Bird Investor Presentation Deck

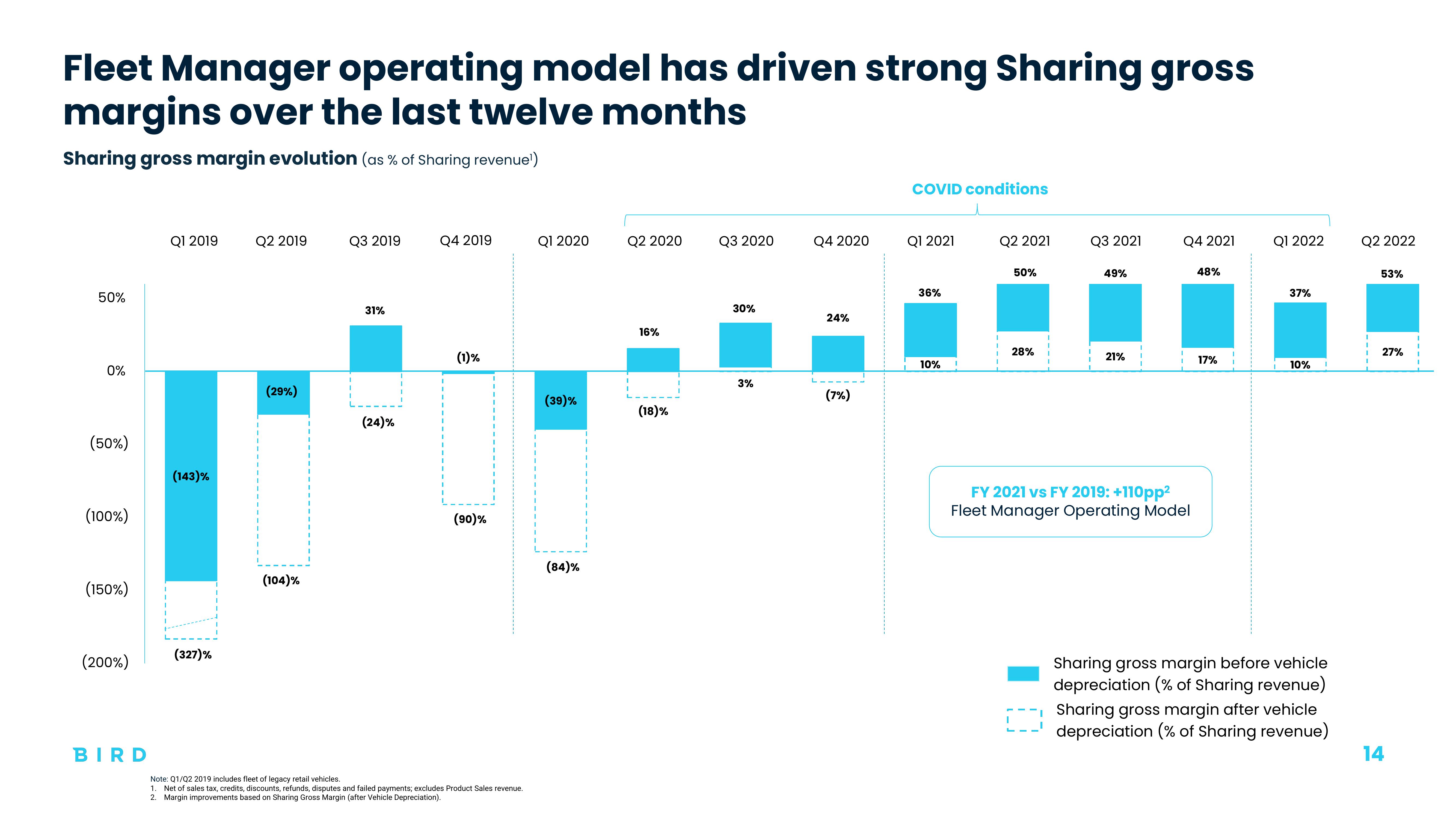

Fleet Manager operating model has driven strong Sharing gross

margins over the last twelve months

Sharing gross margin evolution (as % of Sharing revenue¹)

50%

0%

(50%)

(100%)

(150%)

(200%)

BIRD

Q1 2019

(143)%

(327)%

Q2 2019

(29%)

(104)%

Q3 2019

31%

(24)%

Q4 2019

(1)%

(90)%

Note: Q1/Q2 2019 includes fleet of legacy retail vehicles.

1. Net of sales tax, credits, discounts, refunds, disputes and failed payments; excludes Product Sales revenue.

2. Margin improvements based on Sharing Gross Margin (after Vehicle Depreciation).

Q1 2020

(39)%

(84)%

Q2 2020

16%

(18)%

Q3 2020

30%

3%

Q4 2020

24%

(7%)

COVID conditions

Q1 2021

36%

10%

Q2 2021

50%

28%

Q3 2021

49%

21%

Q4 2021

FY 2021 vs FY 2019: +110pp²

Fleet Manager Operating Model

48%

17%

Q1 2022

37%

10%

Sharing gross margin before vehicle

depreciation (% of Sharing revenue)

Sharing gross margin after vehicle

depreciation (% of Sharing revenue)

Q2 2022

53%

27%

14View entire presentation