SimCorp Investor Day Presentation Deck

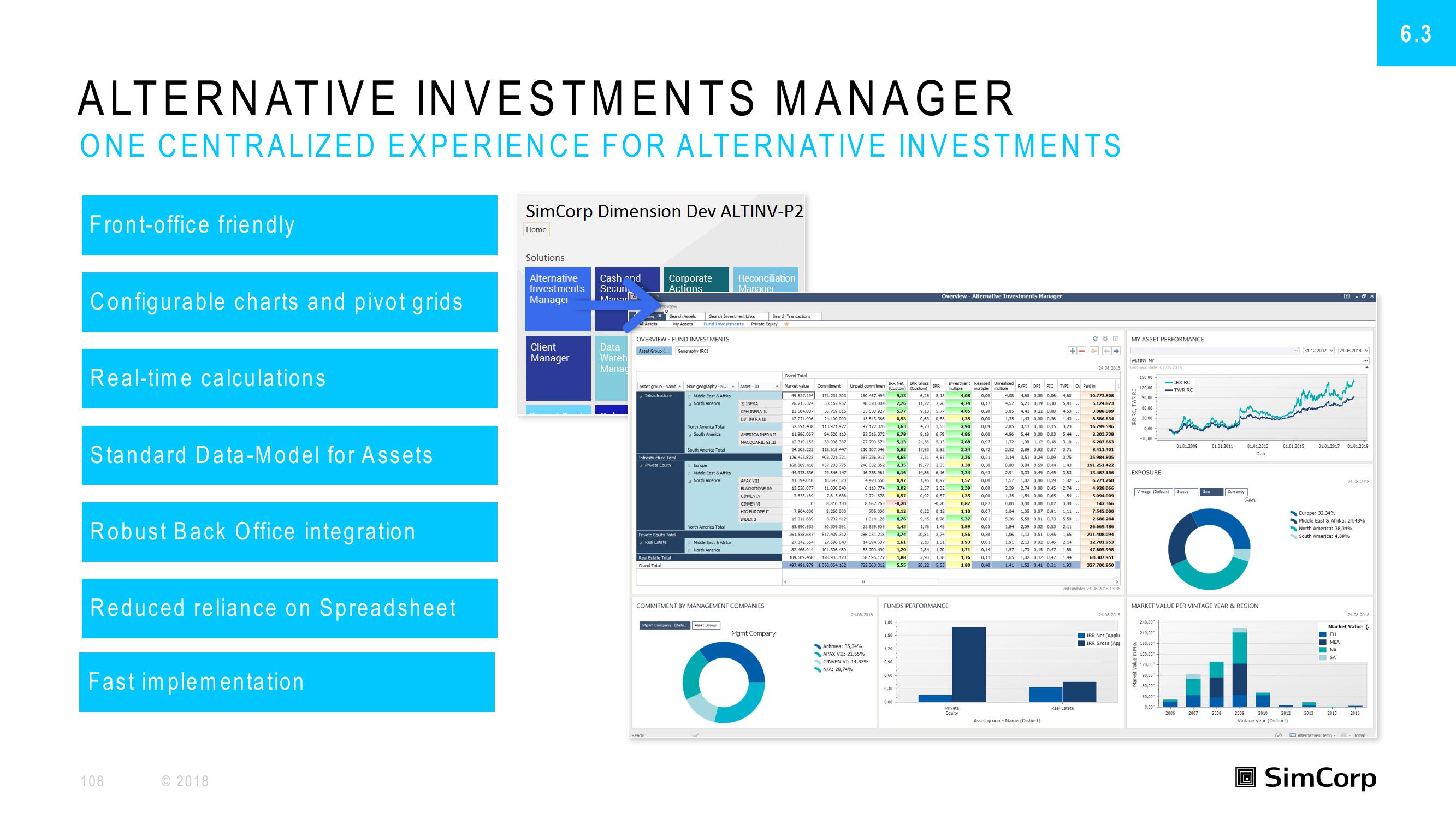

ALTERNATIVE INVESTMENTS MANAGER

ONE CENTRALIZED EXPERIENCE FOR ALTERNATIVE INVESTMENTS

Front-office friendly

Configurable charts and pivot grids

Real-time calculations

Standard Data-Model for Assets

Robust Back Office integration

Reduced reliance on Spreadsheet

Fast implementation

108

©2018

SimCorp Dimension Dev ALTINV-P2

Home

Solutions

Alternative Cash and

Investments Secun

Manad

Manager

Client

Manager

Data

Wareh

Mana

Al Assets

Corporate

Actions

Search Assets

My Assets

OVERVIEW - FUND INVESTMENTS

Asset Group (...

Geography (RC)

Asset group-Name

Infrastructure:

Infrastructure Total

Private Equity

Private Equity Total

Real Estate

Real Estate Total

Grand Total

Ready

Search Investment Links

Fund Investments Private Equity

Main geography -N.

Middle East & Afrika

North America

North America Total

A South America

South America Total

Ment Company (Def.

