Barclays Capital 2010 Global Financial Services Conference

Net Interest Margin & Operating Expenses

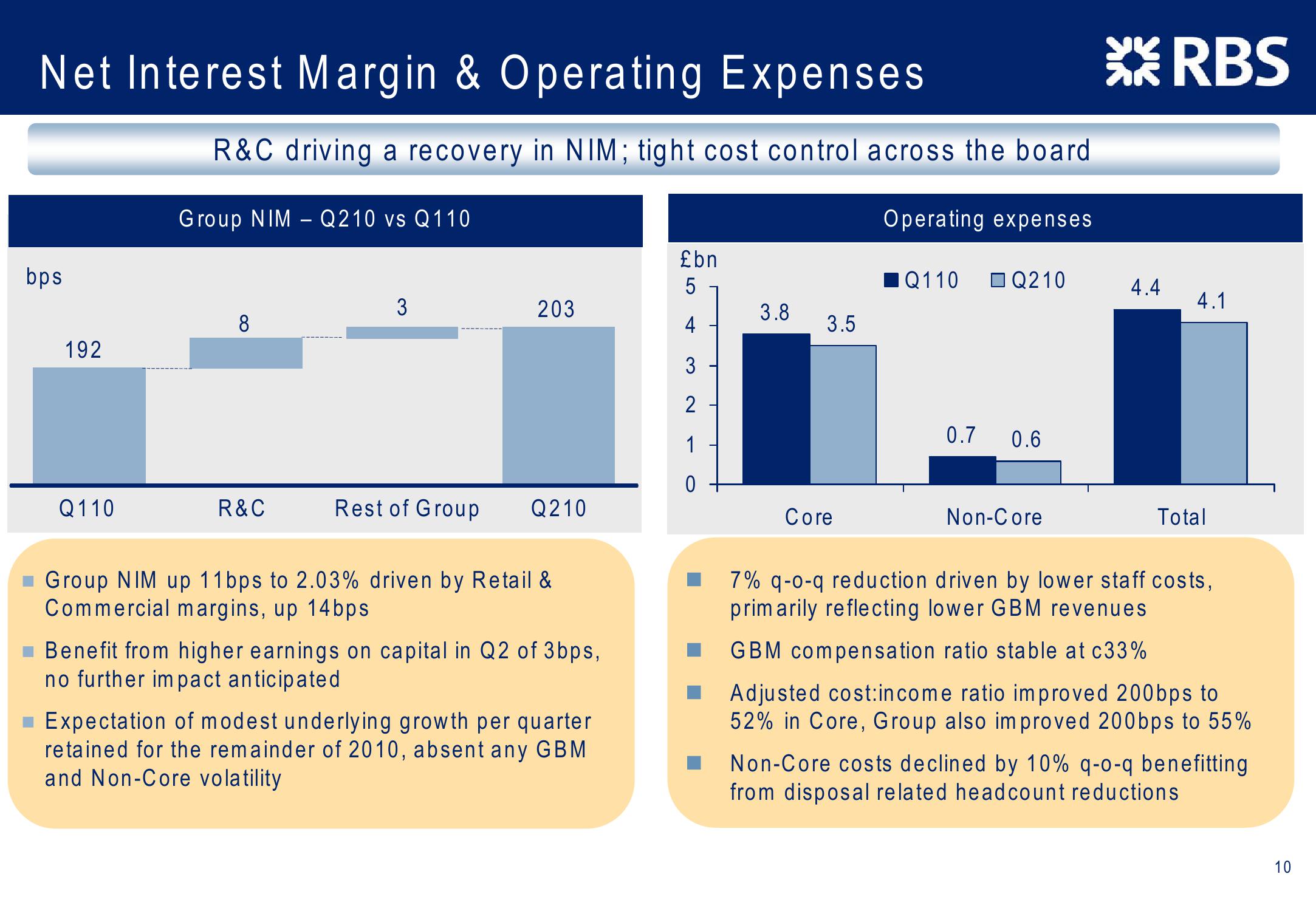

R&C driving a recovery in NIM; tight cost control across the board

Group NIM Q210 vs Q110

-

Operating expenses

XRBS

bps

£bn

5

■ Q110 Q210

4.4

4.1

3

203

3.8

8

4

3.5

192

3

2

Q110

0

R&C

Rest of Group

Q210

Core

0.7

0.6

Non-Core

Total

Group NIM up 11bps to 2.03% driven by Retail &

Commercial margins, up 14bps

■ Benefit from higher earnings on capital in Q2 of 3bps,

no further impact anticipated

■ Expectation of modest underlying growth per quarter

retained for the remainder of 2010, absent any GBM

and Non-Core volatility

7% q-o-q reduction driven by lower staff costs,

primarily reflecting lower GBM revenues

GBM compensation ratio stable at c33%

Adjusted cost:income ratio improved 200bps to

52% in Core, Group also improved 200bps to 55%

Non-Core costs declined by 10% q-o-q benefitting

from disposal related headcount reductions

10View entire presentation