Crocs Investor Presentation Deck

cr

CS

cr

CS

CI

OC!

Cl

APPENDIX

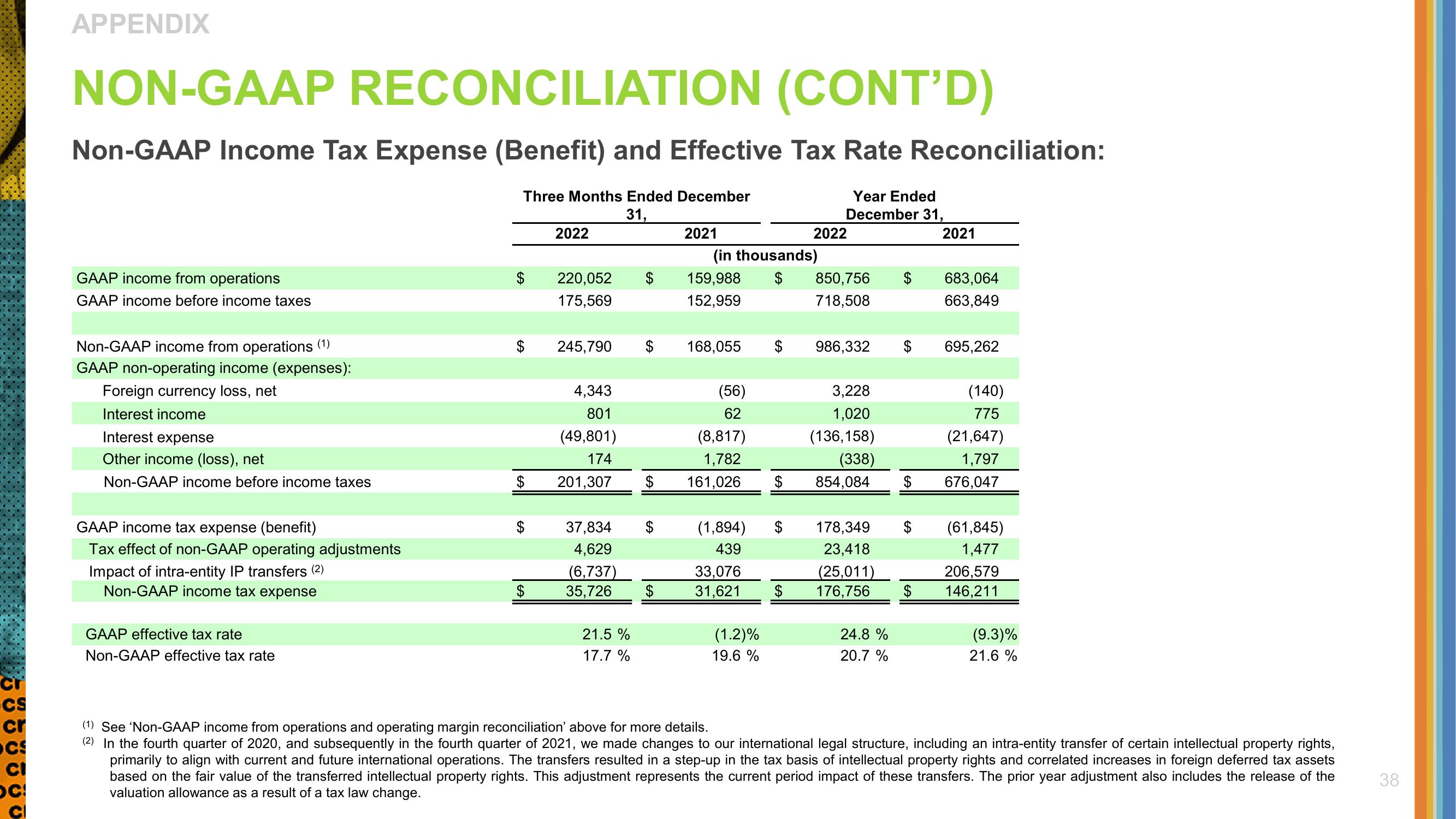

NON-GAAP RECONCILIATION (CONT'D)

Non-GAAP Income Tax Expense (Benefit) and Effective Tax Rate Reconciliation:

Year Ended

December 31,

GAAP income from operations

GAAP income before income taxes

Non-GAAP income from operations (1)

GAAP non-operating income (expenses):

Foreign currency loss, net

Interest income

Interest expense

Other income (loss), net

Non-GAAP income before income taxes

GAAP income tax expense (benefit)

Tax effect of non-GAAP operating adjustments

Impact of intra-entity IP transfers (2)

Non-GAAP income tax expense

GAAP effective tax rate

Non-GAAP effective tax rate

Three Months Ended December

31,

2022

220,052

175,569

245,790

4,343

801

(49,801)

174

$ 201,307 $

37,834 $

4,629

(6,737)

35,726

21.5 %

17.7%

$

2021

(in thousands)

159,988

152,959

168,055

(56)

62

(8,817)

1,782

161,026 $

(1,894) $

439

33,076

31,621

(1.2)%

19.6 %

2022

$

850,756

718,508

986,332

3,228

1,020

(136,158)

(338)

854,084

$

24.8 %

20.7 %

$

178,349 $

23,418

(25,011)

176,756 $

2021

683,064

663,849

695,262

(140)

775

(21,647)

1,797

676,047

(61,845)

1,477

206,579

146,211

(9.3)%

21.6%

(1) See 'Non-GAAP income from operations and operating margin reconciliation' above for more details.

(2) In the fourth quarter of 2020, and subsequently in the fourth quarter of 2021, we made changes to our international legal structure, including an intra-entity transfer of certain intellectual property rights,

primarily to align with current and future international operations. The transfers resulted in a step-up in the tax basis of intellectual property rights and correlated increases in foreign deferred tax assets

based on the fair value of the transferred intellectual property rights. This adjustment represents the current period impact of these transfers. The prior year adjustment also includes the release of the

valuation allowance as a result of a tax law change.

38View entire presentation