HBT Financial Results Presentation Deck

Loan Portfolio Overview: Commercial and Commercial Real Estate

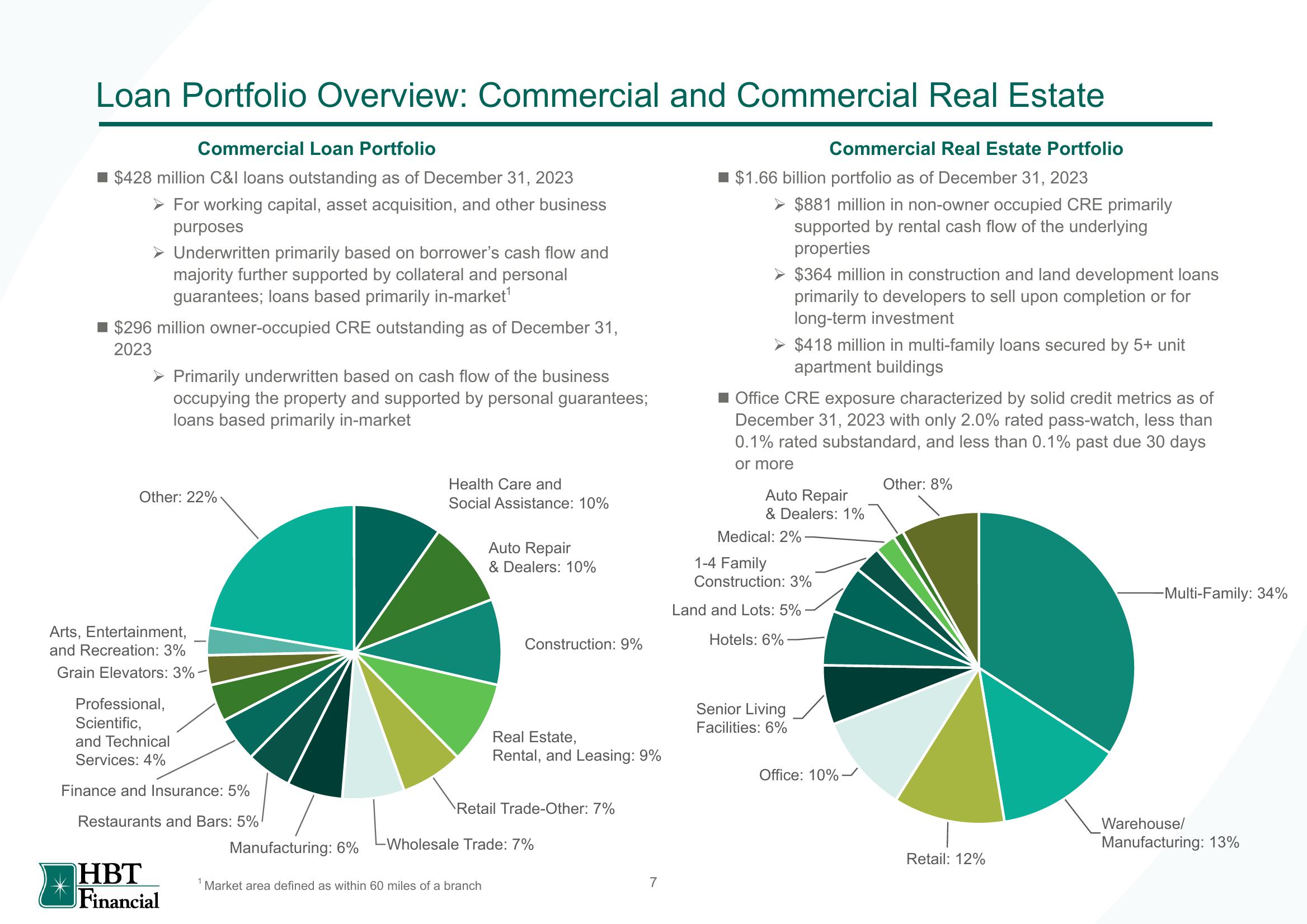

Commercial Loan Portfolio

$428 million C&I loans outstanding as of December 31, 2023

➤ For working capital, asset acquisition, and other business

purposes

> Underwritten primarily based on borrower's cash flow and

majority further supported by collateral and personal

guarantees; loans based primarily in-market¹

$296 million owner-occupied CRE outstanding as of December 31,

2023

➤ Primarily underwritten based on cash flow of the business

occupying the property and supported by personal guarantees;

loans based primarily in-market

Other: 22%

Arts, Entertainment,

and Recreation: 3%

Grain Elevators: 3%-

Professional,

Scientific,

and Technical

Services: 4%

Finance and Insurance: 5%

Restaurants and Bars: 5%

HBT

Financial

1

Manufacturing: 6%

Health Care and

Social Assistance: 10%

Auto Repair

& Dealers: 10%

Construction: 9%

Market area defined as within 60 miles of a branch

Real Estate,

Rental, and Leasing: 9%

Retail Trade-Other: 7%

Wholesale Trade: 7%

7

Commercial Real Estate Portfolio

$1.66 billion portfolio as of December 31, 2023

$881 million in non-owner occupied CRE primarily

supported by rental cash flow of the underlying

properties

➤ $364 million in construction and land development loans

primarily to developers to sell upon completion or for

long-term investment

> $418 million in multi-family loans secured by 5+ unit

apartment buildings

Office CRE exposure characterized by solid credit metrics as of

December 31, 2023 with only 2.0% rated pass-watch, less than

0.1% rated substandard, and less than 0.1% past due 30 days

or more

Auto Repair

& Dealers: 1%

Medical: 2%-

1-4 Family

Construction: 3%

Land and Lots: 5%

Hotels: 6%

Senior Living

Facilities: 6%

Office: 10%-

Other: 8%

Retail: 12%

-Multi-Family: 34%

Warehouse/

Manufacturing: 13%View entire presentation