Bank of America Investment Banking Pitch Book

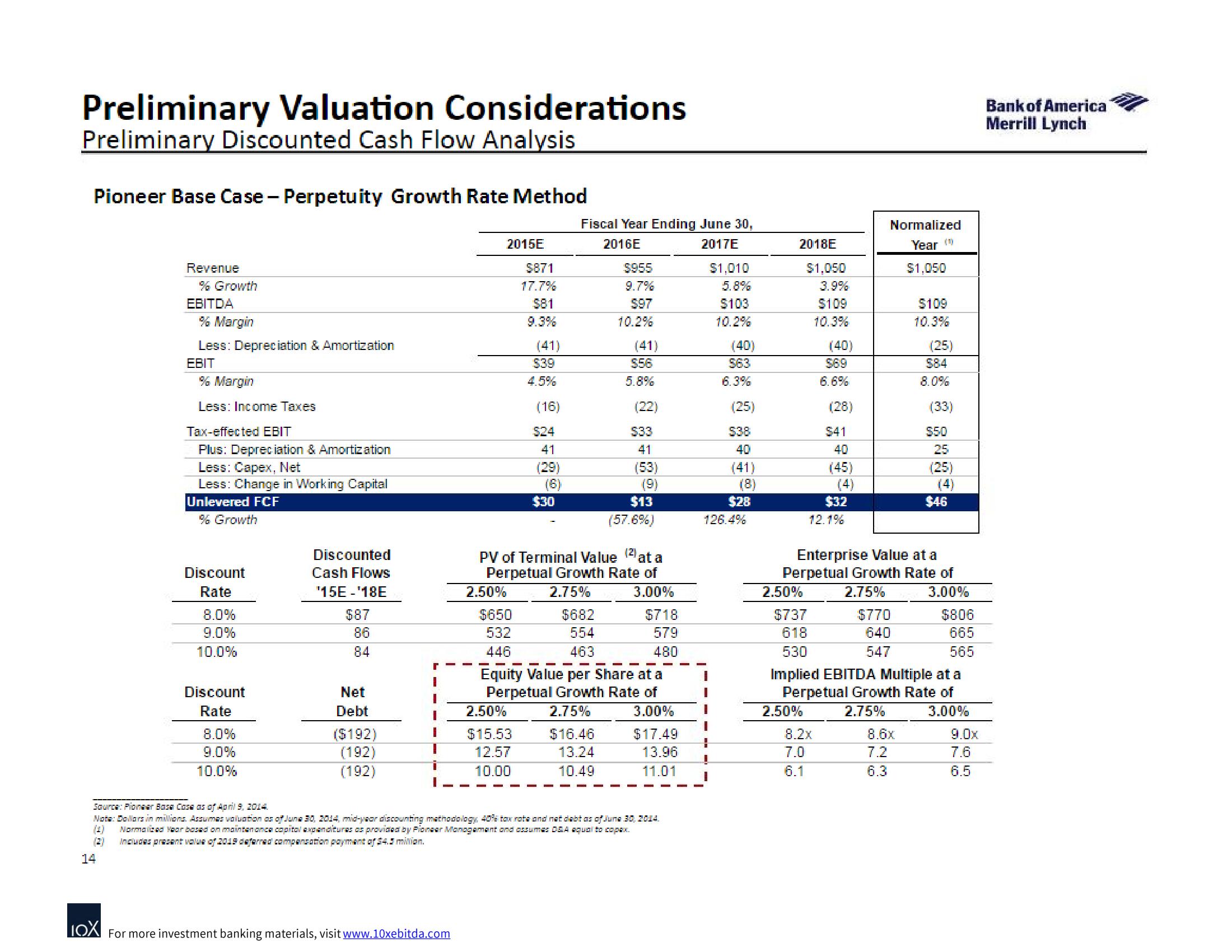

Preliminary Valuation Considerations

Preliminary Discounted Cash Flow Analysis

Pioneer Base Case - Perpetuity Growth Rate Method

Revenue

14

% Growth

EBITDA

% Margin

Less: Depreciation & Amortization

EBIT

% Margin

Less: Income Taxes

Tax-effected EBIT

Plus: Depreciation & Amortization

Less: Capex, Net

Less: Change in Working Capital

Unlevered FCF

% Growth

Discount

Rate

8.0%

9.0%

10.0%

Discount

Rate

8.0%

9.0%

10.0%

Discounted

Cash Flows

¹15E - ¹18E

$87

86

84

Net

Debt

($192)

(192)

(192)

r

LOX For more investment banking materials, visit www.10xebitda.com

2015E

2.50%

$650

532

446

$871

17.7%

$81

(41)

2.50%

$15.53

12.57

10.00

$39

4.5%

(16)

$24

41

(29)

$30

Fiscal Year Ending June 30,

2016E

2017E

$682

554

463

$955

9.7%

597

10.2%

(41)

PV of Terminal Value at a

Perpetual Growth Rate of

2.75%

3.00%

$16.46

13.24

10.49

$56

5.8%

(22)

$33

41

(53)

(9)

$13

(57.6%)

Equity Value per Share at a

Perpetual Growth Rate of

2.75%

3.00%

$718

579

480

Source: Pioneer Base Cosa as of April 9, 2014.

Note: Dollars in millions. Assumes valuation as of June 30, 2014, mid-year discounting methodology, 40% tax rate and net debt as of June 30, 2014.

(1) Normalized Year based on maintenance capital expenditures as provided by Pioneer Management and assumes DSA equal to copax.

Includes present value of 2019 diaferrad compensation payment of $4.3 milion.

$17.49

13.96

11.01

$1,010

5.8%

$103

10.2%

I

1

(40)

563

6.3%

(25)

$38

40

(41)

$28

126.4%

2018E

2.50%

$1,050

3.9%

$109

10.3%

$737

618

530

2.50%

(40)

$69

6.6%

(28)

8.2x

7.0

6.1

$41

40

(45)

(4)

$32

12.1%

Normalized

Year (

$770

640

547

$1,050

$109

Enterprise Value at a

Perpetual Growth Rate of

2.75%

3.00%

8.6x

7.2

6.3

(25)

S84

8.0%

(33)

$50

25

(25)

$46

Implied EBITDA Multiple at a

Perpetual Growth Rate of

2.75%

3.00%

$806

665

565

9.0x

7.6

6.5

(100

Bank of America

Merrill LynchView entire presentation