LCI Industries Investor Presentation Deck

APPENDIX

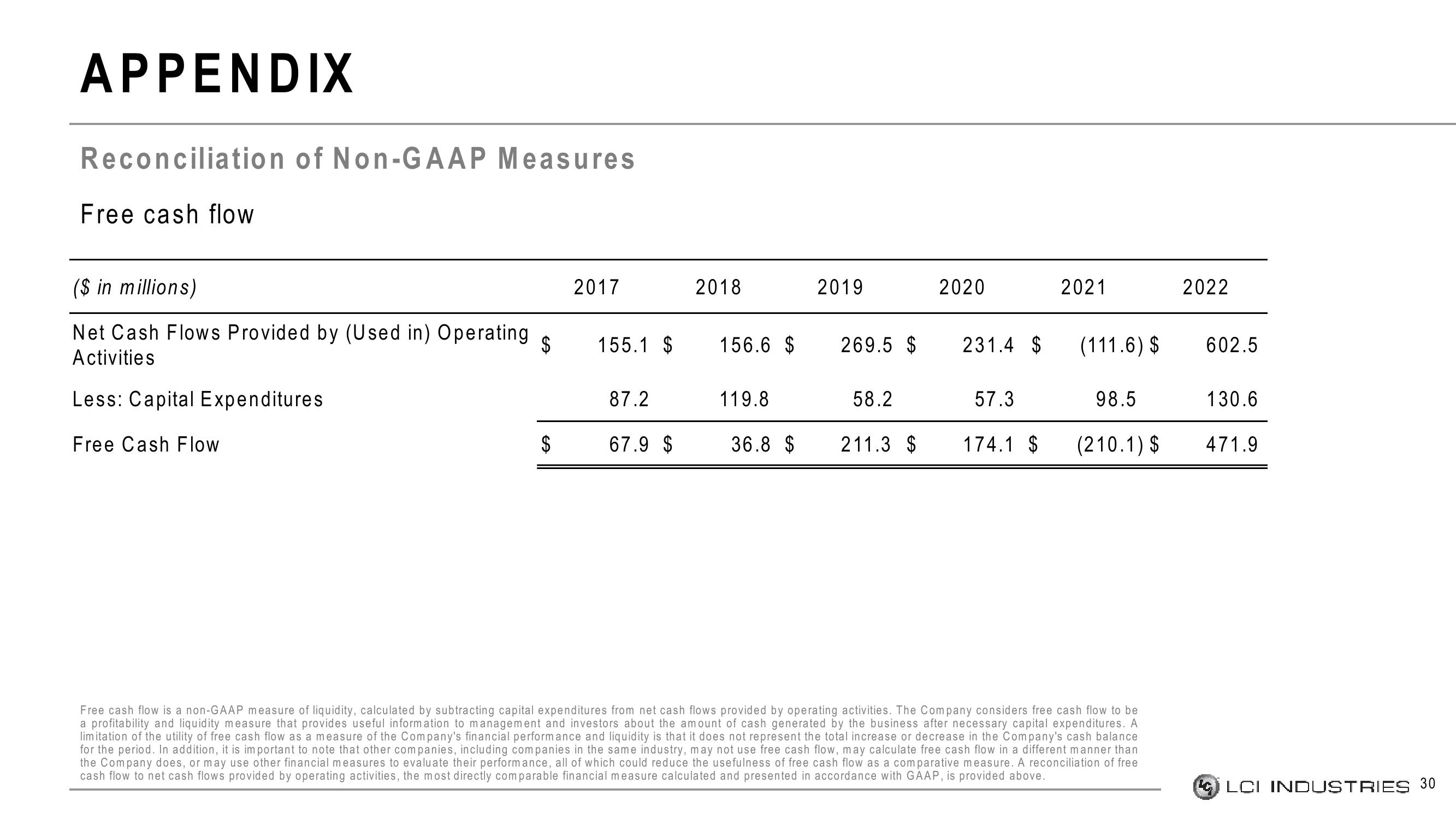

Reconciliation of Non-GAAP Measures

Free cash flow

($ in millions)

Net Cash Flows Provided by (Used in) Operating $

Activities

Less: Capital Expenditures

Free Cash Flow

$

2017

2018

155.1 $ 156.6 $

87.2

67.9 $

119.8

36.8 $

2019

269.5 $ 231.4 $

58.2

2020

211.3 $

57.3

174.1 $

2021

(111.6) $

98.5

(210.1) $

Free cash flow is a non-GAAP measure of liquidity, calculated by subtracting capital expenditures from net cash flows provided by operating activities. The Company considers free cash flow to be

a profitability and liquidity measure that provides useful information to management and investors about the amount of cash generated by the business after necessary capital expenditures. A

limitation of the utility of free cash flow as a measure of the Company's financial performance and liquidity is that it does not represent the total increase or decrease in the Company's cash balance

for the period. In addition, it is important to note that other companies, including companies in the same industry, may not use free cash flow, may calculate free cash flow in a different manner than

the Company does, or may use other financial measures to evaluate their performance, all of which could reduce the usefulness of free cash flow as a comparative measure. A reconciliation of free

cash flow to net cash flows provided by operating activities, the most directly comparable financial measure calculated and presented in accordance with GAAP, is provided above.

2022

602.5

130.6

471.9

LCI INDUSTRIES 30View entire presentation