Anghami SPAC Presentation Deck

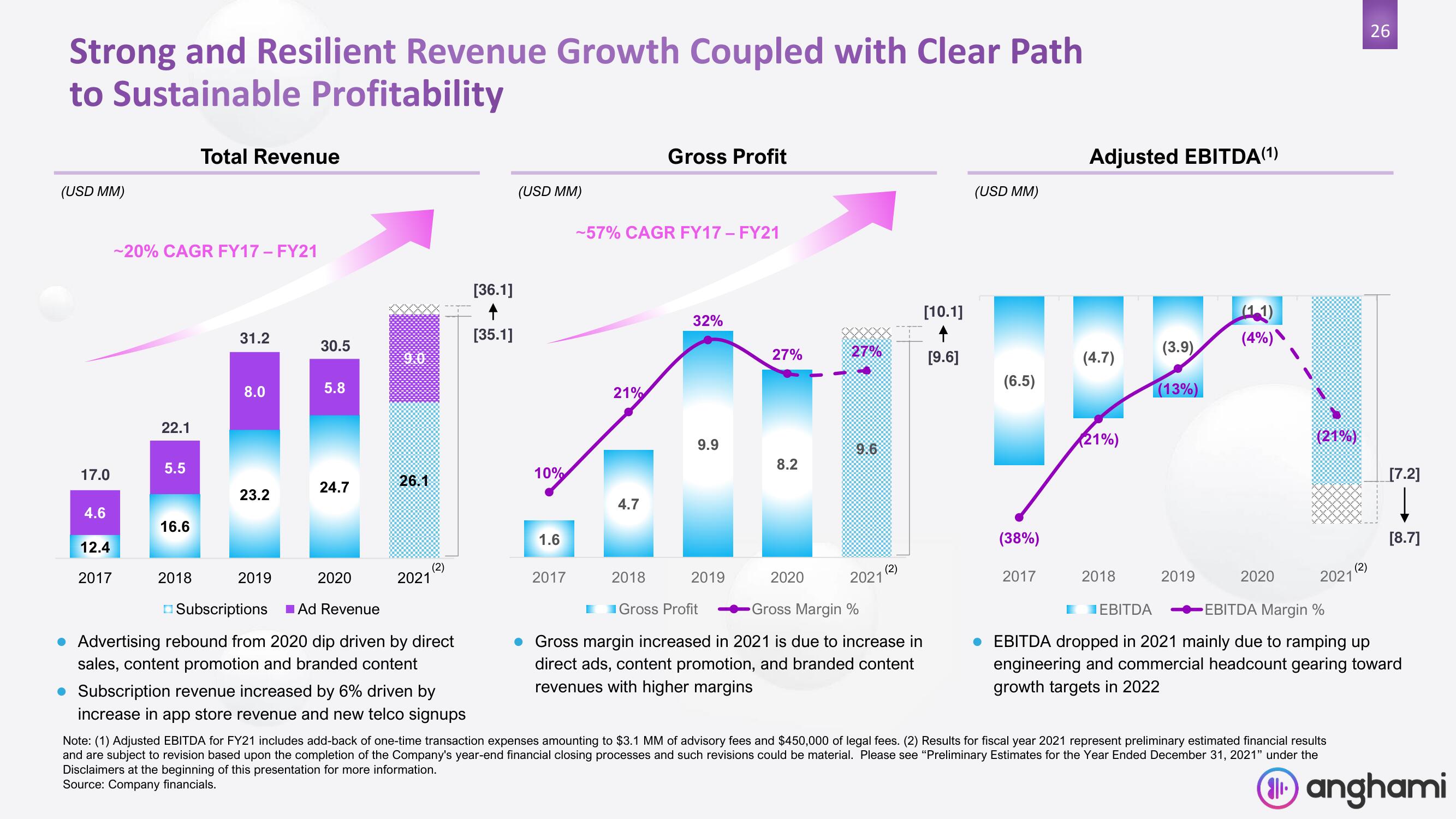

Strong and Resilient Revenue Growth Coupled with Clear Path

to Sustainable Profitability

(USD MM)

17.0

4.6

12.4

2017

~20% CAGR FY17 - FY21

22.1

5.5

16.6

Total Revenue

2018

31.2

8.0

23.2

2019

30.5

5.8

24.7

2020

9.0

26.1

2021

(2)

[36.1]

[35.1]

(USD MM)

10%

1.6

2017

-57% CAGR FY17- FY21

21%

4.7

Gross Profit

2018

32%

9.9

2019

27%

8.2

2020

27%

9.6

2021

(2)

Gross Profit

Gross Margin %

Gross margin increased in 2021 is due to increase in

direct ads, content promotion, and branded content

revenues with higher margins

[10.1]

[9.6]

(USD MM)

(6.5)

(38%)

2017

Adjusted EBITDA(1)

(4.7)

(21%)

2018

(3.9)

(13%)

2019

(1.1)

(4%)

2020

(21%)

2021

(2)

26

[7.2]

Į

[8.7]

EBITDA

EBITDA Margin %

EBITDA dropped in 2021 mainly due to ramping up

engineering and commercial headcount gearing toward

growth targets in 2022

Subscriptions Ad Revenue

Advertising rebound from 2020 dip driven by direct

sales, content promotion and branded content

Subscription revenue increased by 6% driven by

increase in app store revenue and new telco signups

Note: (1) Adjusted EBITDA for FY21 includes add-back of one-time transaction expenses amounting to $3.1 MM of advisory fees and $450,000 of legal fees. (2) Results for fiscal year 2021 represent preliminary estimated financial results

and are subject to revision based upon the completion of the Company's year-end financial closing processes and such revisions could be material. Please see "Preliminary Estimates for the Year Ended December 31, 2021" under the

Disclaimers at the beginning of this presentation for more information.

Source: Company financials.

11anghamiView entire presentation