Kinnevik Results Presentation Deck

Intro

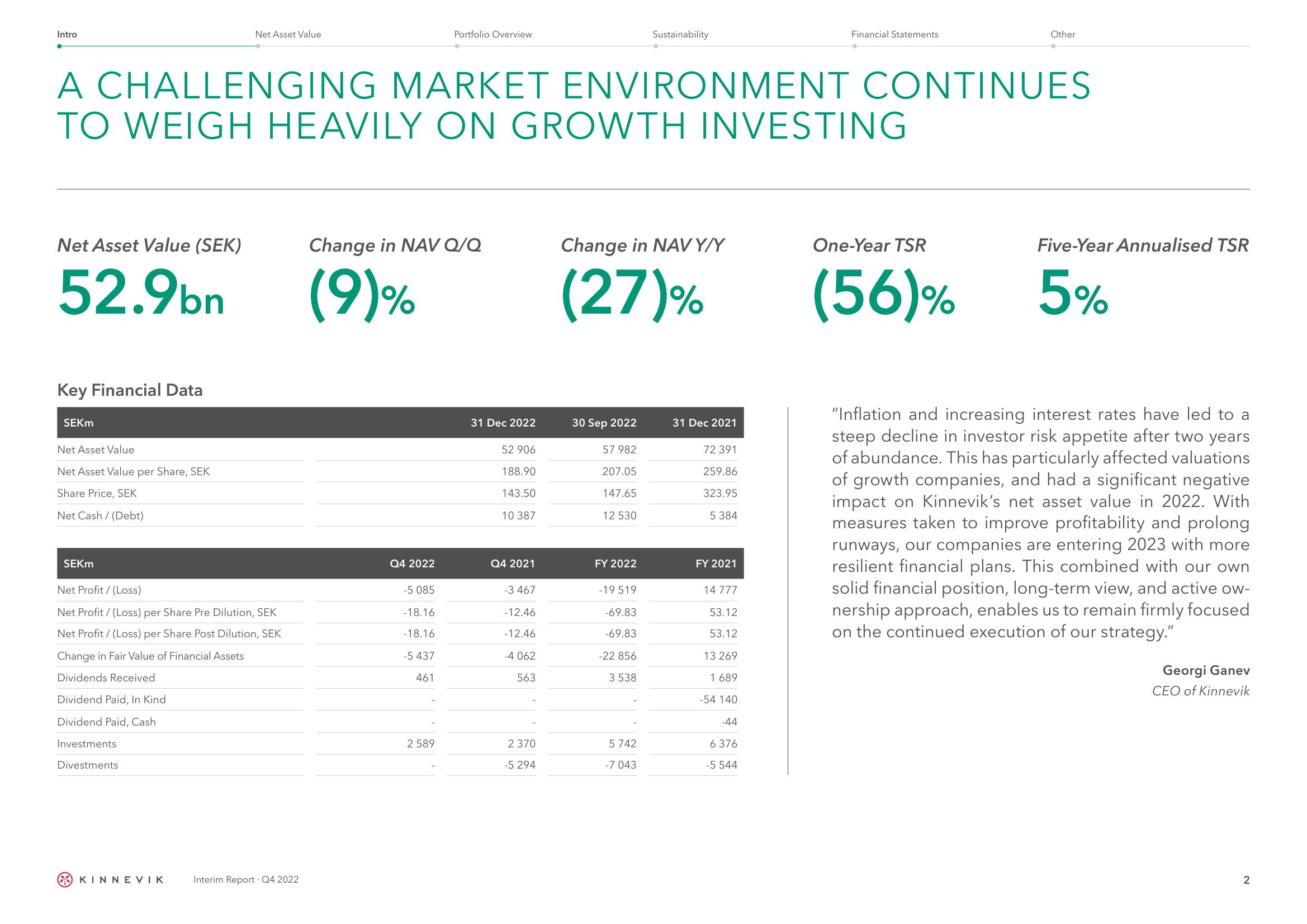

Net Asset Value (SEK)

52.9bn

Key Financial Data

SEKM

Net Asset Value

Net Asset Value per Share, SEK

Share Price, SEK

Net Cash/ (Debt)

A CHALLENGING MARKET ENVIRONMENT CONTINUES

TO WEIGH HEAVILY ON GROWTH INVESTING

SEKM

Net Asset Value

Net Profit/(Loss)

Net Profit / (Loss) per Share Pre Dilution, SEK

Net Profit / (Loss) per Share Post Dilution, SEK

Change in Fair Value of Financial Assets

Dividends Received

Dividend Paid, In Kind

Dividend Paid, Cash

Investments

Divestments

KINNEVIK

Interim Report. Q4 2022

Change in NAV Q/Q

(9)%

Q4 2022

Portfolio Overview

-5 085

-18.16

-18.16

-5 437

461

2 589

31 Dec 2022

52 906

188.90

143.50

10 387

Q4 2021

-3 467

-12.46

-12.46

-4 062

563

2 370

-5 294

Change in NAVY/Y

(27)%

30 Sep 2022

57 982

207.05

147.65

12 530

FY 2022

-19 519

Sustainability

-69.83

-69.83

-22 856

3 538

5 742

-7 043

31 Dec 2021

72 391

259.86

323.95

5 384

FY 2021

14 777

53.12

53.12

13 269

1 689

-54 140

Financial Statements

-44

6

376

-5 544

Other

One-Year TSR

(56)%

Five-Year Annualised TSR

5%

"Inflation and increasing interest rates have led to a

steep decline in investor risk appetite after two years

of abundance. This has particularly affected valuations

of growth companies, and had a significant negative

impact on Kinnevik's net asset value in 2022. With

measures taken to improve profitability and prolong

runways, our companies are entering 2023 with more

resilient financial plans. This combined with our own

solid financial position, long-term view, and active ow-

nership approach, enables us to remain firmly focused

on the continued execution of our strategy."

Georgi Ganev

CEO of Kinnevik

2View entire presentation