DiamondRock Hospitality Investor Presentation Deck

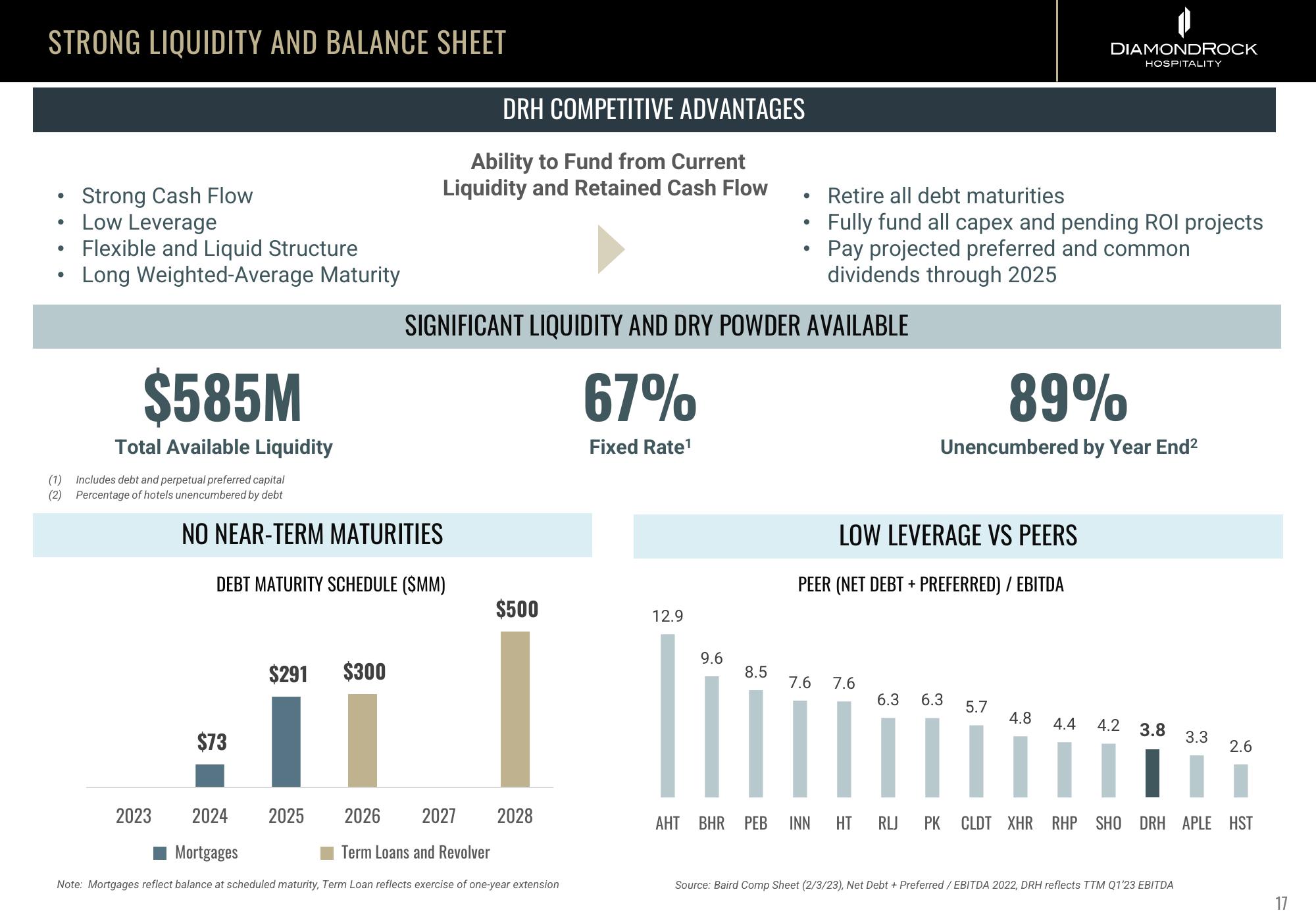

STRONG LIQUIDITY AND BALANCE SHEET

Strong Cash Flow

Low Leverage

Flexible and Liquid Structure

• Long Weighted-Average Maturity

●

●

●

(1)

(2)

$585M

Total Available Liquidity

Includes debt and perpetual preferred capital

Percentage of hotels unencumbered by debt

2023

$73

NO NEAR-TERM MATURITIES

DEBT MATURITY SCHEDULE (SMM)

$291

2025

$300

Ability to Fund from Current

Liquidity and Retained Cash Flow

DRH COMPETITIVE ADVANTAGES

2026 2027

Term Loans and Revolver

SIGNIFICANT LIQUIDITY AND DRY POWDER AVAILABLE

$500

2024

■Mortgages

Note: Mortgages reflect balance at scheduled maturity, Term Loan reflects exercise of one-year extension

2028

67%

Fixed Rate¹

12.9

9.6

●

8.5

Retire all debt maturities

Fully fund all capex and pending ROI projects

Pay projected preferred and common

dividends through 2025

LOW LEVERAGE VS PEERS

PEER (NET DEBT+ PREFERRED) / EBITDA

7.6 7.6

DIAMONDROCK

HOSPITALITY

89%

Unencumbered by Year End²

6.3 6.3 5.7

4.8 4.4 4.2 3.8

3.3

Source: Baird Comp Sheet (2/3/23), Net Debt + Preferred / EBITDA 2022, DRH reflects TTM Q1'23 EBITDA

2.6

AHT BHR PEB INN HT RLJ PK CLDT XHR RHP SHO DRH APLE HST

17View entire presentation