Spirit Mergers and Acquisitions Presentation Deck

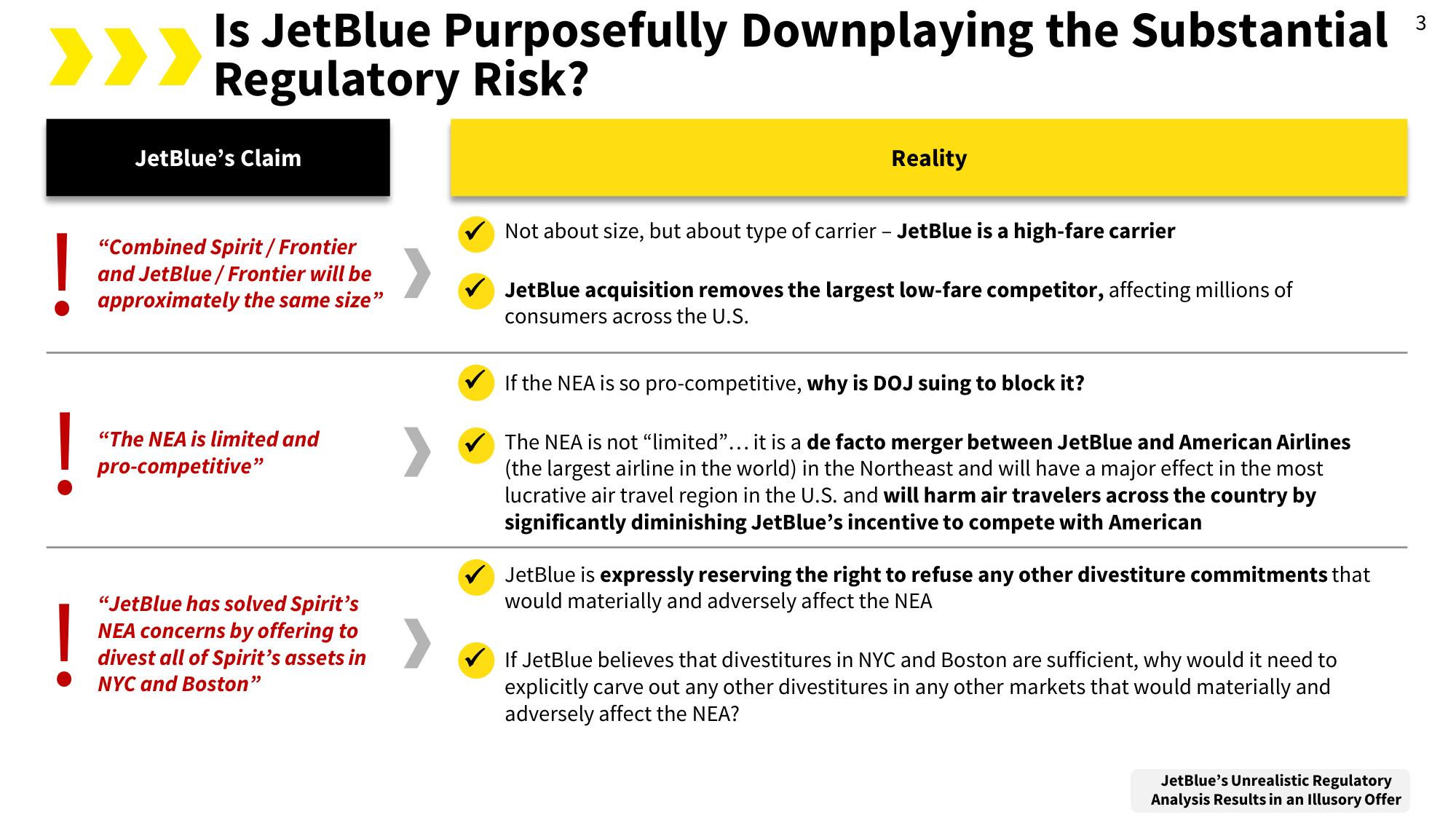

Is JetBlue Purposefully Downplaying the Substantial

>>> Regulatory Risk?

!

JetBlue's Claim

"Combined Spirit / Frontier

and JetBlue/Frontier will be

approximately the same size"

"The NEA is limited and

pro-competitive"

"JetBlue has solved Spirit's

NEA concerns by offering to

divest all of Spirit's assets in

NYC and Boston"

Reality

Not about size, but about type of carrier - JetBlue is a high-fare carrier

JetBlue acquisition removes the largest low-fare competitor, affecting millions of

consumers across the U.S.

If the NEA is so pro-competitive, why is DOJ suing to block it?

The NEA is not "limited”….. it is a de facto merger between JetBlue and American Airlines

(the largest airline in the world) in the Northeast and will have a major effect in the most

lucrative air travel region in the U.S. and will harm air travelers across the country by

significantly diminishing JetBlue's incentive to compete with American

JetBlue is expressly reserving the right to refuse any other divestiture commitments that

would materially and adversely affect the NEA

If JetBlue believes that divestitures in NYC and Boston are sufficient, why would it need to

explicitly carve out any other divestitures in any other markets that would materially and

adversely affect the NEA?

JetBlue's Unrealistic Regulatory

Analysis Results in an Illusory Offer

3View entire presentation