Antero Midstream Partners Investor Presentation Deck

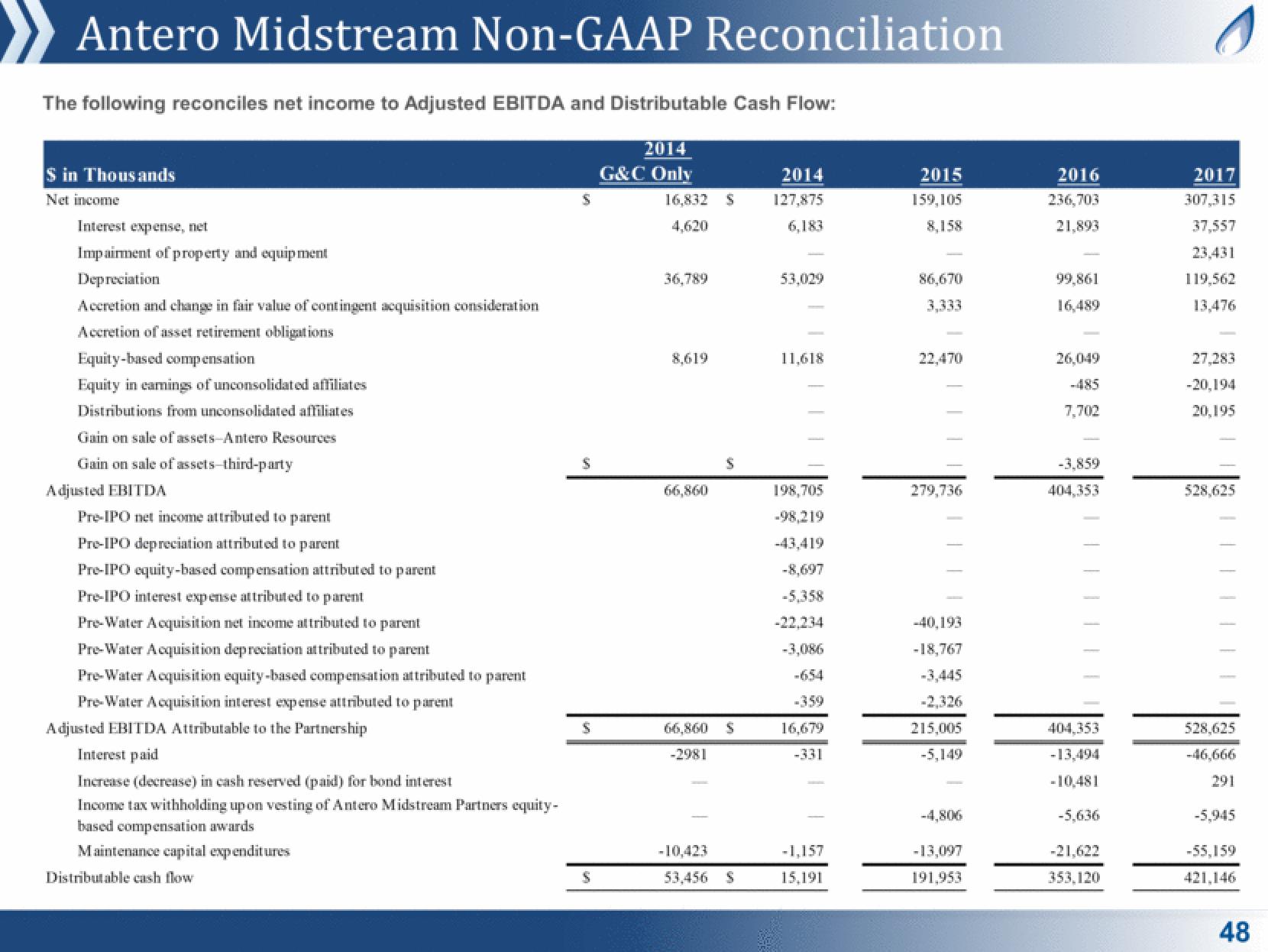

Antero Midstream Non-GAAP Reconciliation

The following reconciles net income to Adjusted EBITDA and Distributable Cash Flow:

2014

G&C Only

S in Thousands

Net income

Interest expense, net

Impairment of property and equipment

Depreciation

Accretion and change in fair value of contingent acquisition consideration

Accretion of asset retirement obligations

Equity-based compensation

Equity in earnings of unconsolidated affiliates

Distributions from unconsolidated affiliates

Gain on sale of assets-Antero Resources

Gain on sale of assets-third-party

Adjusted EBITDA

Pre-IPO net income attributed to parent

Pre-IPO depreciation attributed to parent

Pre-IPO equity-based compensation attributed to parent

Pre-IPO interest expense attributed to parent

Pre-Water Acquisition net income attributed to parent

Pre-Water Acquisition depreciation attributed to parent

Pre-Water Acquisition equity-based compensation attributed to parent

Pre-Water Acquisition interest expense attributed to parent

Adjusted EBITDA Attributable to the Partnership

Interest paid

Increase (decrease) in cash reserved (paid) for bond interest

Income tax withholding upon vesting of Antero Midstream Partners equity-

based compensation awards

Maintenance capital expenditures

Distributable cash flow

S

S

S

S

16,832 S

4,620

36,789

8,619

66,860

66,860

-2981

-10,423

53,456

S

S

2014

127,875

6,183

53,029

11,618

198,705

-98,219

-43,419

-8,697

-5,358

-22,234

-3,086

16,679

-331

-1,157

15,191

2015

159,105

8,158

86,670

22,470

279,736

-40,193

-18,767

-3,445

215,005

-5,149

-4,806

-13,097

191,953

2016

236,703

21,893

99,861

16,489

26,049

7,702

-

-3,859

404,353

404,353

-13,494

-10,481

-5,636

-21,622

353,120

s

2017

307,315

37,557

23,431

119,562

13,476

27,283

-20,194

20,195

528,625

528,625

-46,666

291

-5,945

-55,159

421,146

48View entire presentation