Fort Capital Investment Banking Pitch Book

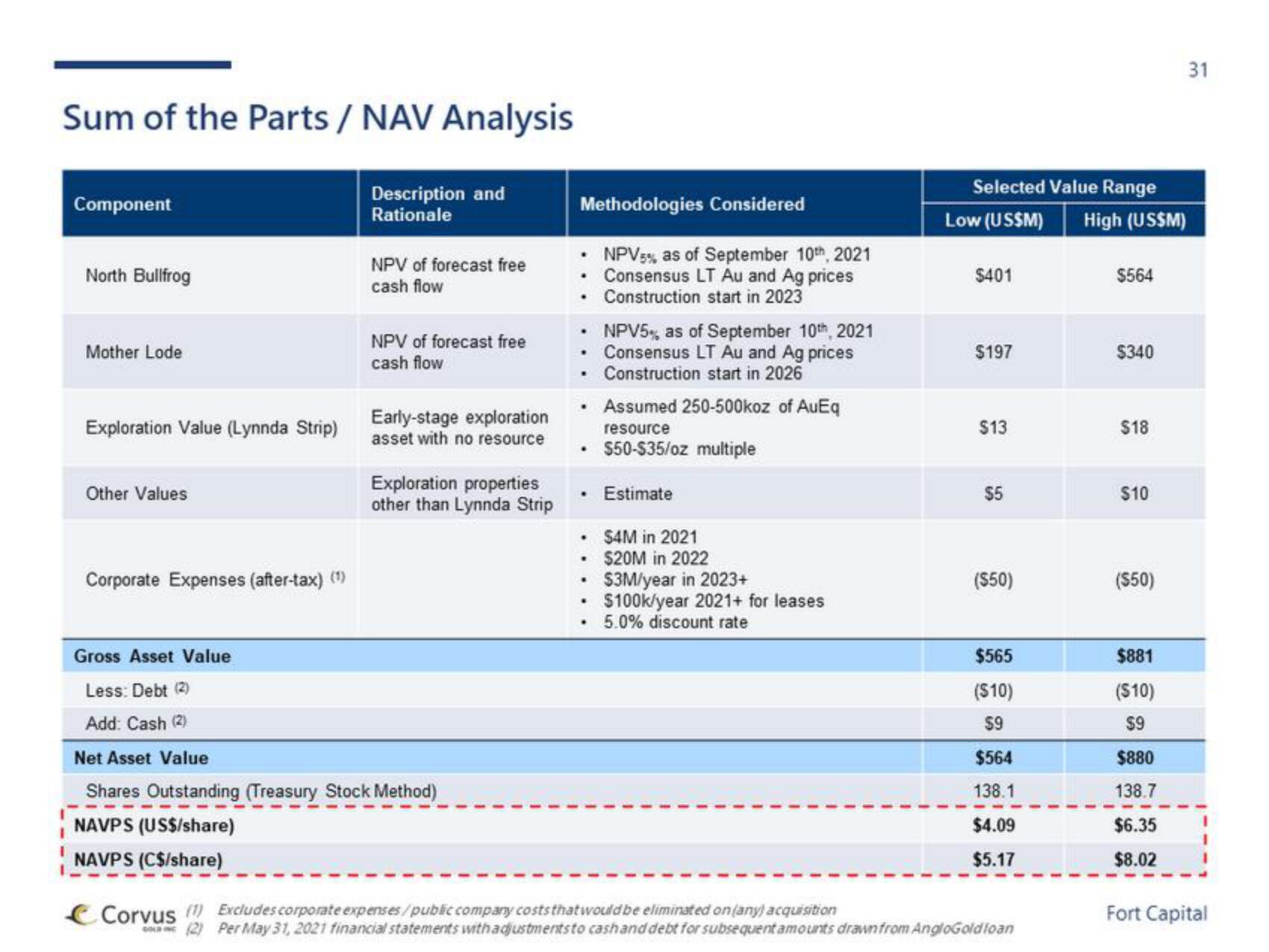

Sum of the Parts / NAV Analysis

Description and

Rationale

Component

North Bullfrog

Mother Lode

Exploration Value (Lynnda Strip)

Other Values

Corporate Expenses (after-tax) (1)

Gross Asset Value

Less: Debt (2)

Add: Cash (2)

NPV of forecast free

cash flow

NPV of forecast free

cash flow

Early-stage exploration

asset with no resource

Exploration properties

other than Lynnda Strip

Net Asset Value

Shares Outstanding (Treasury Stock Method)

NAVPS (US$/share)

NAVPS (C$/share)

Methodologies Considered

• NPV 5%, as of September 10th, 2021

. Consensus LT Au and Ag prices

• Construction start in 2023

NPV5% as of September 10th, 2021

Consensus LT Au and Ag prices

Construction start in 2026

Assumed 250-500koz of AuEq

resource

• $50-$35/oz multiple

. Estimate

• $4M in 2021

$20M in 2022

$3M/year in 2023+

$100k/year 2021+ for leases

5.0% discount rate

Selected Value Range

Low (US$M)

$401

$197

$13

$5

($50)

$565

($10)

$9

$564

138.1

$4.09

$5.17

Corvus (1) Excludes corporate expenses/public company costs that would be eliminated on (any) acquisition

OLE (2) Per May 31, 2021 financial statements with adjustments to cash and debt for subsequent amounts drawn from AngloGoldloan

High (US$M)

$564

$340

$18

$10

($50)

$881

($10)

$9

31

$880

138.7

$6.35

$8.02

Fort CapitalView entire presentation