Selina SPAC

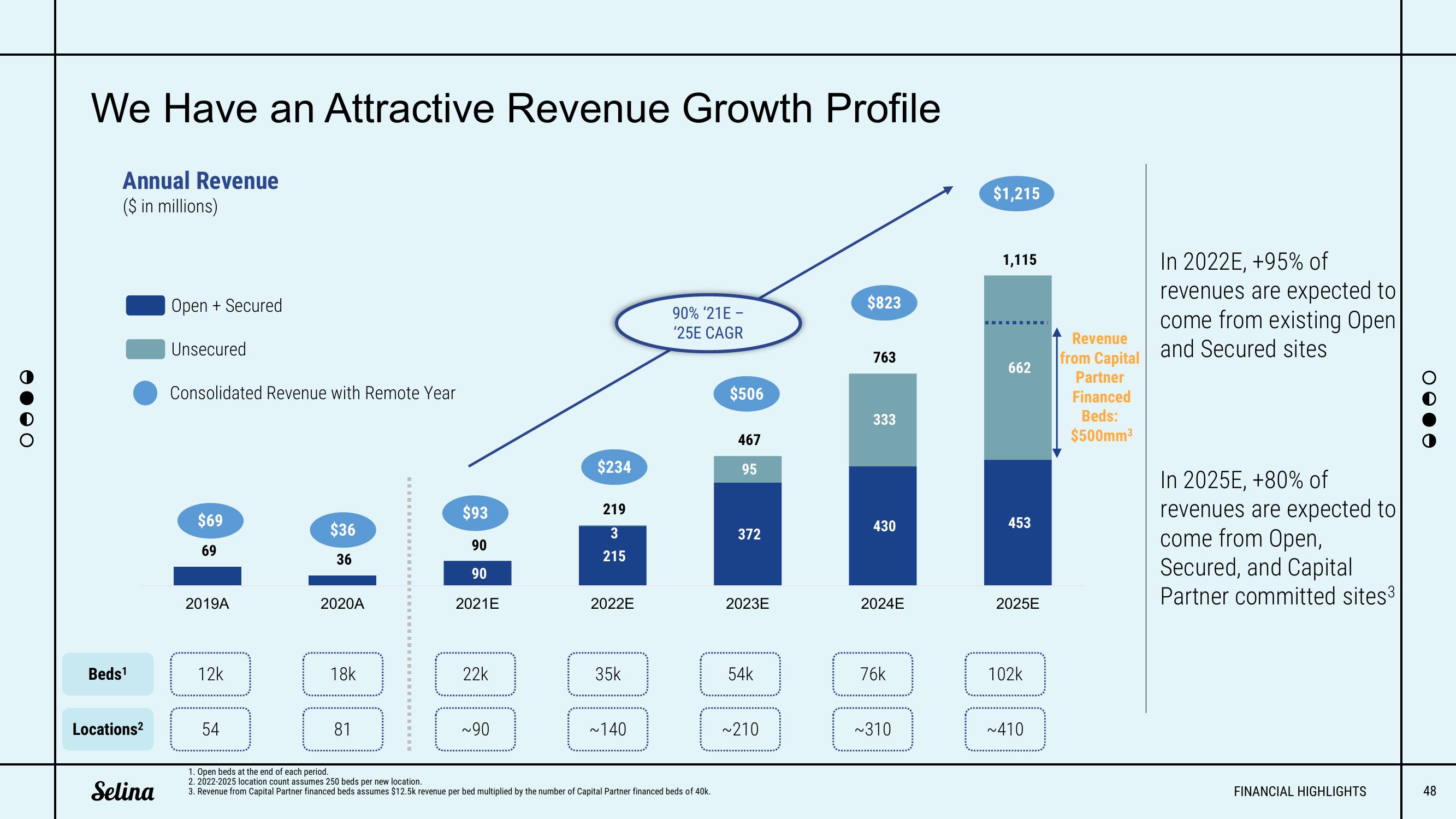

We Have an Attractive Revenue Growth Profile

Annual Revenue

($ in millions)

Beds¹

Locations²

Selina

Open + Secured

Unsecured

Consolidated Revenue with Remote Year

$69

69

2019A

12k

54

$36

36

2020A

18k

81

m

1

H

M

$93

90

90

2021E

22k

~90

$234

219

3

215

2022E

35k

~140

90% '21E -

'25E CAGR

1. Open beds at the end of each period.

2. 2022-2025 location count assumes 250 beds per new location.

3. Revenue from Capital Partner financed beds assumes $12.5k revenue per bed multiplied by the number of Capital Partner financed beds of 40k.

$506

467

95

372

2023E

54k

~210

$823

763

333

430

2024E

76k

~310

$1,215

1,115

‒‒‒‒‒

662

453

2025E

102k

~410

Revenue

from Capital

Partner

Financed

Beds:

$500mm³

In 2022E, +95% of

revenues are expected to

come from existing Open

and Secured sites

In 2025E, +80% of

revenues are expected to

come from Open,

Secured, and Capital

Partner committed sites³

FINANCIAL HIGHLIGHTS

48View entire presentation