Energy Vault SPAC Presentation Deck

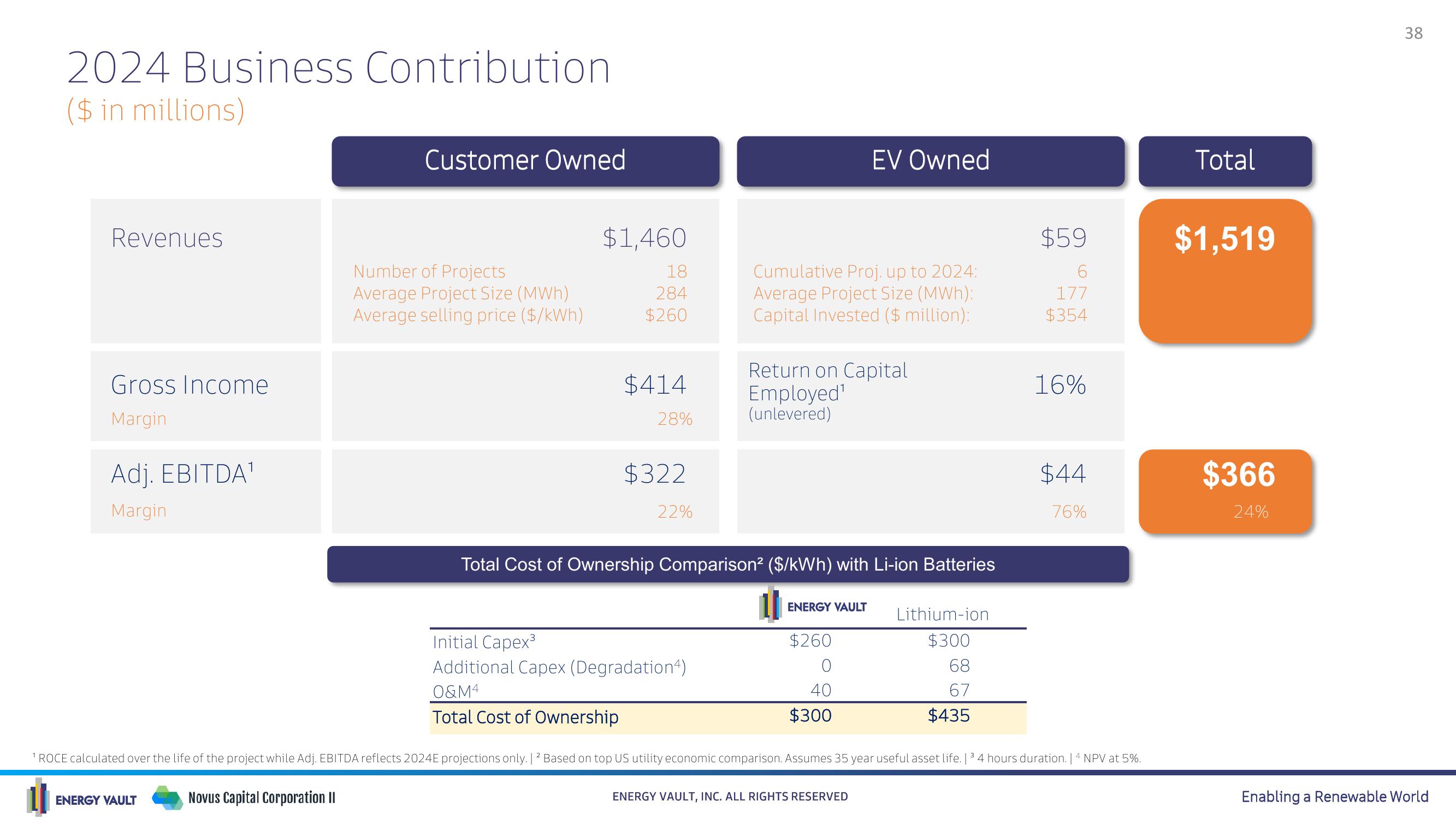

2024 Business Contribution

($ in millions)

Revenues

Gross Income

Margin

Adj. EBITDA¹

Margin

ENERGY VAULT

Customer Owned

Novus Capital Corporation II

Number of Projects

Average Project Size (MWh)

Average selling price ($/kWh)

$1,460

18

284

$260

$414

28%

$322

22%

Initial Capex³

Additional Capex (Degradation)

O&M4

Total Cost of Ownership

Cumulative Proj. up to 2024:

Average Project Size (MWh):

Capital Invested ($ million):

Return on Capital

Employed¹

(unlevered)

Total Cost of Ownership Comparison² ($/kWh) with Li-ion Batteries

EV Owned

ENERGY VAULT

$260

O

40

$300

ENERGY VAULT, INC. ALL RIGHTS RESERVED

Lithium-ion

$300

68

67

$435

$59

6

177

$354

¹ ROCE calculated over the life of the project while Adj. EBITDA reflects 2024E projections only. | 2 Based on top US utility economic comparison. Assumes 35 year useful asset life. | 34 hours duration. | 4 NPV at 5%.

16%

$44

76%

Total

$1,519

$366

24%

38

Enabling a Renewable WorldView entire presentation