Europe

Middle East & Afrika

North America

North America Total

Middle East & Afrika

North America

Reconciliation

Manager

Asset Group

Asset-ID

31 INFRA

CPH INFRA IL

DIF INFRA III

COMMITMENT BY MANAGEMENT COMPANIES

AMERICA INFRA II

MACQUARIE GI III

APAX VIII

BLACKSTONE 09

CINVEN IV

CONVEN VI

HIG EUROPE II

INDEX 3

Search Transactions

Mgmt Company

O

Commitment

Grand Total

Market value

49.527.194 171.231.303

26.715.324 53.152.957

13.604.087 36.719.015

12.271.996 24.100.000

52.591.408 113.971.972

11.986.067 84.520.110

12.319.155 33.998.337

24.305.222 118.518.447

126.423.823 403.721.721

160.889.418 437.283.775

44.978.336 29.846, 147

11.394.018 10.692.320

13.526.077 11.038.840

7.855.169

7.815.688

<

8.810,130

8.250.000

7.904.000

15.011.669

3.702.412

$5.690.933 50.309.391

261.558.687 517.439.312

27.042.554

82.466.914 101.306.489

109.509.468 128.903. 128

497.491.979 1.050.064. 162

0

Unpaid commitmen

3,63

6,78

160.457.494 5,13

48.028.084 7,76

33,630.927 5.77

15.513.366 0.53

97.172.376

82.316.372

27.790.674

110.107.046 5,82

367.736.917 4,65

246.032.352 2.35

16.358.961 6.16

4.420.560 0.97

5,13

6.110.774

2.02

2.721.678

0.57

8.667.765 -0,20

705.000

0,12

8.76

1.43

3.74

1.61

1.70

1.88

5.55

1.014.128

23.639.905

286.031.218

14.894.687

53.700.490

68.595.177

722.363.312

24.08.2018

Achmea: 35,34%

APAX VII: 21,55%

IRR Net IRR Gross

(Custom) (Custom)

CINVEN VI: 14,37%

N/A: 28,74%

1,80 +

1,20

0,90-

0.60

FUNDS PERFORMANCE

0.30

Overview - Alternative Investments Manager

0,00

IRR

6,25 5,13

11,22 7,76

9,13 5.77

0.63 0.53

4,73 3,63

8.18 6,78

24,56 5,13

17,93 5,82

7,31 4,65

19,77 2,35

14,86 6,16

1,45 0,97

2,57 2,02

0,92 0,57

-0,20

0,22 0.12

9,45 8,76

1,76 1,43

20,81 3,74

2,10 1,61

2,84

2,98 1,88

20,22 5,55

Investment Realised Unrealised RVPT

multiple

multiple multiple

Private

Equity

4,08 0.00

4.74

0,17

4.05

0,20

1.35

0,00

2.94 0,09

0,00

0,97

0,72

0,21

4,86

2,68

3,24

1.38

0,58

3,34

0,43

1.57 0,00

2,39

0.00

1.35

0.00

0.87

0,87

1.10 0,07

5.37

0,01

1,89

0,05

1,56

0.50

1.93

0,01

1.71 0.14

1,76 0,11

1,80

0,40

4.57

3.85 4.41 0.22 0.08

PIC

4,60 0,00 0,06

4,60

5,21 0,19 0,10 5,41

4.63

1.35 1.43 0.00 0.36 1,43 ...

2.85

3.13 0.10 0.15 3,23

5.44

4.86 5.44 0.00 0.03

TVPI

1,72 1,98 1,12 0,18 3,10

2,52 2,89 0,82 0,07 3,71

3,14

3,75

0.80 0,84 0,59 0,44

Asset group - Name (Distinct)

2,91

3.33 0,49 0.45 3,83

1,82

1,57

1,82 0,00 0,59

2.39 2,74 0,00 0.45 2,74 ...

1.35

1.54 0.00 0,65 1.54

0,00

0.00 0.00 0.02 0.00

1,04

1,05 0,07

1,11

5.36 5.58 0.01 0.73 5,59

1.84 2,09 0,02 0,53 2,11

1.06

1.13 0.51 0.45

1.65

2,13 0,02 0,46

2,14

1.57

1,73 0,15 0,47 1,88

1.65 1,82 0,12 0,47 1.94

1,41 1,52 0,41 0,31 1,93

O Paid in

20

Real Estate

14

24.08.2018

10.773.808

5.124.873

3.088.089

8.586.634

16.799.596

2.203.738

6.207.663

8.411.401

35.984.805

191.251.422

13.487.186

6.271.760

4.928.066

5.094.009

142.366

7.545.000

2.688.284

26.669.486

231.408.094

12.701.953

47.605.998

60.307.951

327.700.850

>

Last update: 24.08.2018 13:36

24.08.2018

IRR Net (Applic

IRR Gross (App

MY ASSET PERFORMANCE

ALTIN MY

Last valid date: 07.06.2018

150,00

120,00

90,00

60,00

30,00-

0,00-

9

-30,00

EXPOSURE

Vintage (Default)

Market Value in Mio.

240,00

210,00

-IRR RC

-TWR RC

180,00

150,00

120,00

90,00

60,00

30,00"

0,00"

01.01.2009

Status

MARKET VALUE PER VINTAGE YEAR & REGION

2006

Geo

01.01.2011

Currency

2007

01.01.2013

Date

O

Geo

.....

2008

2009

2010

Vintage year (Distinct)

2012

01.01.2015

31.12.2007 24.08.2018

раницит

- x

2013

wher

01.01.2017

01.01.2019

24.08.2018

Europe: 32,34%

Middle East & Afrika: 24,43%

North America: 38,34%

South America: 4,89%

24.08.2018

Market Value (

EU

MEA

ΝΑ

SA

2016

Alternatives Demo 8 Initial

SimCorp

6.3View entire presentation