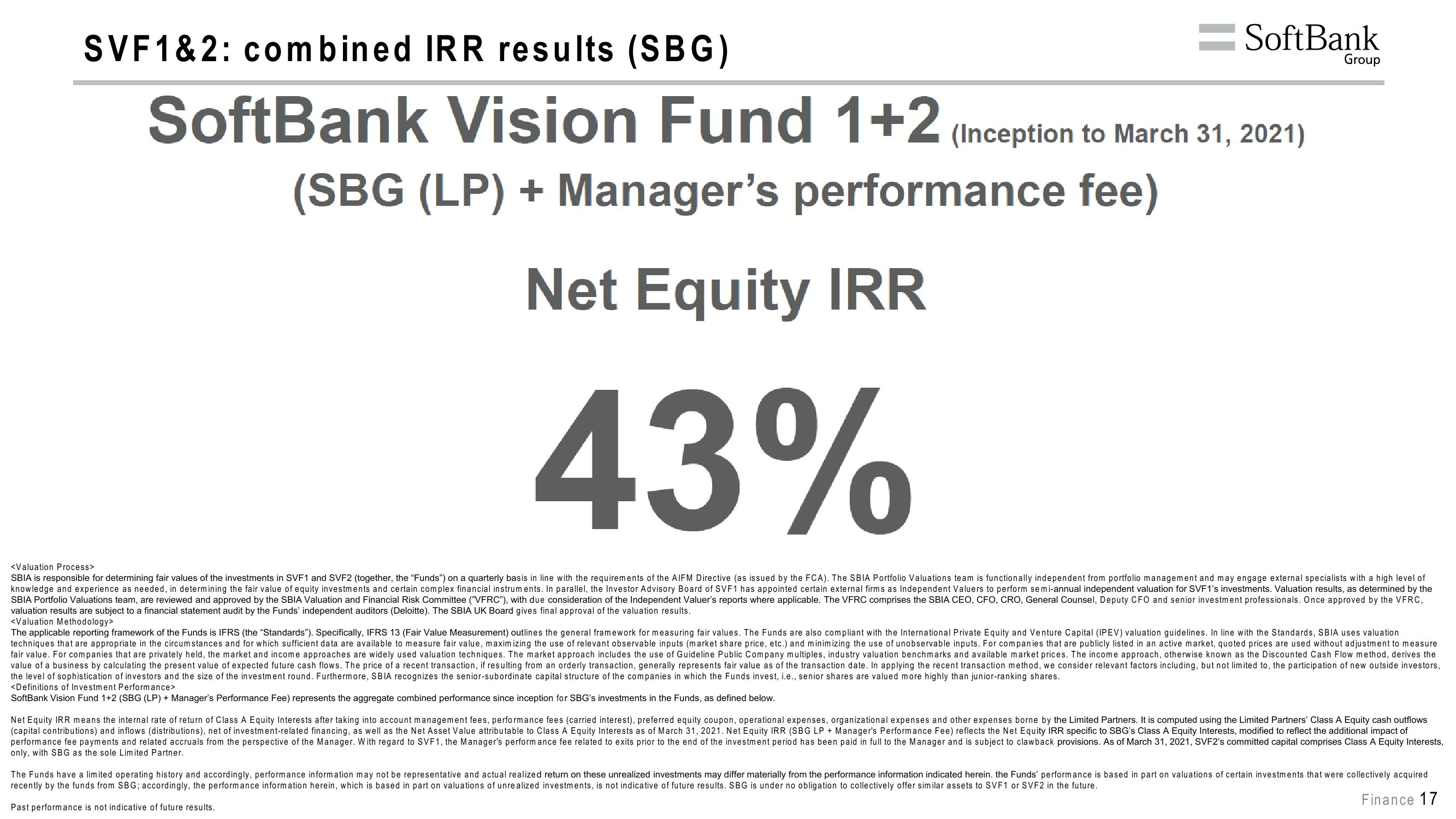

SVF1&2: combined IRR results (SBG)

SoftBank Vision Fund 1+2 (Inception to March 31, 2021)

