Oaktree Real Estate Opportunities Fund VII, L.P.

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

State of the Market - Opportunity Drivers in Europe

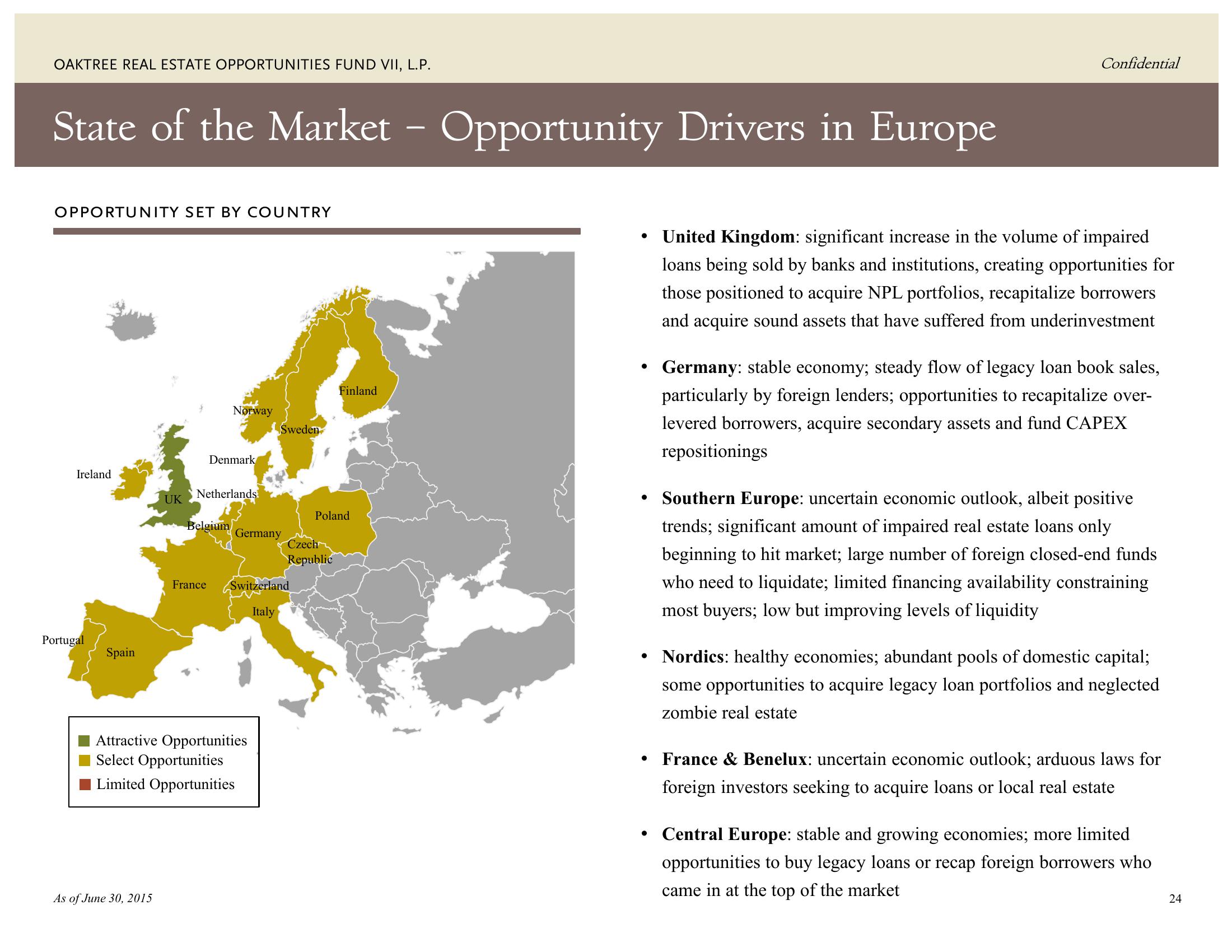

OPPORTUNITY SET BY COUNTRY

Ireland

Portugal

Spain

UK

As of June 30, 2015

Norway

Denmark

Netherlands!

Belgium

Sweden

Germany

Attractive Opportunities

Select Opportunities

Limited Opportunities

France Switzerland

Italy

Czech

Republic

Finland

Poland

●

●

●

Confidential

●

United Kingdom: significant increase in the volume of impaired

loans being sold by banks and institutions, creating opportunities for

those positioned to acquire NPL portfolios, recapitalize borrowers

and acquire sound assets that have suffered from underinvestment

Germany: stable economy; steady flow of legacy loan book sales,

particularly by foreign lenders; opportunities to recapitalize over-

levered borrowers, acquire secondary assets and fund CAPEX

repositionings

Southern Europe: uncertain economic outlook, albeit positive

trends; significant amount of impaired real estate loans only

beginning to hit market; large number of foreign closed-end funds

who need to liquidate; limited financing availability constraining

most buyers; low but improving levels of liquidity

Nordics: healthy economies; abundant pools of domestic capital;

some opportunities to acquire legacy loan portfolios and neglected

zombie real estate

• France & Benelux: uncertain economic outlook; arduous laws for

foreign investors seeking to acquire loans or local real estate

Central Europe: stable and growing economies; more limited

opportunities to buy legacy loans or recap foreign borrowers who

came in at the top of the market

24View entire presentation