Blackwells Capital Activist Presentation Deck

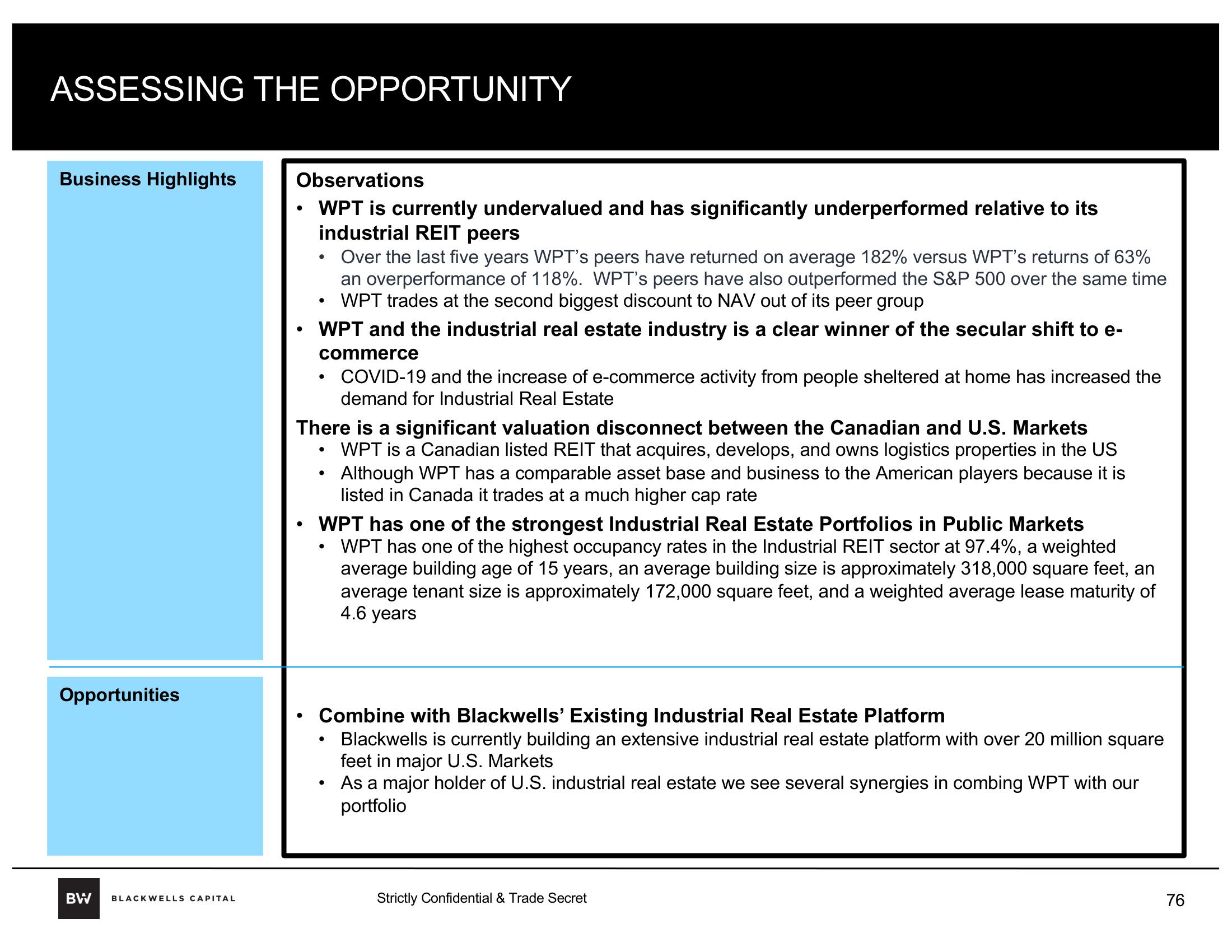

ASSESSING THE OPPORTUNITY

Business Highlights

Opportunities

BW

BLACKWELLS CAPITAL

Observations

WPT is currently undervalued and has significantly underperformed relative to its

industrial REIT peers

●

●

●

Over the last five years WPT's peers have returned on average 182% versus WPT's returns of 63%

an overperformance of 118%. WPT's peers have also outperformed the S&P 500 over the same time

WPT trades at the second biggest discount to NAV out of its peer group

WPT and the industrial real estate industry is a clear winner of the secular shift to e-

commerce

COVID-19 and the increase of e-commerce activity from people sheltered at home has increased the

demand for Industrial Real Estate

●

●

There is a significant valuation disconnect between the Canadian and U.S. Markets

WPT is a Canadian listed REIT that acquires, develops, and owns logistics properties in the US

Although WPT has a comparable asset base and business to the American players because it is

listed in Canada it trades at a much higher cap rate

●

●

WPT has one of the strongest Industrial Real Estate Portfolios in Public Markets

WPT has one of the highest occupancy rates in the Industrial REIT sector at 97.4%, a weighted

average building age of 15 years, an average building size is approximately 318,000 square feet, an

average tenant size is approximately 172,000 square feet, and a weighted average lease maturity of

4.6 years

Combine with Blackwells' Existing Industrial Real Estate Platform

Blackwells is currently building an extensive industrial real estate platform with over 20 million square

feet in major U.S. Markets

As a major holder of U.S. industrial real estate we see several synergies in combing WPT with our

portfolio

●

Strictly Confidential & Trade Secret

76View entire presentation