Modeling with New Disclosures Linking Price & Drivers to Financial Results

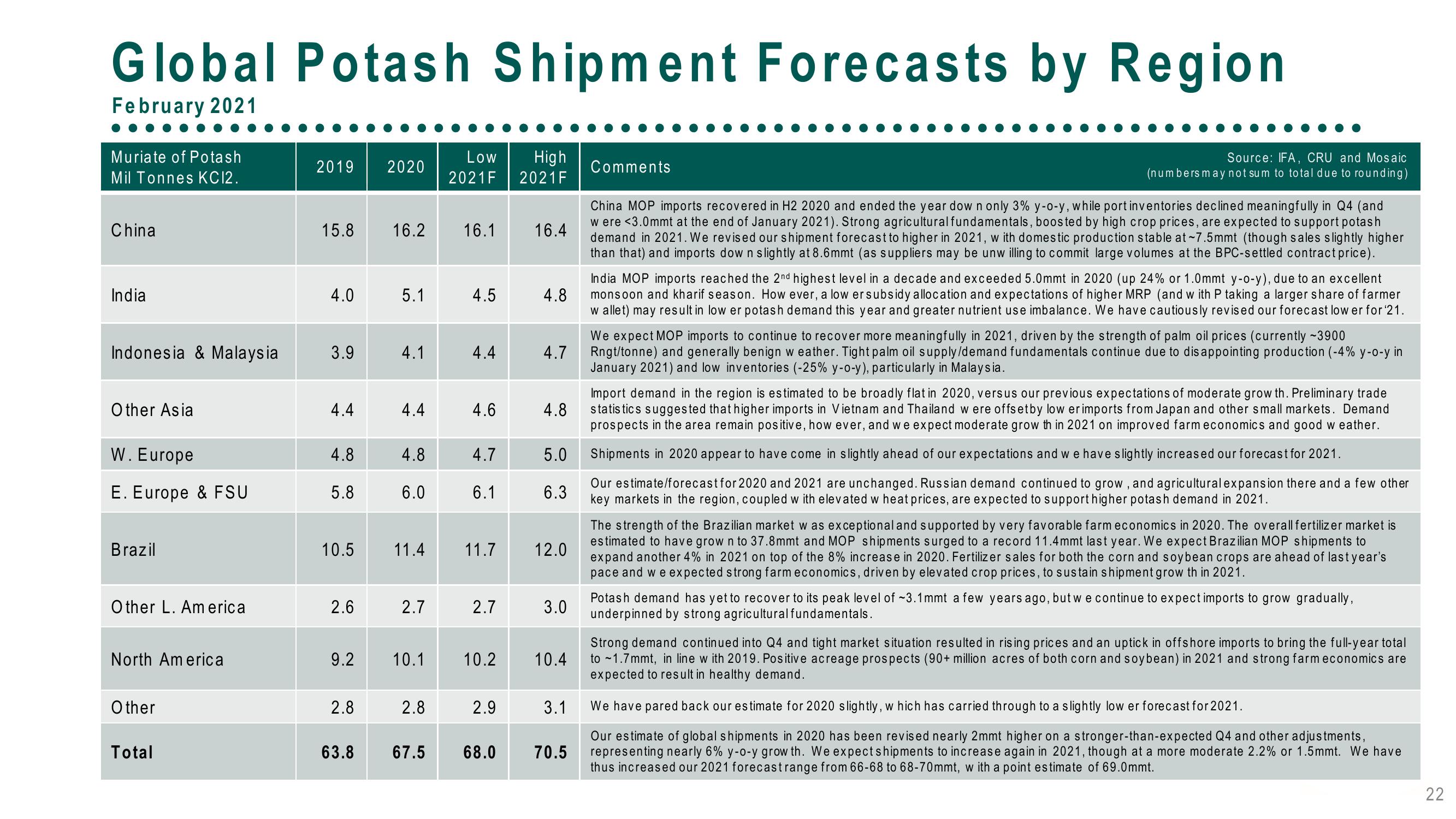

Global Potash Shipment Forecasts by Region

February 2021

Muriate of Potash

Mil Tonnes KC12.

