MSR Value Growth & Market Trends

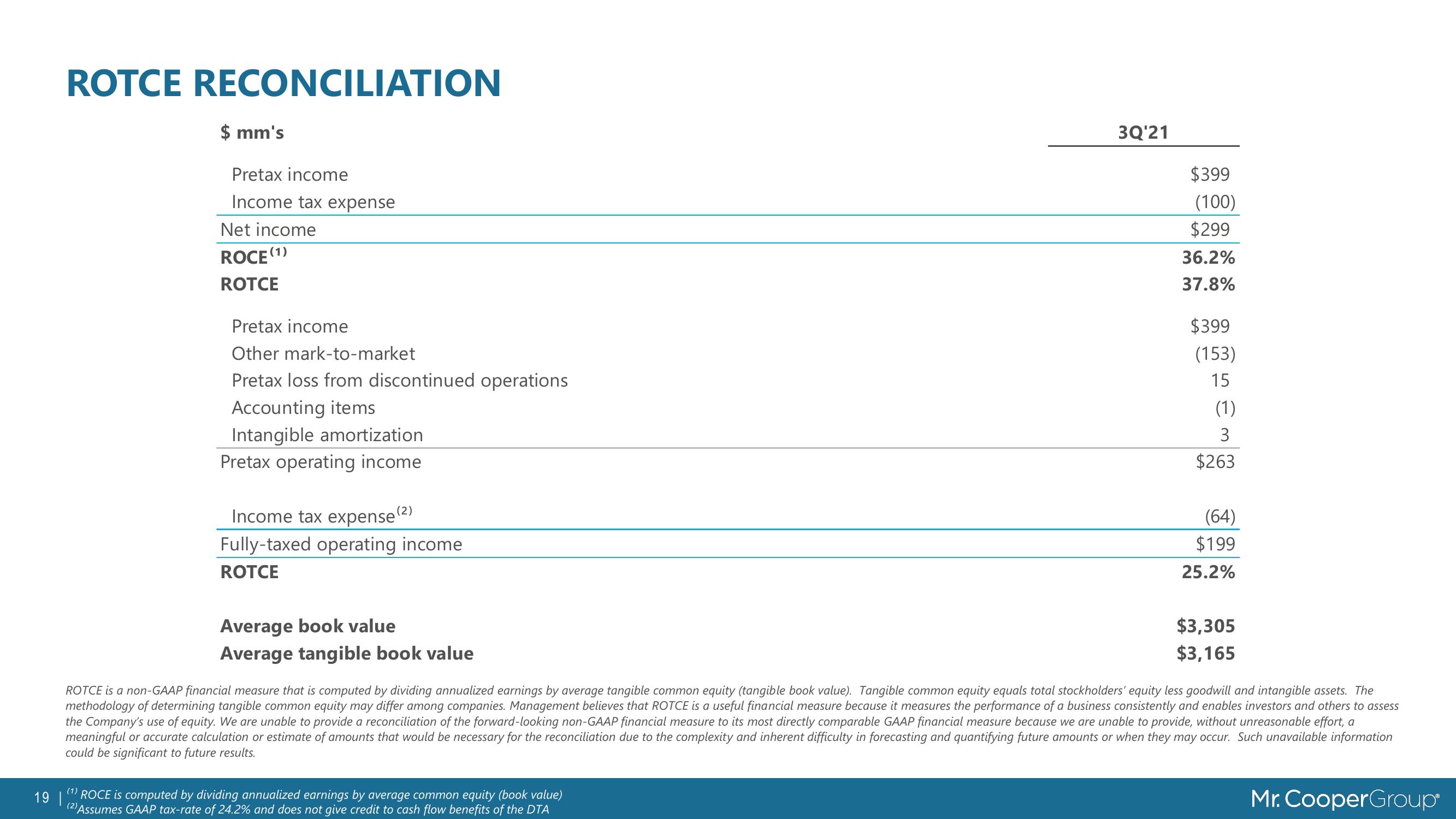

ROTCE RECONCILIATION

$ mm's

Pretax income

Income tax expense

Net income

ROCE (1

(1)

ROTCE

Pretax income

Other mark-to-market

Pretax loss from discontinued operations

Accounting items

Intangible amortization

Pretax operating income

Income tax expense (2

Fully-taxed operating income

ROTCE

Average book value

Average tangible book value

3Q'21

19 |

(1) ROCE is computed by dividing annualized earnings by average common equity (book value)

(2) Assumes GAAP tax-rate of 24.2% and does not give credit to cash flow benefits of the DTA

$399

(100)

$299

36.2%

37.8%

$399

(153)

15

(1)

3

$263

(64)

$199

25.2%

$3,305

$3,165

ROTCE is a non-GAAP financial measure that is computed by dividing annualized earnings by average tangible common equity (tangible book value). Tangible common equity equals total stockholders' equity less goodwill and intangible assets. The

methodology of determining tangible common equity may differ among companies. Management believes that ROTCE is a useful financial measure because it measures the performance of a business consistently and enables investors and others to assess

the Company's use of equity. We are unable to provide a reconciliation of the forward-looking non-GAAP financial measure to its most directly comparable GAAP financial measure because we are unable to provide, without unreasonable effort, a

meaningful or accurate calculation or estimate of amounts that would be necessary for the reconciliation due to the complexity and inherent difficulty in forecasting and quantifying future amounts or when they may occur. Such unavailable information

could be significant to future results.

Mr. CooperGroupView entire presentation