PJT Partners Investment Banking Pitch Book

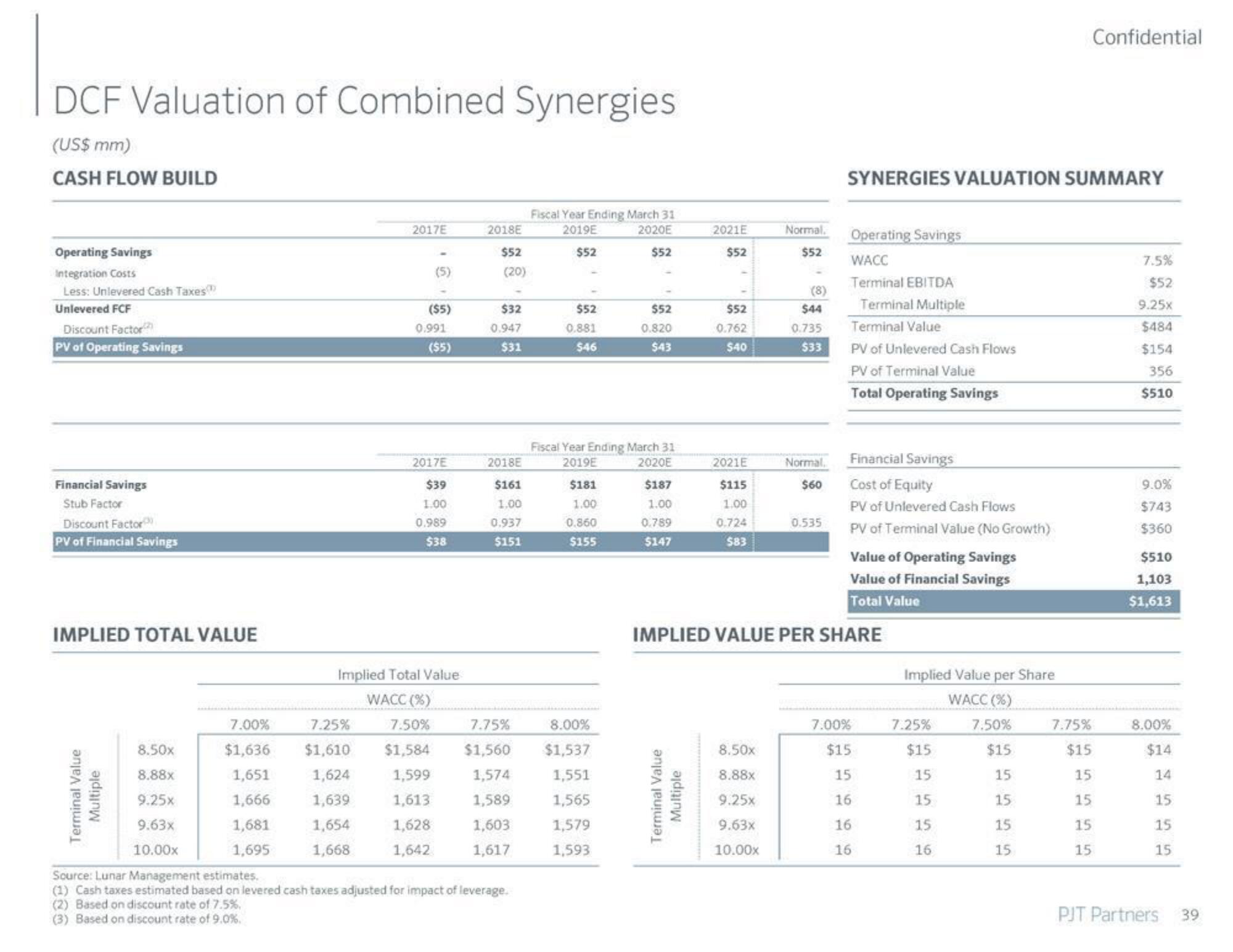

DCF Valuation of Combined Synergies

(US$ mm)

CASH FLOW BUILD

Operating Savings

Integration Costs

Less: Unlevered Cash Taxes

Unlevered FCF

Discount Factor

PV of Operating Savings

Financial Savings

Stub Factor

Discount Factor

PV of Financial Savings

IMPLIED TOTAL VALUE

Terminal Value

Multiple

8.50x

8.88x

9.25x

9.63x

10.00x

7.00%

$1,636

1,651

1,666

1,681

1,695

2017E

(5)

($5)

0.991

($5)

2017E

$39

1.00

0.989

$38

2018E

$52

(20)

$32

0.947

$31

2018E

$161

1.00

0.937

$151

Fiscal Year Ending March 31

2019E

2020E

$52

$52

Source: Lunar Management estimates.

(1) Cash taxes estimated based on levered cash taxes adjusted for impact of leverage.

(2) Based on discount rate of 7.5%.

(3) Based on discount rate of 9.0%.

$52

0.881

$46

Fiscal Year Ending March 31

2019E

2020E

$181

1.00

0.860

$155

Implied Total Value

WACC (%)

7.25%

8.00%

7.50% 7.75%

$1,610 $1,584 $1,560 $1,537

1,624

1,599

1,574

1,551

1,639

1,613

1,589

1,565

1,654

1,628

1,603

1,579

1,668

1,642

1,617

1,593

$52

0.820

$43

$187

1.00

0.789

$147

2021E

$52

Terminal Value

Multiple

$52

0.762

$40

2021E

$115

1.00

0.724

$83

Normal.

$52

8.50x

8.88x

9.25x

9.63x

10.00x

(8)

$44

0.735

$33

Normal.

$60

0.535

SYNERGIES VALUATION SUMMARY

Operating Savings

WACC

Terminal EBITDA

Terminal Multiple

Terminal Value

PV of Unlevered Cash Flows

PV of Terminal Value

Total Operating Savings

Financial Savings

Cost of Equity

PV of Unlevered Cash Flows

PV of Terminal Value (No Growth)

IMPLIED VALUE PER SHARE

Value of Operating Savings

Value of Financial Savings

Total Value

7.00%

$15

15

16

16

16

Implied Value per Share

WACC (%)

7.50%

$15

15

15

15

15

Confidential

7.25%

$15

15

15

15

16

7.75%

$15

15

15

15

15

7.5%

$52

9.25x

$484

$154

356

$510

9.0%

$743

$360

$510

1,103

$1,613

8.00%

$14

14

15

15

15

PJT Partners

39View entire presentation