Bank of America Investment Banking Pitch Book

I

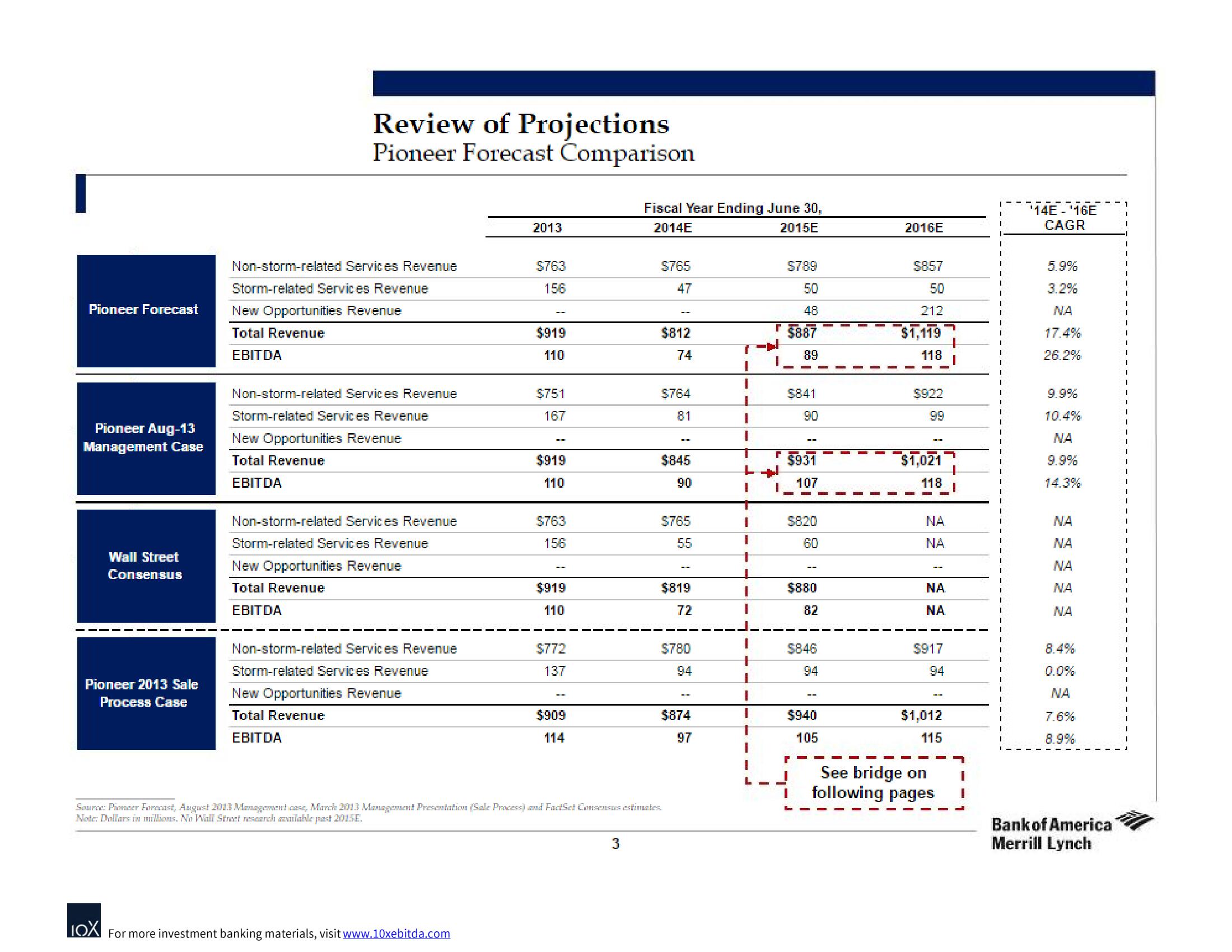

Pioneer Forecast

Pioneer Aug-13

Management Case

Wall Street

Consensus

Pioneer 2013 Sale

Process Case

Review of Projections

Pioneer Forecast Comparison

Non-storm-related Services Revenue

Storm-related Services Revenue

New Opportunities Revenue

Total Revenue

EBITDA

Non-storm-related Services Revenue

Storm-related Services Revenue

New Opportunities Revenue

Total Revenue

EBITDA

Non-storm-related Services Revenue

Storm-related Services Revenue

New Opportunities Revenue

Total Revenue

EBITDA

Non-storm-related Services Revenue

Storm-related Services Revenue

New Opportunities Revenue

Total Revenue

EBITDA

2013

LOX For more investment banking materials, visit www.10xebitda.com

$763

156

$919

110

$751

167

$919

110

$763

156

$919

110

$772

137

$909

114

Fiscal Year Ending June 30,

2014E

2015E

3

$765

47

$812

74

$764

81

$845

90

$765

55

$819

72

$780

Source: Pioneer Forecast, August 2013 Management case, March 2013 Management Presentation (Sale Process) and FactSet Consensus estimates.

Note: Dollars in millions. No Wall Street research vilable pest 2015E.

$874

97

T

1

I

I

T

L

I

L

$789

50

48

T 5887

N

89

5841

90

$931

I 107

$8.20

60

$880

82

$846

94

$940

105

I

2016E

$857

50

212

$1,119

118

5922

99

$1,021

118

NA

NA

NA

NA

$917

94

$1,012

115

See bridge on

following pages

I

I

I

I

T

1

I

I

I

T

I

I

I

I

T

I

I

I

I

I

'14E - '16E

CAGR

5.9%

3.2%

NA

17.4%

26.2%

9.9%

10.4%

NA

9.9%

14.3%

NA

NA

NA

NA

NA

0.0%

NA

7.6%

8.9%

Bank of America

Merrill Lynch

1

I

I

IView entire presentation