China

India

Indonesia & Malaysia

Other Asia

W. Europe

E. Europe & FSU

Brazil

Other L. America

North America

Other

Total

2019 2020

15.8 16.2

4.0

3.9

4.4

4.8

5.8

10.5

2.6

2.8

5.1

63.8

4.1

4.4

4.8

6.0

11.4

9.2 10.1

2.7

2.8

Low

High

2021F 2021F

16.1

4.5

4.4

4.6

4.7

6.1

11.7

2.7

2.9

16.4

67.5 68.0

4.8

4.7

4.8

5.0

6.3

12.0

10.2 10.4

3.0

3.1

70.5

Comments

Source: IFA, CRU and Mosaic

(numbers may not sum to total due to rounding)

China MOP imports recovered in H2 2020 and ended the year dow n only 3% y-o-y, while port inventories declined meaningfully in Q4 (and

w ere <3.0mmt at the end of January 2021). Strong agricultural fundamentals, boosted by high crop prices, are expected to support potash

demand in 2021. We revised our shipment forecast to higher in 2021, with domestic production stable at ~7.5mmt (though sales slightly higher

than that) and imports dow n slightly at 8.6mmt (as suppliers may be unw illing to commit large volumes at the C-settled contract price).

India MOP imports reached the 2nd highest level in a decade and exceeded 5.0mmt in 2020 (up 24% or 1.0mmt y-o-y), due to an excellent

monsoon and kharif season. How ever, a low ersubsidy allocation and expectations of higher MRP (and with P taking a larger share of farmer

w allet) may result in low er potash demand this year and greater nutrient use imbalance. We have cautiously revised our forecast low er for ¹21.

We expect MOP imports to continue to recover more meaningfully in 2021, driven by the strength of palm oil prices (currently -3900

Rngt/tonne) and generally benign weather. Tight palm oil supply/demand fundamentals continue due to disappointing production (-4% y-o-y in

January 2021) and low inventories (-25% y-o-y), particularly in Malaysia.

Import demand in the region is estimated to be broadly flat in 2020, versus our previous expectations of moderate grow th. Preliminary trade

statistics suggested that higher imports in Vietnam and Thailand were offset by low er imports from Japan and other small markets. Demand

prospects in the area remain positive, how ever, and we expect moderate grow th in 2021 on improved farm economics and good weather.

Shipments in 2020 appear to have come in slightly ahead of our expectations and we have slightly increased our forecast for 2021.

Our estimate/forecast for 2020 and 2021 are unchanged. Russian demand continued to grow, and agricultural expansion there and a few other

key markets in the region, coupled with elevated w heat prices, are expected to support higher potash demand in 2021.

The strength of the Brazilian market w as exceptional and supported by very favorable farm economics in 2020. The overall fertilizer market is

estimated to have grown to 37.8mmt and MOP shipments surged to a record 11.4mmt last year. We expect Brazilian MOP shipments to

expand another 4% in 2021 on top of the 8% increase in 2020. Fertilizer sales for both the corn and soybean crops are ahead of last year's

pace and we expected strong farm economics, driven by elevated crop prices, to sustain shipment grow th in 2021.

Potash demand has yet to recover to its peak level of ~3.1mmt a few years ago, but we continue to expect imports to grow gradually,

underpinned by strong agricultural fundamentals.

Strong demand continued into Q4 and tight market situation resulted in rising prices and an uptick in offshore imports to bring the full-year total

to 1.7mmt, in line with 2019. Positive acreage prospects (90+ million acres of both corn and soybean) in 2021 and strong farm economics are

expected to result in healthy demand.

We have pared back our estimate for 2020 slightly, w hich has carried through to a slightly low er forecast for 2021.

Our estimate of global shipments in 2020 has been revised nearly 2mmt higher on a stronger-than-expected Q4 and other adjustments,

representing nearly 6% y-o-y grow th. We expect shipments to increase again in 2021, though at a more moderate 2.2% or 1.5mmt. We have

thus increased our 2021 forecast range from 66-68 to 68-70mmt, with a point estimate of 69.0mmt.

22View entire presentation