WeWork SPAC Presentation Deck

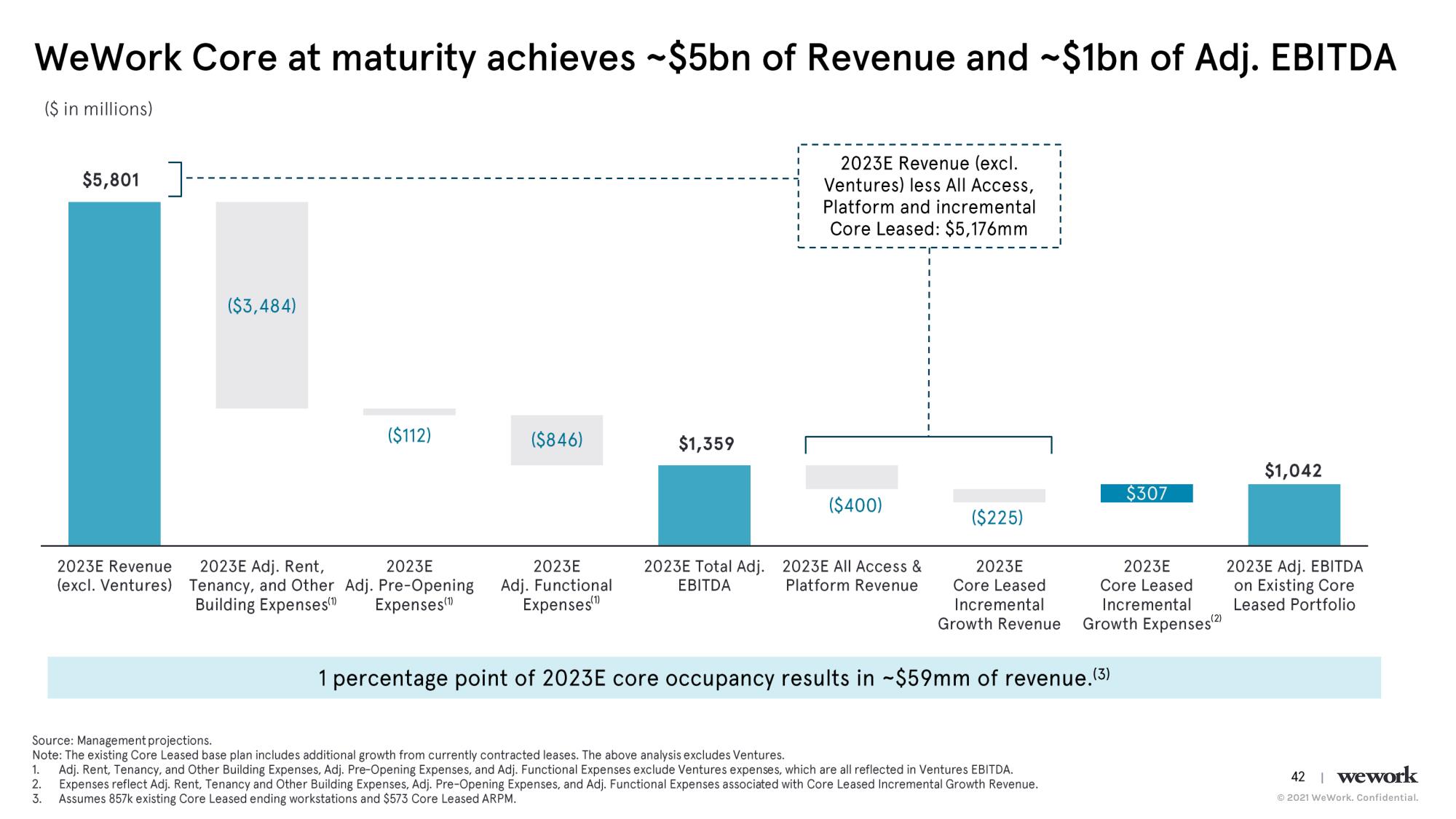

WeWork Core at maturity achieves ~$5bn of Revenue and ~$1bn of Adj. EBITDA

($ in millions)

$5,801

2023E Revenue

(excl. Ventures)

($3,484)

($112)

2023E

2023E Adj. Rent,

Tenancy, and Other Adj. Pre-Opening

Building Expenses(1) Expenses (¹)

($846)

2023E

Adj. Functional

Expenses(¹)

$1,359

2023E Revenue (excl.

Ventures) less All Access,

Platform and incremental

Core Leased: $5,176mm

($400)

2023E Total Adj. 2023E All Access &

EBITDA

Platform Revenue

Source: Management projections.

Note: The existing Core Leased base plan includes additional growth from currently contracted leases. The above analysis excludes Ventures.

($225)

2023E

Core Leased

Incremental

Growth Revenue Growth Expenses(²)

1 percentage point of 2023E core occupancy results in -$59mm of revenue. (3)

$307

2023E

Core Leased

Incremental

1. Adj. Rent, Tenancy, and Other Building Expenses, Adj. Pre-Opening Expenses, and Adj. Functional Expenses exclude Ventures expenses, which are all reflected in Ventures EBITDA.

Expenses reflect Adj. Rent, Tenancy and Other Building Expenses, Adj. Pre-Opening Expenses, and Adj. Functional Expenses associated with Core Leased Incremental Growth Revenue.

Assumes 857k existing Core Leased ending workstations and $573 Core Leased ARPM.

2.

3.

$1,042

2023E Adj. EBITDA

on Existing Core

Leased Portfolio

42 | wework

Ⓒ2021 WeWork. Confidential.View entire presentation