Evercore Investment Banking Pitch Book

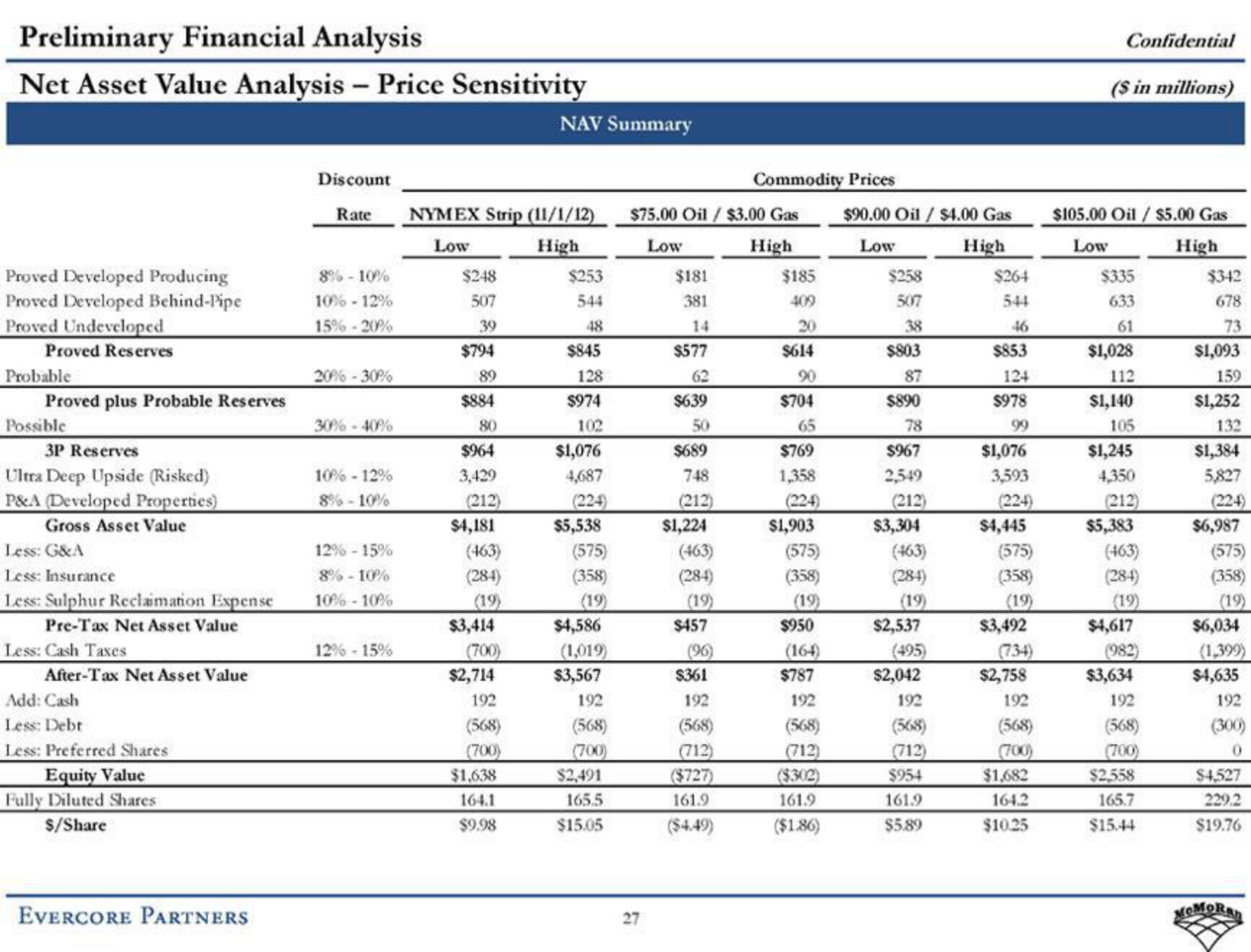

Preliminary Financial Analysis

Net Asset Value Analysis - Price Sensitivity

Proved Developed Producing

Proved Developed Behind-Pipe

Proved Undeveloped

Proved Reserves

Probable

Proved plus Probable Reserves

Possible

3P Reserves

Ultra Deep Upside (Risked)

P&A (Developed Properties)

Gross Asset Value

Less: G&A

Less: Insurance

Less: Sulphur Reclaimation Expense

Pre-Tax Net Asset Value

Less: Cash Taxes

After-Tax Net Asset Value

Add: Cash

Less: Debt

Less: Preferred Shares

Equity Value

Fully Diluted Shares

$/Share

EVERCORE PARTNERS

Discount

Rate

8%-10%

10% -12%

15%-20%

20%-30%

30% -40%

10% -12%

8%-10%

12%-15%

8%-10%

10%-10%

12%-15%

NYMEX Strip (11/1/12)

Low

High

$248

507

39

$794

89

$884

80

$964

3,429

(212)

$4,181

(463)

(284)

$3,414

(700)

$2,714

NAV Summary

192

(568)

(700)

$1,638

164.1

$9.98

$253

544

48

$845

128

$974

102

$1,076

4,687

(224)

$5,538

(575)

(358)

(19)

$4,586

(1,019)

$3,567

192

(568)

(700)

$2,491

165.5

$15.05

$75.00 Oil/ $3.00 Gas

Low

High

27

$181

381

14

$577

62

$639

50

$689

748

(212)

$1,224

(463)

(284)

(19)

$457

(96)

Commodity Prices

$361

192

(568)

(712)

($727)

161.9

($4.49)

$185

409

20

$614

$704

65

$769

1,358

(224)

$1,903

(575)

(358)

(19)

$950

(164)

$787

192

(568)

(712)

($302)

161.9

($1.86)

$90.00 Oil / $4.00 Gas

Low

High

$258

507

38

$803

87

$890

78

$967

2,549

(212)

$3,304

(463)

(284)

(19)

$2,537

(495)

$2,042

192

(568)

(712)

$954

161.9

$5.89

$264

544

46

$853

124

$978

99

$1,076

3,593

(224)

$4,445

(575)

(358)

(19)

$3,492

(734)

$2,758

192

(568)

(700)

$1,682

164.2

$10.25

Confidential

($ in millions)

$105.00 Oil / $5.00 Gas

Low

High

$335

633

61

$1,028

112

$1,140

105

$1,245

4,350

(212)

$5,383

(463)

(284)

(19)

$4,617

(982)

$3,634

192

(568)

(700)

$2,558

165.7

$15.44

$342

678

73

$1,093

159

$1,252

132

$1,384

5,827

(224)

$6,987

(575)

(358)

(19)

$6,034

(1,399)

$4,635

192

(300)

0

$4,527

229.2

$19.76

MOMORALView entire presentation