The Urgent Need for Change and The Superior Path Forward

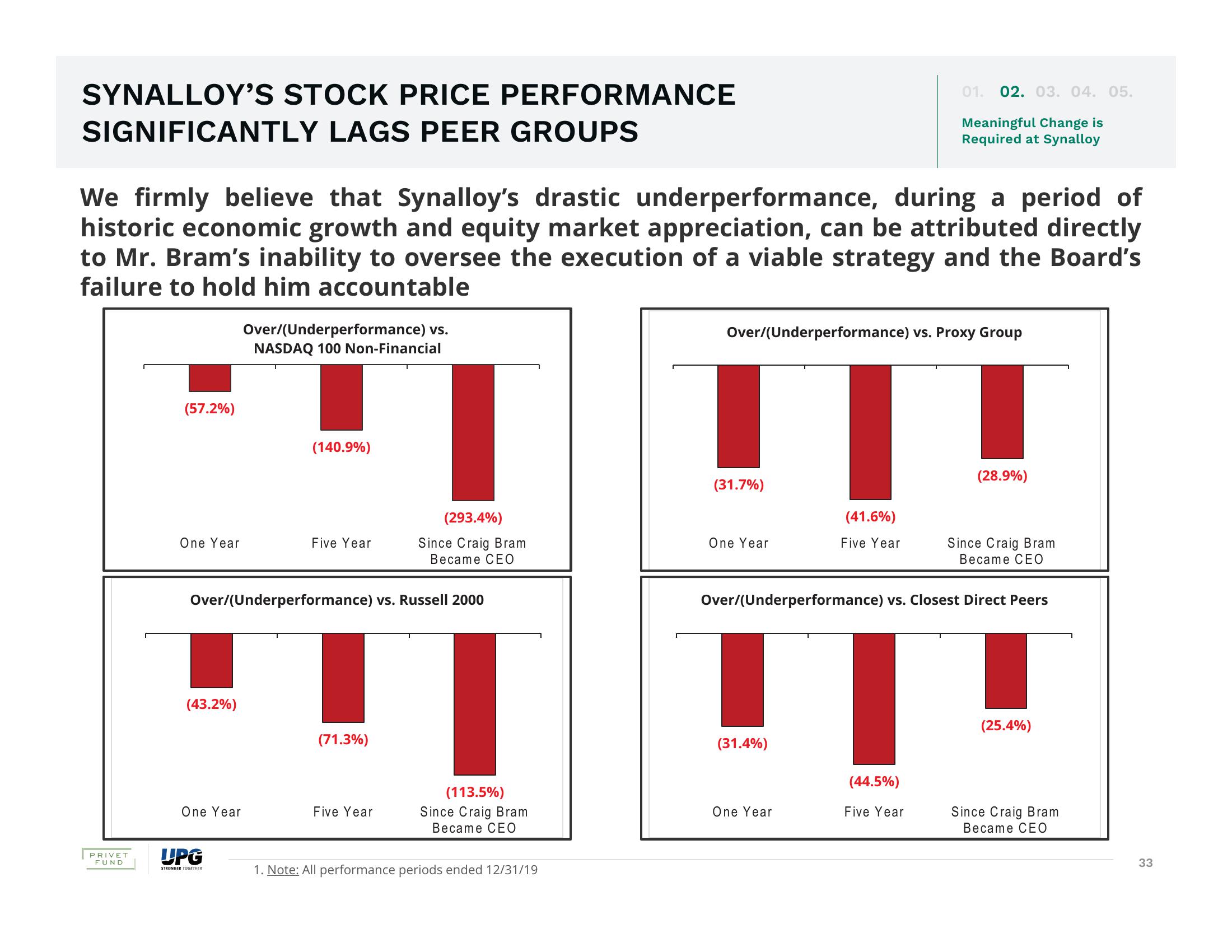

SYNALLOY'S STOCK PRICE PERFORMANCE

SIGNIFICANTLY LAGS PEER GROUPS

PRIVET

FUND

We firmly believe that Synalloy's drastic underperformance, during a period of

historic economic growth and equity market appreciation, can be attributed directly

to Mr. Bram's inability to oversee the execution of a viable strategy and the Board's

failure to hold him accountable

(57.2%)

One Year

(43.2%)

One Year

Over/(Underperformance) vs.

NASDAQ 100 Non-Financial

UPG

STRONGER TOGETHER

(140.9%)

Over/(Underperformance) vs. Russell 2000

Five Year

(71.3%)

(293.4%)

Since Craig Bram

Became CEO

Five Year

(113.5%)

Since Craig Bram

Became CEO

1. Note: All performance periods ended 12/31/19

(31.7%)

Over/(Underperformance) vs. Proxy Group

One Year

(31.4%)

(41.6%)

Five Year

One Year

01. 02. 03. 04. 05.

Meaningful Change is

Required at Synalloy

(44.5%)

Over/(Underperformance) vs. Closest Direct Peers

Five Year

(28.9%)

Since Craig Bram

Became CEO

(25.4%)

Since Craig Bram

Became CEO

33View entire presentation