Deutsche Bank Results Presentation Deck

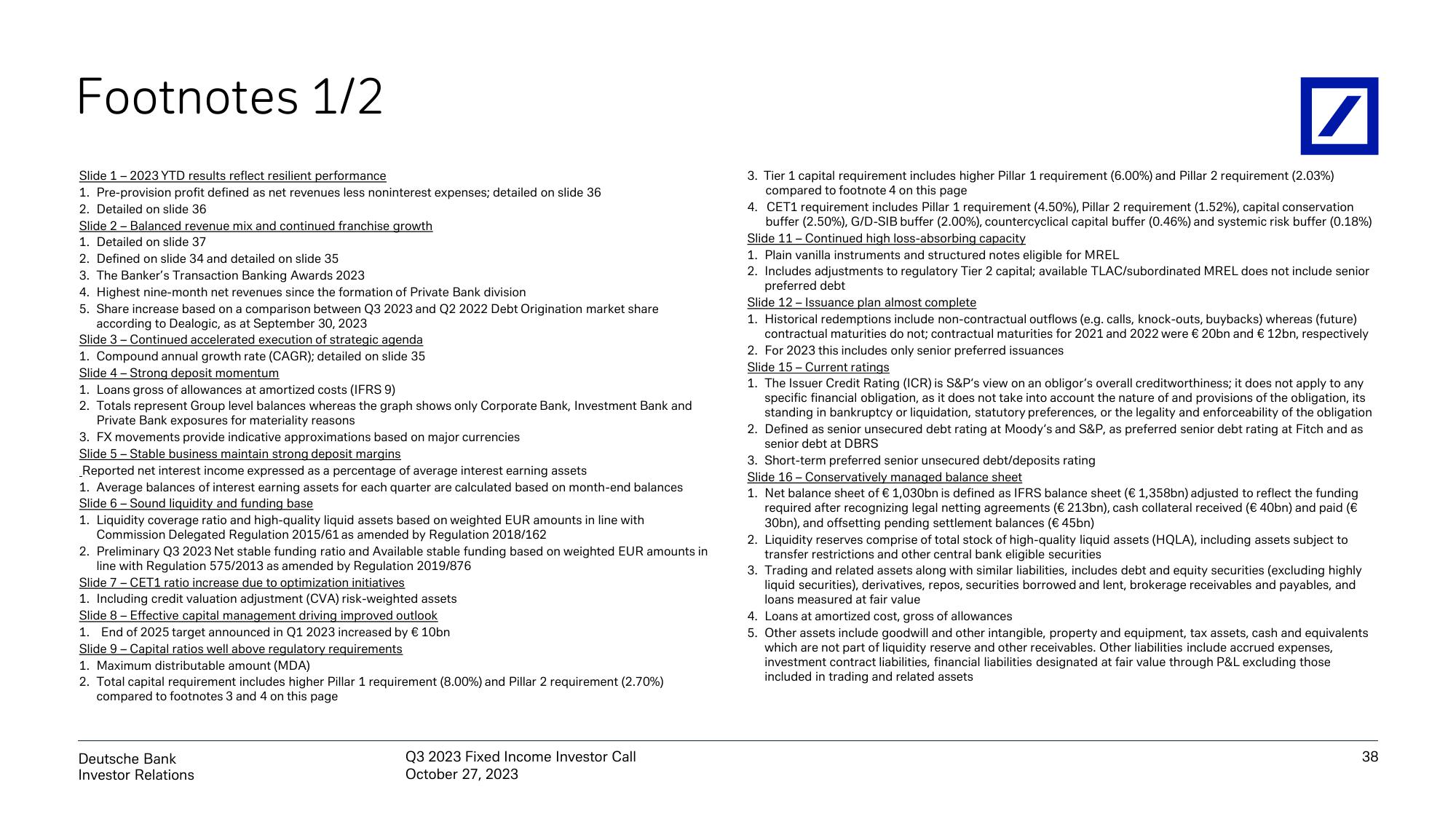

Footnotes 1/2

Slide 1-2023 YTD results reflect resilient performance

1. Pre-provision profit defined as net revenues less noninterest expenses; detailed on slide 36

2. Detailed on slide 36

Slide 2 Balanced revenue mix and continued franchise growth

1. Detailed on slide 37

2. Defined on slide 34 and detailed on slide 35

3. The Banker's Transaction Banking Awards 2023

4. Highest nine-month net revenues since the formation of Private Bank division

5. Share increase based on a comparison between Q3 2023 and Q2 2022 Debt Origination market share

according to Dealogic, as at September 30, 2023

Slide 3 Continued accelerated execution of strategic agenda

1. Compound annual growth rate (CAGR); detailed on slide 35

Slide 4-Strong deposit momentum

1. Loans gross of allowances at amortized costs (IFRS 9)

2. Totals represent Group level balances whereas the graph shows only Corporate Bank, Investment Bank and

Private Bank exposures for materiality reasons

3. FX movements provide indicative approximations based on major currencies

Slide 5-Stable business maintain strong deposit margins

Reported net interest income expressed as a percentage of average interest earning assets

1. Average balances of interest earning assets for each quarter are calculated based on month-end balances

Slide 6-Sound liquidity and funding base

1. Liquidity coverage ratio and high-quality liquid assets based on weighted EUR amounts in line with

Commission Delegated Regulation 2015/61 as amended by Regulation 2018/162

2. Preliminary Q3 2023 Net stable funding ratio and Available stable funding based on weighted EUR amounts in

line with Regulation 575/2013 as amended by Regulation 2019/876

Slide 7 - CET1 ratio increase due to optimization initiatives

1. Including credit valuation adjustment (CVA) risk-weighted assets

Slide 8 - Effective capital management driving improved outlook

1. End of 2025 target announced in Q1 2023 increased by € 10bn

Slide 9 Capital ratios well above regulatory requirements

1. Maximum distributable amount (MDA)

2. Total capital requirement includes higher Pillar 1 requirement (8.00%) and Pillar 2 requirement (2.70%)

compared to footnotes 3 and 4 on this page

Deutsche Bank

Investor Relations

Q3 2023 Fixed Income Investor Call

October 27, 2023

3. Tier 1 capital requirement includes higher Pillar 1 requirement (6.00%) and Pillar 2 requirement (2.03%)

compared to footnote 4 on this page

