Summer 2023 Solar Industry Update

Transferability of Tax Credits Guidance

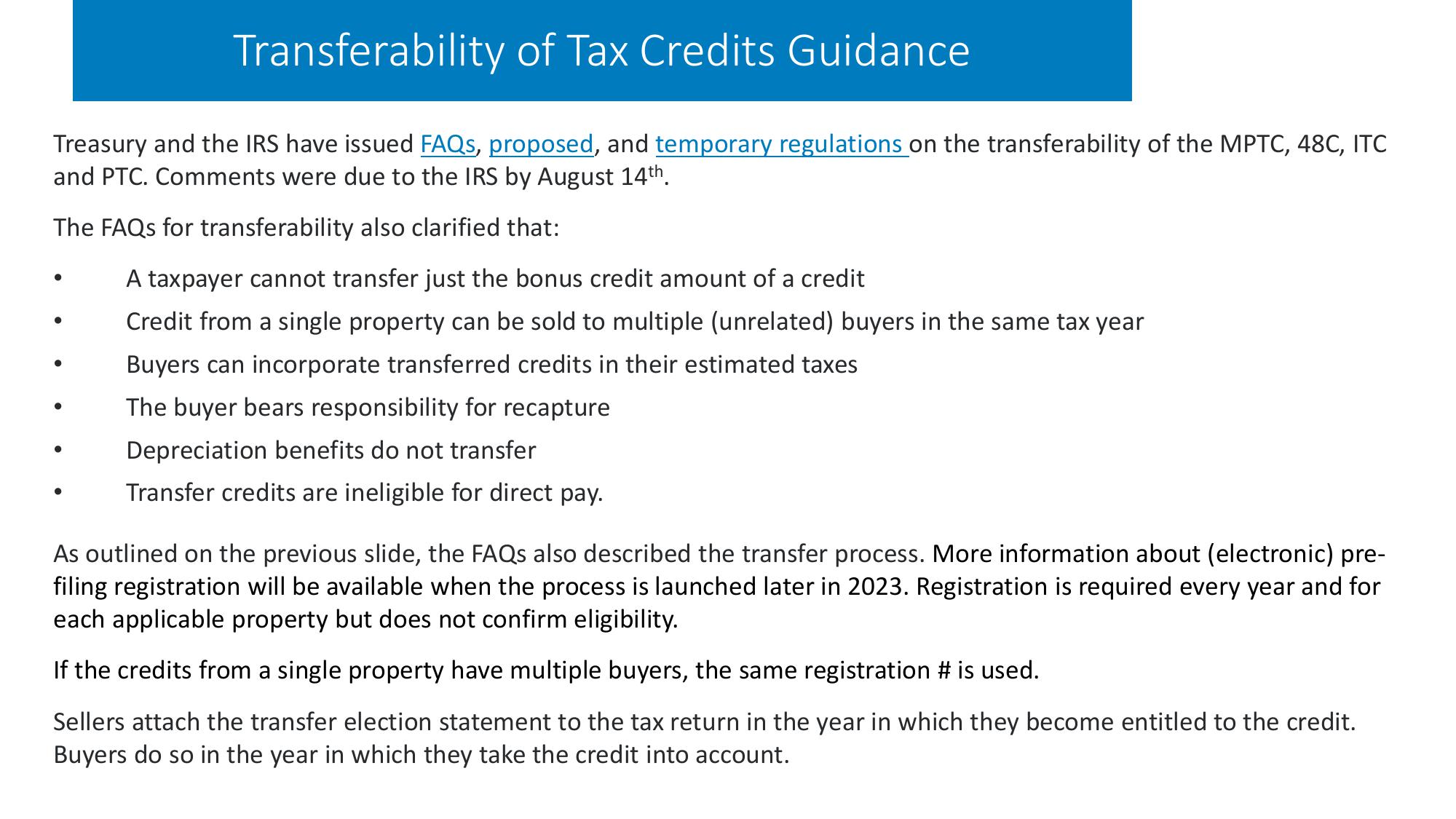

Treasury and the IRS have issued FAQs, proposed, and temporary regulations on the transferability of the MPTC, 48C, ITC

and PTC. Comments were due to the IRS by August 14th.

The FAQs for transferability also clarified that:

.

.

A taxpayer cannot transfer just the bonus credit amount of a credit

Credit from a single property can be sold to multiple (unrelated) buyers in the same tax year

Buyers can incorporate transferred credits in their estimated taxes

The buyer bears responsibility for recapture

Depreciation benefits do not transfer

Transfer credits are ineligible for direct pay.

As outlined on the previous slide, the FAQs also described the transfer process. More information about (electronic) pre-

filing registration will be available when the process is launched later in 2023. Registration is required every year and for

each applicable property but does not confirm eligibility.

If the credits from a single property have multiple buyers, the same registration # is used.

Sellers attach the transfer election statement to the tax return in the year in which they become entitled to the credit.

Buyers do so in the year in which they take the credit into account.View entire presentation