Deutsche Bank Fixed Income Presentation Deck

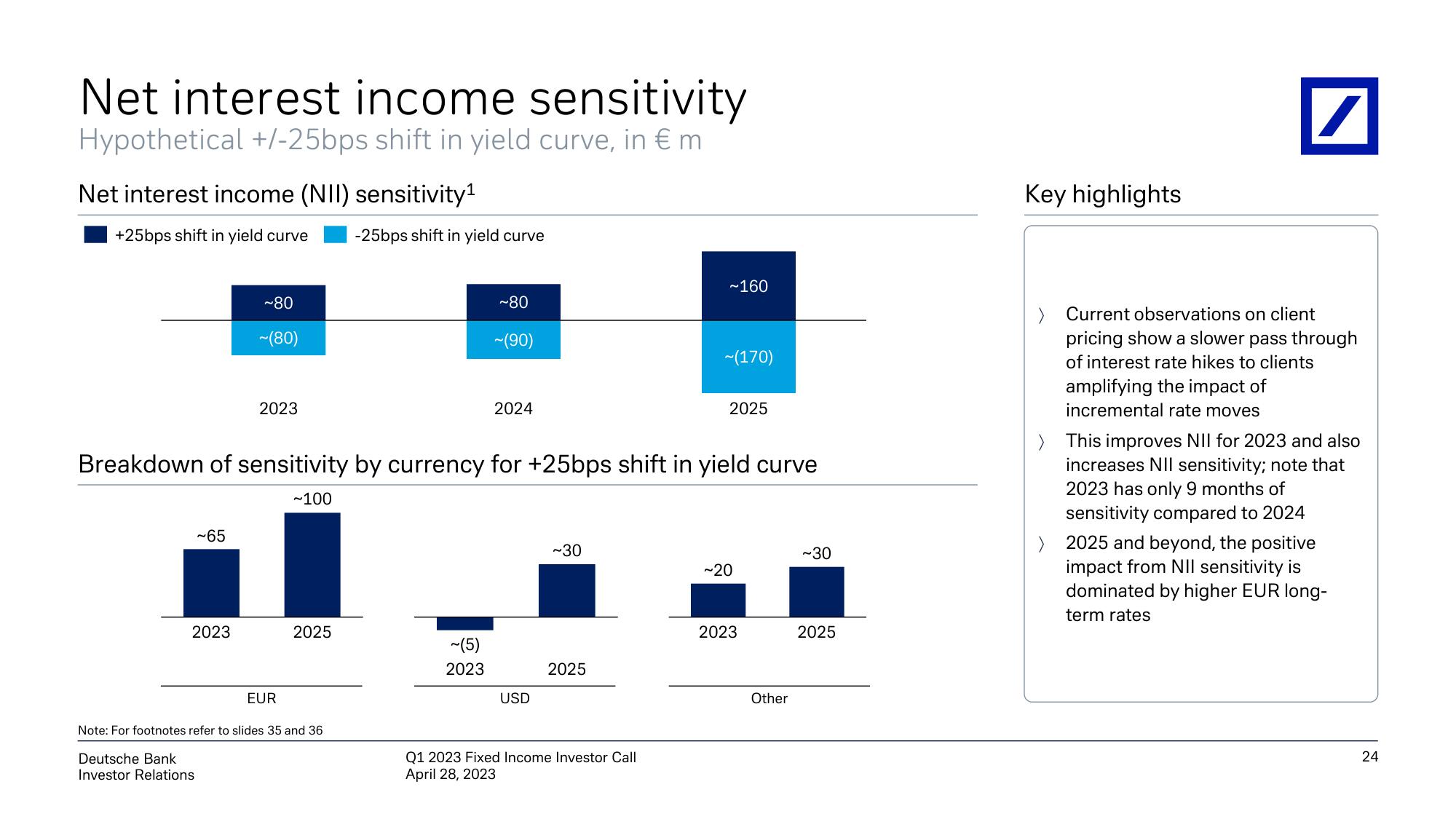

Net interest income sensitivity

Hypothetical +/-25bps shift in yield curve, in € m

Net interest income (NII) sensitivity¹

+25bps shift in yield curve -25bps shift in yield curve

~65

~80

~(80)

2023

2023

EUR

2025

Note: For footnotes refer to slides 35 and 36

Deutsche Bank

Investor Relations

~80

Breakdown of sensitivity by currency for +25bps shift in yield curve

~100

~(5)

2023

~(90)

2024

USD

~30

2025

~160

Q1 2023 Fixed Income Investor Call

April 28, 2023

~(170)

2025

~20

2023

Other

~30

2025

Key highlights

/

> Current observations on client

pricing show a slower pass through

of interest rate hikes to clients

amplifying the impact of

incremental rate moves

> This improves NII for 2023 and also

increases NII sensitivity; note that

2023 has only 9 months of

sensitivity compared to 2024

> 2025 and beyond, the positive

impact from NII sensitivity is

dominated by higher EUR long-

term rates

24View entire presentation