4. CET1 requirement includes Pillar 1 requirement (4.50%), Pillar 2 requirement (1.52%), capital conservation

buffer (2.50%), G/D-SIB buffer (2.00%), countercyclical capital buffer (0.46%) and systemic risk buffer (0.18%)

Slide 11- Continued high loss-absorbing capacity

1. Plain vanilla instruments and structured notes eligible for MREL

2. Includes adjustments to regulatory Tier 2 capital; available TLAC/subordinated MREL does not include senior

preferred debt

Slide 12 - Issuance plan almost complete

1. Historical redemptions include non-contractual outflows (e.g. calls, knock-outs, buybacks) whereas (future)

contractual maturities do not; contractual maturities for 2021 and 2022 were € 20bn and € 12bn, respectively

2. For 2023 this includes only senior preferred issuances

Slide 15- Current ratings

1. The Issuer Credit Rating (ICR) is S&P's view on an obligor's overall creditworthiness; it does not apply to any

specific financial obligation, as it does not take into account the nature of and provisions of the obligation, its

standing in bankruptcy or liquidation, statutory preferences, or the legality and enforceability of the obligation

2. Defined as senior unsecured debt rating at Moody's and S&P, as preferred senior debt rating at Fitch and as

senior debt at DBRS

3. Short-term preferred senior unsecured debt/deposits rating

Slide 16 - Conservatively managed balance sheet

1. Net balance sheet of € 1,030bn is defined as IFRS balance sheet (€ 1,358bn) adjusted to reflect the funding

required after recognizing legal netting agreements (€ 213bn), cash collateral received (€ 40bn) and paid (€

30bn), and offsetting pending settlement balances (€ 45bn)

2. Liquidity reserves comprise of total stock of high-quality liquid assets (HQLA), including assets subject to

transfer restrictions and other central bank eligible securities

3. Trading and related assets along with similar liabilities, includes debt and equity securities (excluding highly

liquid securities), derivatives, repos, securities borrowed and lent, brokerage receivables and payables, and

loans measured at fair value

4. Loans at amortized cost, gross of allowances

5. Other assets include goodwill and other intangible, property and equipment, tax assets, cash and equivalents

which are not part of liquidity reserve and other receivables. Other liabilities include accrued expenses,

investment contract liabilities, financial liabilities designated at fair value through P&L excluding those

included in trading and related assets

38View entire presentation