(SBG (LP) + Manager's performance fee)

Net Equity IRR

Group

43%

<Valuation Process>

SBIA is responsible for determining fair values of the investments in SVF1 and SVF2 (together, the "Funds") on a quarterly basis in line with the requirements of the AIFM Directive (as issued by the FCA). The SBIA Portfolio Valuations team is functionally independent from portfolio management and may engage external specialists with a high level of

knowledge and experience as needed, in determining the fair value of equity investments and certain complex financial instruments. In parallel, the Investor Advisory Board of SVF1 has appointed certain external firms as Independent Valuers to perform semi-annual independent valuation for SVF1's investments. Valuation results, as determined by the

SBIA Portfolio Valuations team, are reviewed and approved by the SBIA Valuation and Financial Risk Committee ("VFRC"), with due consideration of the Independent Valuer's reports where applicable. The VFRC comprises the SBIA CEO, CFO, CRO, General Counsel, Deputy CFO and senior investment professionals. Once approved by the VFRC,

valuation results are subject to a financial statement audit by the Funds' independent auditors (Deloitte). The SBIA UK Board gives final approval of the valuation results.

<Valuation Methodology>

The applicable reporting framework of the Funds is IFRS (the "Standards"). Specifically, IFRS 13 (Fair Value Measurement) outlines the general framework for measuring fair values. The Funds are also compliant with the International Private Equity and Venture Capital (IPEV) valuation guidelines. In line with the Standards, SBIA uses valuation

techniques that are appropriate in the circumstances and for which sufficient data are available to measure fair value, maximizing the use of relevant observable inputs (market share price, etc.) and minimizing the use of unobservable inputs. For companies that are publicly listed in an active market, quoted prices are used without adjustment to measure

fair value. For companies that are privately held, the market and income approaches are widely used valuation techniques. The market approach includes the use of Guideline Public Company multiples, industry valuation benchmarks and available market prices. The income approach, otherwise known as the Discounted Cash Flow method, derives the

value of a business by calculating the present value of expected future cash flows. The price of a recent transaction, if resulting from an orderly transaction, generally represents fair value as of the transaction date. In applying the recent transaction method, we consider relevant factors including, but not limited to, the participation of new outside investors,

the level of sophistication of investors and the size of the investment round. Furthermore, SBIA recognizes the senior-subordinate capital structure of the companies in which the Funds invest, i.e., senior shares are valued more highly than junior-ranking shares.

<Definitions of Investment Performance>

SoftBank Vision Fund 1+2 (SBG (LP) + Manager's Performance Fee) represents the aggregate combined performance since inception for SBG's investments in the Funds, as defined below.

Net Equity IRR means the internal rate of return of Class A Equity Interests after taking into account management fees, performance fees (carried interest), preferred equity coupon, operational expenses, organizational expenses and other expenses borne by the Limited Partners. It is computed using the Limited Partners' Class A Equity cash outflows

(capital contributions) and inflows (distributions), net of investment-related financing, as well as the Net Asset Value attributable to Class A Equity Interests as of March 31, 2021. Net Equity IRR (SBG LP + Manager's Performance Fee) reflects the Net Equity IRR specific to SBG's Class A Equity Interests, modified to reflect the additional impact of

performance fee payments and related accruals from the perspective of the Manager. With regard to SVF1, the Manager's performance fee related to exits prior to the end of the investment period has been paid in full to the Manager and is subject to clawback provisions. As of March 31, 2021, SVF2's committed capital comprises Class A Equity Interests,

only, with SBG as the sole Limited Partner.

The Funds have a limited operating history and accordingly, performance information may not be representative and actual realized return on these unrealized investments may differ materially from the performance information indicated herein. the Funds' performance is based in part on valuations of certain investments that were collectively acquired

recently by the funds from SBG; accordingly, the performance information herein, which is based in part on valuations of unrealized investments, is not indicative of future results. SBG is under no obligation to collectively offer similar assets to SVF1 or SVF2 in the future.

Past performance is not indicative of future results.

Finance 17View entire presentation