Flutter Results Presentation Deck

US

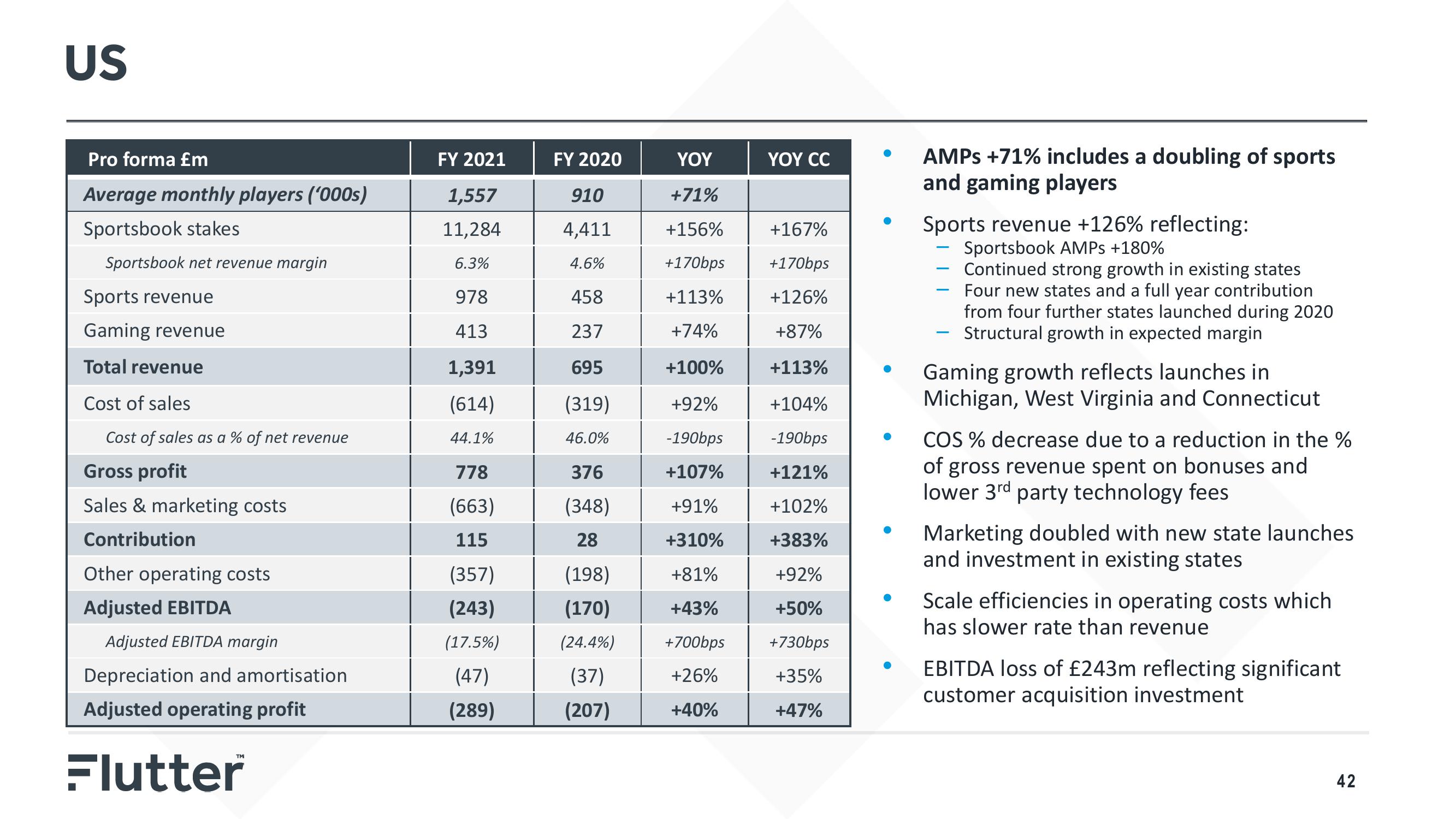

Pro forma £m

Average monthly players ('000s)

Sportsbook stakes

Sportsbook net revenue margin

Sports revenue

Gaming revenue

Total revenue

Cost of sales

Cost of sales as a % of net revenue

Gross profit

Sales & marketing costs

Contribution

Other operating costs

Adjusted EBITDA

Adjusted EBITDA margin

Depreciation and amortisation

Adjusted operating profit

Flutter

FY 2021

1,557

11,284

6.3%

978

413

1,391

(614)

44.1%

778

(663)

115

(357)

(243)

(17.5%)

(47)

(289)

FY 2020

910

4,411

4.6%

458

237

695

(319)

46.0%

376

(348)

28

(198)

(170)

(24.4%)

(37)

(207)

YOY

+71%

+156%

+170bps

+113%

+74%

+100%

+92%

-190bps

+107%

+91%

+310%

+81%

+43%

+700bps

+26%

+40%

YOY CC

+167%

+170bps

+126%

+87%

+113%

+104%

-190bps

+121%

+102%

+383%

+92%

+50%

+730bps

+35%

+47%

AMPS +71% includes a doubling of sports

and gaming players

Sports revenue +126% reflecting:

Sportsbook AMPS +180%

Continued strong growth in existing states

Four new states and a full year contribution

from four further states launched during 2020

Structural growth in expected margin

-

-

-

Gaming growth reflects launches in

Michigan, West Virginia and Connecticut

COS % decrease due to a reduction in the %

of gross revenue spent on bonuses and

lower 3rd party technology fees

Marketing doubled with new state launches

and investment in existing states

Scale efficiencies in operating costs which

has slower rate than revenue

EBITDA loss of £243m reflecting significant

customer acquisition investment

42View entire presentation