Vista Equity Partners Fund VIII, L.P. Recommendation Report

●

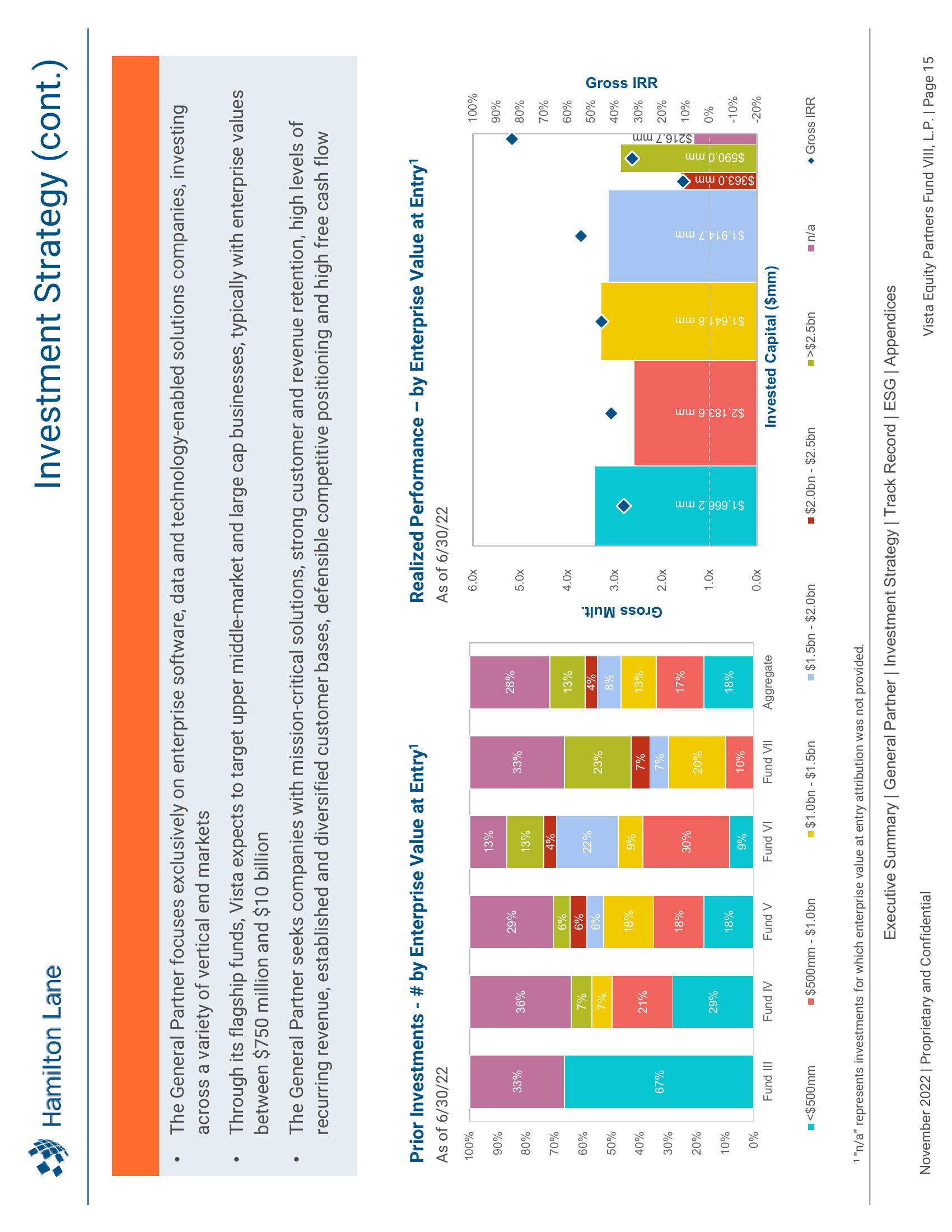

The General Partner focuses exclusively on enterprise software, data and technology-enabled solutions companies, investing

across a variety of vertical end markets

Through its flagship funds, Vista expects to target upper middle-market and large cap businesses, typically with enterprise values

between $750 million and $10 billion

The General Partner seeks companies with mission-critical solutions, strong customer and revenue retention, high levels of

recurring revenue, established and diversified customer bases, defensible competitive positioning and high free cash flow

Prior Investments - # by Enterprise Value at Entry¹

As of 6/30/22

100%

90%

80%

70%

60%

50%

40%

Hamilton Lane

30%

20%

10%

0%

33%

67%

Fund III

■<$500mm

36%

7%

7%

21%

29%

Fund IV

29%

6%

6%

6%

18%

18%

18%

Fund V

■ $500mm - $1.0bn

13%

13%

4%

November 2022 | Proprietary and Confidential

22%

9%

30%

9%

Fund VI

33%

23%

7%

7%

20%

10%

Fund VII

$1.0bn - $1.5bn

28%

13%

4%

8%

13%

17%

18%

Aggregate

1 "n/a" represents investments for which enterprise value at entry attribution was not provided.

Gross Mult.

Realized Performance - by Enterprise Value at Entry¹

As of 6/30/22

6.0x

5.0x

4.0x

3.0x

2.0x

Investment Strategy (cont.)

1.0x

0.0x

$1.5bn - $2.0bn

$1,666.2 mm

$2,183.6 mm

$2.0bn-$2.5bn

$1,641.8 mm

Invested Capital ($mm)

■>$2.5bn

Executive Summary | General Partner | Investment Strategy | Track Record | ESG | Appendices

$1,914.7 mm

■n/a

$363.0 mm<

$590.0 mm

$216.7 mm

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

-10%

-20%

◆ Gross IRR

Gross IRR

Vista Equity Partners Fund VIII, L.P. | Page 15View entire presentation