Apollo Global Management Investor Day Presentation Deck

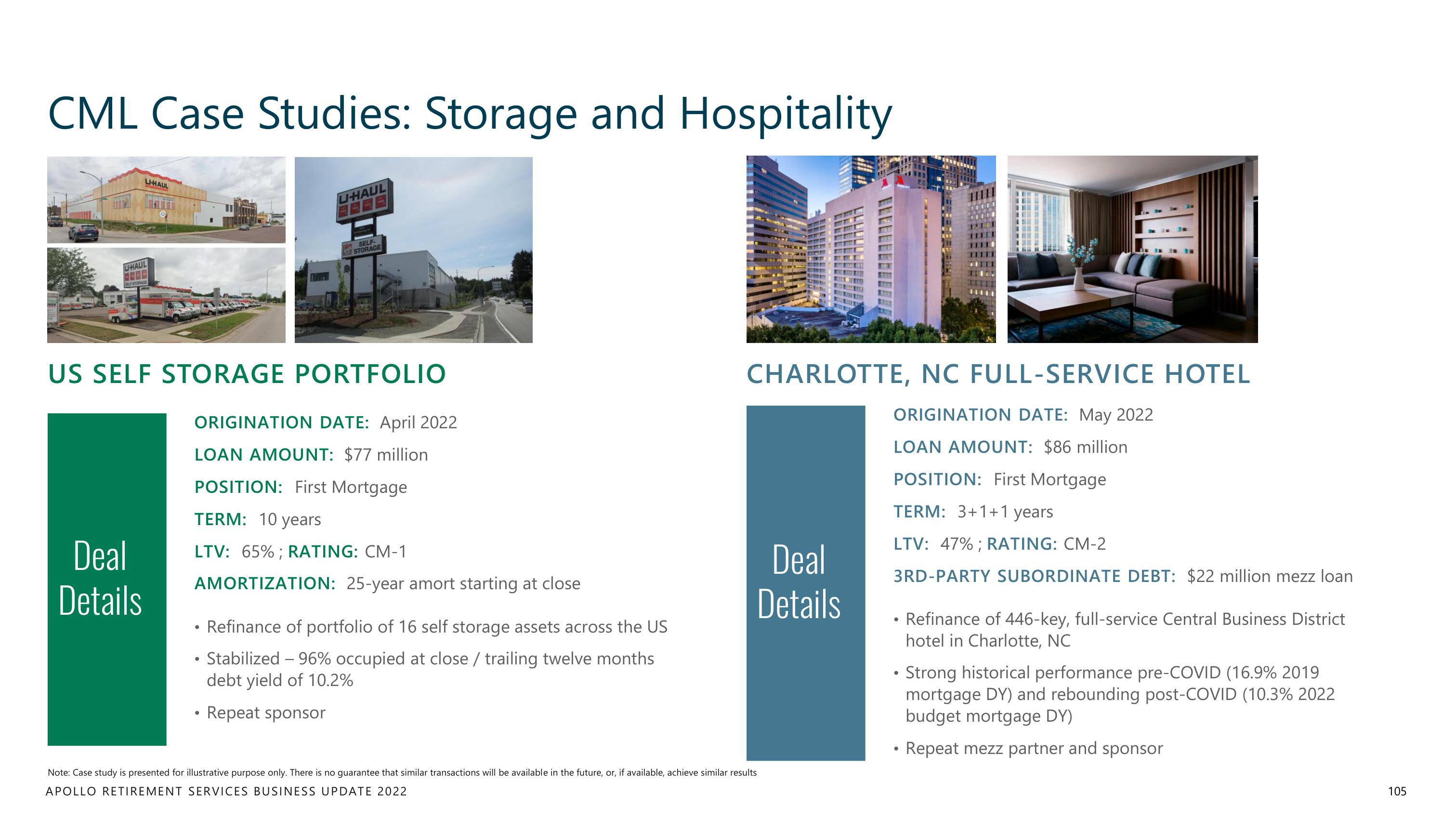

CML Case Studies: Storage and Hospitality

U-HAUL

U-HAUL

STORAGE

Deal

Details

US SELF STORAGE PORTFOLIO

U-HAUL

●

SELF-

STORAGE

ORIGINATION DATE: April 2022

LOAN AMOUNT: $77 million

POSITION: First Mortgage

TERM: 10 years

LTV: 65%; RATING: CM-1

AMORTIZATION: 25-year amort starting at close

●

Refinance of portfolio of 16 self storage assets across the US

Stabilized - 96% occupied at close / trailing twelve months

debt yield of 10.2%

Repeat sponsor

CHARLOTTE, NC FULL-SERVICE HOTEL

ORIGINATION DATE: May 2022

LOAN AMOUNT: $86 million

POSITION: First Mortgage

TERM: 3+1+1 years

LTV: 47%; RATING: CM-2

3RD-PARTY SUBORDINATE DEBT: $22 million mezz loan

Note: Case study is presented for illustrative purpose only. There is no guarantee that similar transactions will be available in the future, or, if available, achieve similar results

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

Deal

Details

●

Refinance of 446-key, full-service Central Business District

hotel in Charlotte, NC

• Strong historical performance pre-COVID (16.9% 2019

mortgage DY) and rebounding post-COVID (10.3% 2022

budget mortgage DY)

Repeat mezz partner and sponsor

105View entire presentation