LSE Mergers and Acquisitions Presentation Deck

2 Capital Markets

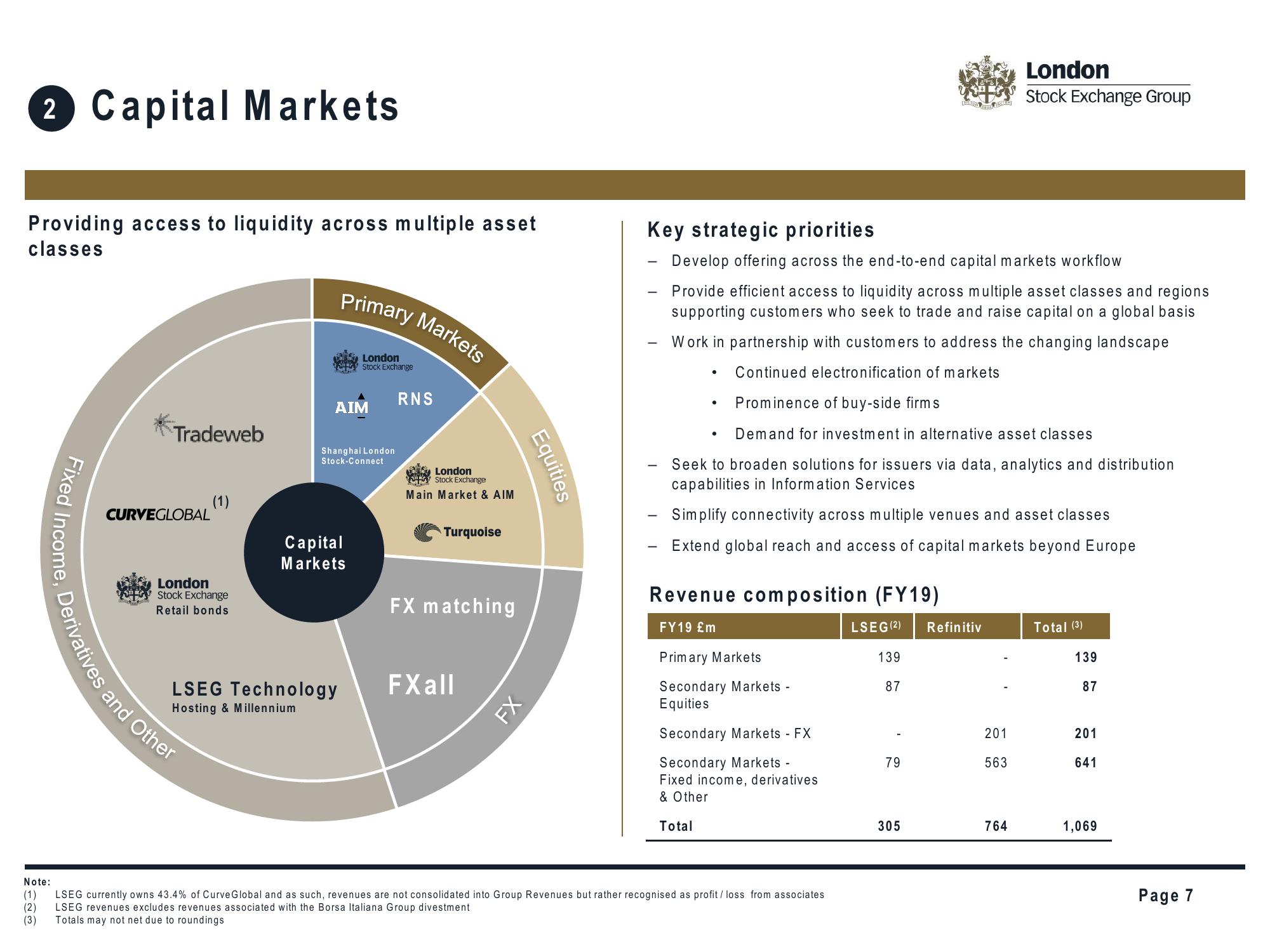

Providing access to liquidity across multiple asset

classes

Fixed

Income,

ives and Other

Tradeweb

CURVEGLOBAL

(1)

London

Stock Exchange

Retail bonds

Primary Markets

AIM

London

Stock Exchange

Shanghai London

Stock-Connect

Capital

Markets

LSEG Technology

Hosting & Millennium

RNS

London

Stock Exchange

Main Market & AIM

Turquoise

FX matching

FX all

FX

Equities

Key strategic priorities

Develop offering across the end-to-end capital markets workflow

Provide efficient access to liquidity across multiple asset classes and regions

supporting customers who seek to trade and raise capital on a global basis

Work in partnership with customers to address the changing landscape

Continued electronification of markets

Prominence of buy-side firms

Demand for investment in alternative asset classes

Seek to broaden solutions for issuers via data, analytics and distribution

capabilities in Information Services

-

●

●

Simplify connectivity across multiple venues and asset classes

Extend global reach and access of capital markets beyond Europe

Revenue composition (FY19)

LSEG (2)

FY19 £m

Primary Markets

Secondary Markets -

Equities

Total

Secondary Markets - FX

Secondary Markets -

Fixed income, derivatives

& Other

Note:

(1) LSEG currently owns 43.4% of CurveGlobal and as such, revenues are not consolidated into Group Revenues but rather recognised as profit / loss from associates

(2) LSEG revenues excludes revenues associated with the Borsa Italiana Group divestment

(3) Totals may not net due to roundings

139

87

79

305

Refinitiv

201

London

Stock Exchange Group

563

764

Total (3)

139

87

201

641

1,069

Page 7View entire presentation