Affirm Investor Event Presentation Deck

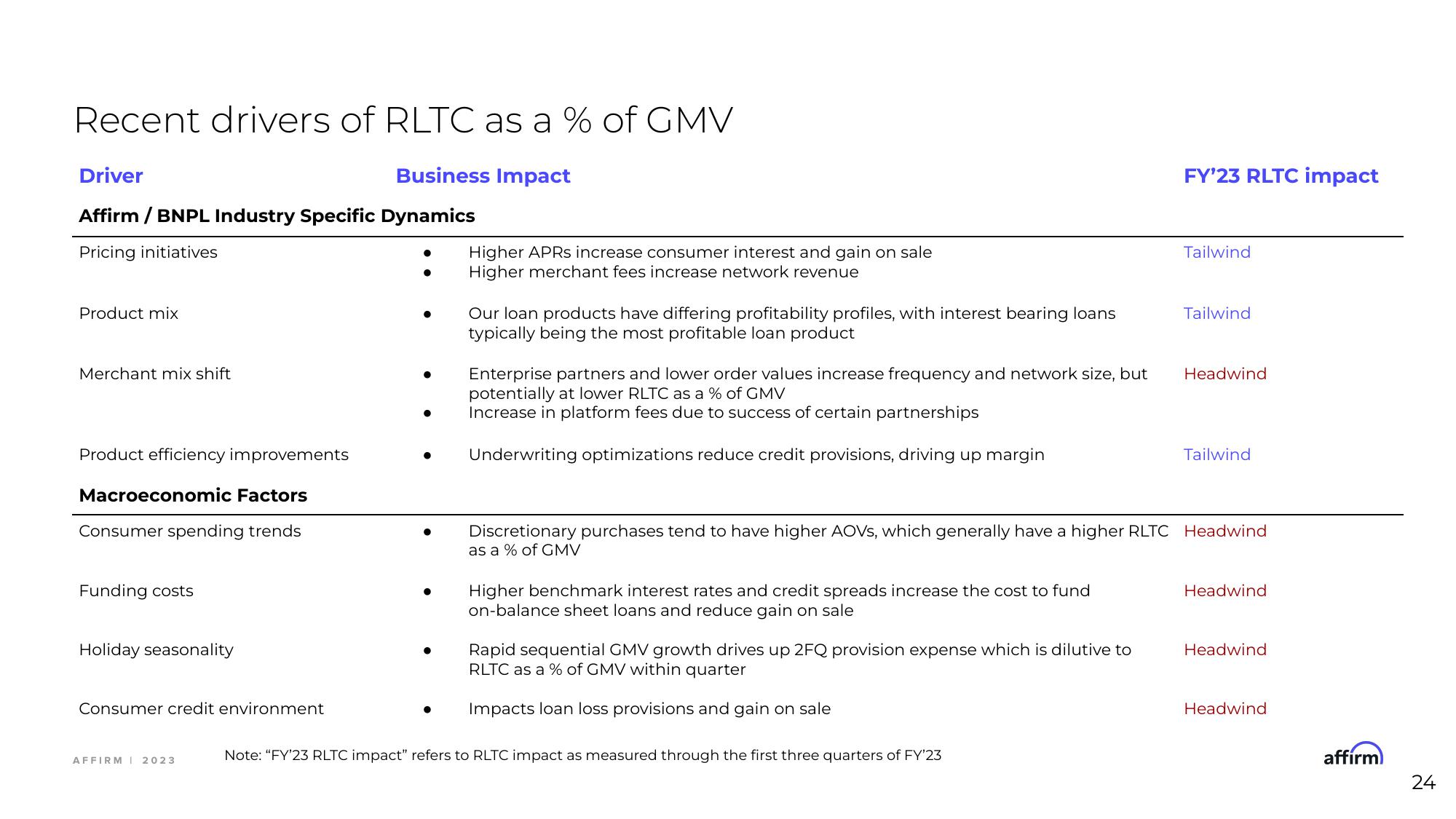

Recent drivers of RLTC as a % of GMV

Business Impact

Driver

Affirm / BNPL Industry Specific Dynamics

Pricing initiatives

Product mix

Merchant mix shift.

Product efficiency improvements

Macroeconomic Factors

Consumer spending trends

Funding costs

Holiday seasonality

Consumer credit environment

AFFIRM I 2023

●

●

Higher APRS increase consumer interest and gain on sale

Higher merchant fees increase network revenue

Our loan products have differing profitability profiles, with interest bearing loans

typically being the most profitable loan product

Enterprise partners and lower order values increase frequency and network size, but

potentially at lower RLTC as a % of GMV

Increase in platform fees due to success of certain partnerships

Underwriting optimizations reduce credit provisions, driving up margin

Higher benchmark interest rates and credit spreads increase the cost to fund

on-balance sheet loans and reduce gain on sale

Rapid sequential GMV growth drives up 2FQ provision expense which is dilutive to

RLTC as a % of GMV within quarter

Impacts loan loss provisions and gain on sale

FY'23 RLTC impact

Note: "FY'23 RLTC impact" refers to RLTC impact as measured through the first three quarters of FY'23

Tailwind

Tailwind

Discretionary purchases tend to have higher AOVS, which generally have a higher RLTC Headwind

as a % of GMV

Headwind

Tailwind

Headwind

Headwind

Headwind

affirm

24View entire presentation