Apollo Global Management Investor Presentation Deck

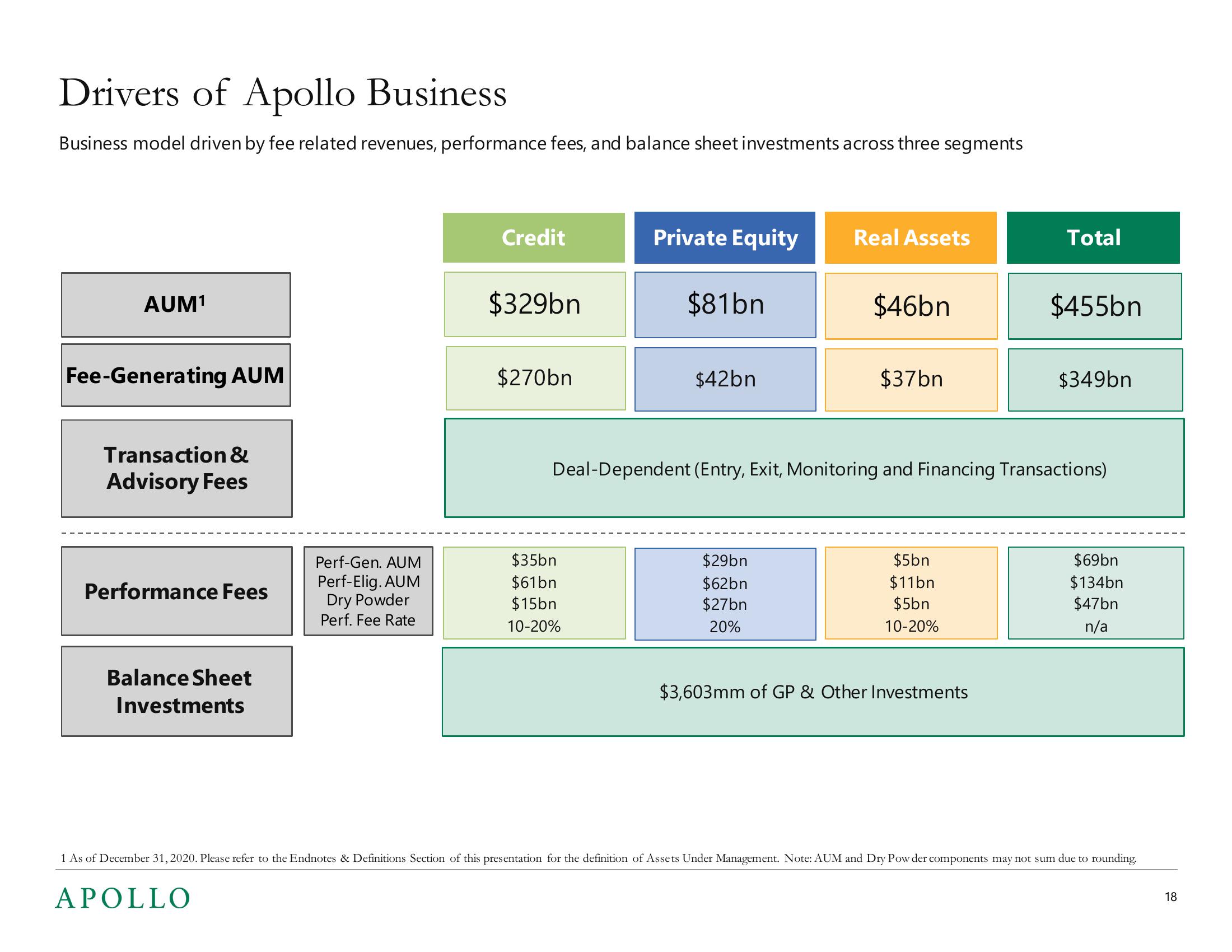

Drivers of Apollo Business

Business model driven by fee related revenues, performance fees, and balance sheet investments across three segments

AUM¹

Fee-Generating AUM

Transaction &

Advisory Fees

Performance Fees

Balance Sheet

Investments

Perf-Gen. AUM

Perf-Elig. AUM

Dry Powder

Perf. Fee Rate

APOLLO

Credit

$329bn

$270bn

Private Equity

$35bn

$61bn

$15bn

10-20%

$81bn

$42bn

Real Assets

$29bn

$62bn

$27bn

20%

$46bn

$37bn

Deal-Dependent (Entry, Exit, Monitoring and Financing Transactions)

$5bn

$11bn

$5bn

10-20%

Total

$3,603mm of GP & Other Investments

$455bn

$349bn

$69bn

$134bn

$47bn

n/a

1 As of December 31, 2020. Please refer to the Endnotes & Definitions Section of this presentation for the definition of Assets Under Management. Note: AUM and Dry Powder components may not sum due to rounding.

18View entire presentation