Carlyle Investor Conference Presentation Deck

Investment Solutions: Consistently Strong Investment Performance

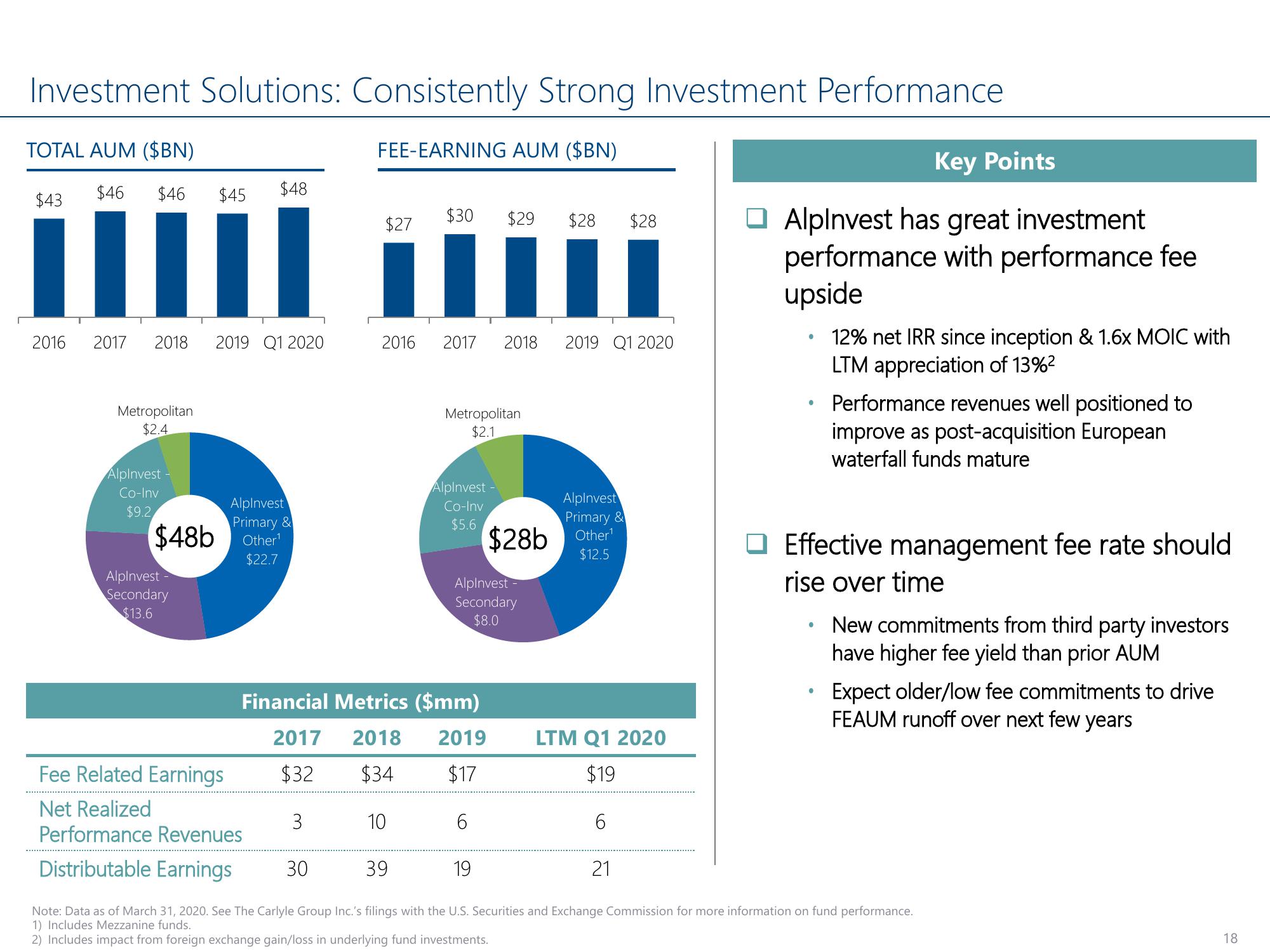

TOTAL AUM ($BN)

FEE-EARNING AUM ($BN)

$46

$43

2016

$46 $45 $48

2017 2018 2019 Q1 2020

Metropolitan

$2.4

Alpinvest

Co-Inv

$9.2

$48b

Alpinvest -

Secondary

$13.6

AlpInvest

Primary &

Other¹

$22.7

$27

Fee Related Earnings

Net Realized

Performance Revenues

Distributable Earnings

2016

$30

2017 2018 2019 Q1 2020

Metropolitan

$2.1

AlpInvest -

Co-Inv

$5.6

$29 $28 $28

Financial Metrics ($mm)

2017 2018 2019

$32 $34

$17

3

10

30

AlpInvest

Secondary

$8.0

6

$28b

AlpInvest

Primary &

Other¹

$12.5

LTM Q1 2020

$19

6

Key Points

AlpInvest has great investment

performance with performance fee

upside

12% net IRR since inception & 1.6x MOIC with

LTM appreciation of 13%²

21

●

●

Performance revenues well positioned to

improve as post-acquisition European

waterfall funds mature

Effective management fee rate should

rise over time

●

New commitments from third party investors

have higher fee yield than prior AUM

Expect older/low fee commitments to drive

FEAUM runoff over next few years

39

19

Note: Data as of March 31, 2020. See The Carlyle Group Inc.'s filings with the U.S. Securities and Exchange Commission for more information on fund performance.

1) Includes Mezzanine funds.

2) Includes impact from foreign exchange gain/loss in underlying fund investments.

18View entire presentation